Gresham Capital CLO IV B.V. - Irish Stock Exchange

Gresham Capital CLO IV B.V. - Irish Stock Exchange

Gresham Capital CLO IV B.V. - Irish Stock Exchange

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

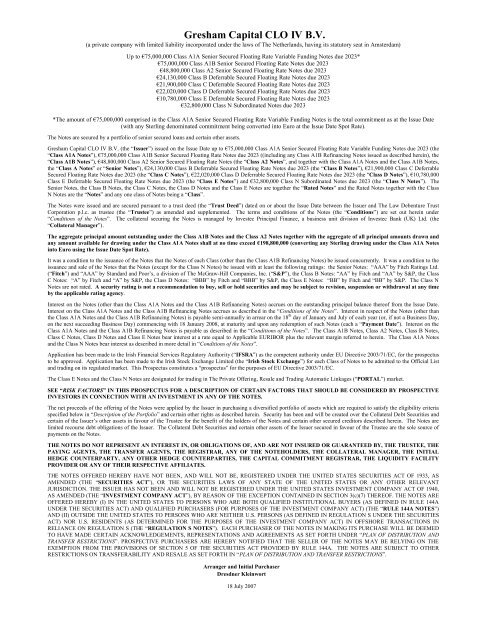

<strong>Gresham</strong> <strong>Capital</strong> <strong>CLO</strong> <strong>IV</strong> B.V.<br />

(a private company with limited liability incorporated under the laws of The Netherlands, having its statutory seat in Amsterdam)<br />

Up to €75,000,000 Class A1A Senior Secured Floating Rate Variable Funding Notes due 2023*<br />

€75,000,000 Class A1B Senior Secured Floating Rate Notes due 2023<br />

€48,800,000 Class A2 Senior Secured Floating Rate Notes due 2023<br />

€24,130,000 Class B Deferrable Secured Floating Rate Notes due 2023<br />

€21,900,000 Class C Deferrable Secured Floating Rate Notes due 2023<br />

€22,020,000 Class D Deferrable Secured Floating Rate Notes due 2023<br />

€10,780,000 Class E Deferrable Secured Floating Rate Notes due 2023<br />

€32,800,000 Class N Subordinated Notes due 2023<br />

*The amount of €75,000,000 comprised in the Class A1A Senior Secured Floating Rate Variable Funding Notes is the total commitment as at the Issue Date<br />

(with any Sterling denominated commitment being converted into Euro at the Issue Date Spot Rate).<br />

The Notes are secured by a portfolio of senior secured loans and certain other assets.<br />

<strong>Gresham</strong> <strong>Capital</strong> <strong>CLO</strong> <strong>IV</strong> B.V. (the “Issuer”) issued on the Issue Date up to €75,000,000 Class A1A Senior Secured Floating Rate Variable Funding Notes due 2023 (the<br />

“Class A1A Notes”), €75,000,000 Class A1B Senior Secured Floating Rate Notes due 2023 ((including any Class A1B Refinancing Notes issued as described herein), the<br />

“Class A1B Notes”), €48,800,000 Class A2 Senior Secured Floating Rate Notes (the “Class A2 Notes”, and together with the Class A1A Notes and the Class A1B Notes,<br />

the “Class A Notes” or “Senior Notes”), €24,130,000 Class B Deferrable Secured Floating Rate Notes due 2023 (the “Class B Notes”), €21,900,000 Class C Deferrable<br />

Secured Floating Rate Notes due 2023 (the “Class C Notes”), €22,020,000 Class D Deferrable Secured Floating Rate Notes due 2023 (the “Class D Notes”), €10,780,000<br />

Class E Deferrable Secured Floating Rate Notes due 2023 (the “Class E Notes”) and €32,800,000 Class N Subordinated Notes due 2023 (the “Class N Notes”). The<br />

Senior Notes, the Class B Notes, the Class C Notes, the Class D Notes and the Class E Notes are together the “Rated Notes” and the Rated Notes together with the Class<br />

N Notes are the “Notes” and any one class of Notes being a “Class”.<br />

The Notes were issued and are secured pursuant to a trust deed (the “Trust Deed”) dated on or about the Issue Date between the Issuer and The Law Debenture Trust<br />

Corporation p.l.c. as trustee (the “Trustee”) as amended and supplemented. The terms and conditions of the Notes (the “Conditions”) are set out herein under<br />

