Summer - InsideOutdoor Magazine

Summer - InsideOutdoor Magazine

Summer - InsideOutdoor Magazine

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

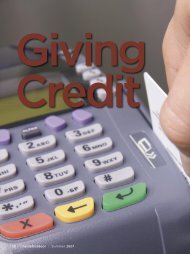

than the promotional period to pay off the debt. The card has an<br />

annual APR of 23 percent. The company also could collect late<br />

fees, if customers made delinquent payments.<br />

By themselves, individual small specialty outdoor retailers<br />

aren’t a lucrative market for GE Money. But taken on aggregate<br />

as a collective volume business, GE Money is banking that<br />

small retailers will make the program worth while.<br />

The Sport Finance Program is a turnkey solution for retailers<br />

in that GE Money provides a dedicated credit card terminal,<br />

marketing materials and signage, staff training and continuous<br />

support, all at no cost as long as the participating retailer meets<br />

the minimum charge volume of $36,000 a year.<br />

GE handles all customer billing, and the retailer is not responsible<br />

for any collections or owed sums should a customer<br />

fail to make payments, says Murphy.<br />

Once retailers are up and rolling they can expect to see 10<br />

percent to 15 percent of sales transactions using the GE Sport<br />

credit card, notes Murphy, as long as they do a good job of<br />

pushing the program.<br />

In general, Murphy says the program is most beneficial<br />

for retailers that pull in around $500,000 a year in receipts,<br />

although there are a handful of retailers in the program that<br />

sell less than that.<br />

One option for retailers that sit beneath that sales threshold<br />

is to pay $39 a month to be part of the program. Some retailers<br />

may want to consider this if it would be beneficial for them to<br />

run the program for a couple of months during a busy selling<br />

season, offers Murphy.<br />

In general, sporting goods customers are a good credit risk.<br />

Although GE Money will provide credit limits up to $10,000 in<br />

the Sport program, Murphy says the typical credit line is less<br />

than half that. In addition, the typical customer uses only a fraction<br />

of available credit, leaving open-to-buy dollars that can be<br />

used for other retail promotions.<br />

In all, about 70 percent of applicants in the sporting goods<br />

segment get approved for a credit line, with the minimum<br />

amount being $1,000. However, even if a customer’s credit is<br />

not the best and he can only be approved for the minimum, GE<br />

Money will try to make accommodations.<br />

“We have something in our system called Meet the Sale Logic,”<br />

says Murphy. “If someone comes in with fairly good credit,<br />

we will do everything we can to meet the sale.”<br />

Thus, if a customer qualified for only the minimum ($1,000)<br />

but was looking to make a total purchase of $1,100, GE would<br />

in all likelihood “meet that sale and approve the customer up to<br />

$1,100 in order to help that merchant make the sale,” he says.<br />

That philosophy is in line with the structure of the program,<br />

which is designed to make implementing and using the program<br />

simple, leaving the retailer to focus on the core business<br />

and how best to incorporate promotional finance into a store’s<br />

sales strategy.<br />

For example, the customer application process takes only<br />

30 | <strong>InsideOutdoor</strong> | <strong>Summer</strong> 2007