“Conditions of the Notes”. The collateral securing the Notes is managed by Investec Principal Finance, a business unit division of Investec Bank (UK) Ltd. (the<br />

“Collateral Manager”).<br />

The aggregate principal amount outstanding under the Class A1B Notes and the Class A2 Notes together with the aggregate of all principal amounts drawn and<br />

any amount available for drawing under the Class A1A Notes shall at no time exceed €198,800,000 (converting any Sterling drawing under the Class A1A Notes<br />

into Euro using the Issue Date Spot Rate).<br />

It was a condition to the issuance of the Notes that the Notes of each Class (other than the Class A1B Refinancing Notes) be issued concurrently. It was a condition to the<br />

issuance and sale of the Notes that the Notes (except for the Class N Notes) be issued with at least the following ratings: the Senior Notes: “AAA” by Fitch Ratings Ltd.<br />

(“Fitch”) and “AAA” by Standard and Poor’s, a division of The McGraw-Hill Companies, Inc. (“S&P”), the Class B Notes: “AA” by Fitch and “AA” by S&P, the Class<br />

C Notes: “A” by Fitch and “A” by S&P, the Class D Notes: “BBB” by Fitch and “BBB” by S&P, the Class E Notes: “BB” by Fitch and “BB” by S&P. The Class N<br />

Notes are not rated. A security rating is not a recommendation to buy, sell or hold securities and may be subject to revision, suspension or withdrawal at any time<br />

by the applicable rating agency.<br />

Interest on the Notes (other than the Class A1A Notes and the Class A1B Refinancing Notes) accrues on the outstanding principal balance thereof from the Issue Date.<br />

Interest on the Class A1A Notes and the Class A1B Refinancing Notes accrues as described in the “Conditions of the Notes”. Interest in respect of the Notes (other than<br />

the Class A1A Notes and the Class A1B Refinancing Notes) is payable semi-annually in arrear on the 18 th day of January and July of each year (or, if not a Business Day,<br />

on the next succeeding Business Day) commencing with 18 January 2008, at maturity and upon any redemption of such Notes (each a “Payment Date”). Interest on the<br />

Class A1A Notes and the Class A1B Refinancing Notes is payable as described in the “Conditions of the Notes”. The Class A1B Notes, Class A2 Notes, Class B Notes,<br />

Class C Notes, Class D Notes and Class E Notes bear interest at a rate equal to Applicable EURIBOR plus the relevant margin referred to herein. The Class A1A Notes<br />

and the Class N Notes bear interest as described in more detail in “Conditions of the Notes”.<br />

Application has been made to the <strong>Irish</strong> Financial Services Regulatory Authority (“IFSRA”) as the competent authority under EU Directive 2003/71/EC, for the prospectus<br />

to be approved. Application has been made to the <strong>Irish</strong> <strong>Stock</strong> <strong>Exchange</strong> Limited (the “<strong>Irish</strong> <strong>Stock</strong> <strong>Exchange</strong>”) for each Class of Notes to be admitted to the Official List<br />

and trading on its regulated market. This Prospectus constitutes a “prospectus” for the purposes of EU Directive 2003/71/EC.<br />

The Class E Notes and the Class N Notes are designated for trading in The Private Offering, Resale and Trading Automatic Linkages (“PORTAL”) market.<br />

SEE “RISK FACTORS” IN THIS PROSPECTUS FOR A DESCRIPTION OF CERTAIN FACTORS THAT SHOULD BE CONSIDERED BY PROSPECT<strong>IV</strong>E<br />

INVESTORS IN CONNECTION WITH AN INVESTMENT IN ANY OF THE NOTES.<br />

The net proceeds of the offering of the Notes were applied by the Issuer in purchasing a diversified portfolio of assets which are required to satisfy the eligibility criteria<br />

specified below in “Description of the Portfolio” and certain other rights as described herein. Security has been and will be created over the Collateral Debt Securities and<br />

certain of the Issuer’s other assets in favour of the Trustee for the benefit of the holders of the Notes and certain other secured creditors described herein. The Notes are<br />

limited recourse debt obligations of the Issuer. The Collateral Debt Securities and certain other assets of the Issuer secured in favour of the Trustee are the sole source of<br />

payments on the Notes.<br />

THE NOTES DO NOT REPRESENT AN INTEREST IN, OR OBLIGATIONS OF, AND ARE NOT INSURED OR GUARANTEED BY, THE TRUSTEE, THE<br />

PAYING AGENTS, THE TRANSFER AGENTS, THE REGISTRAR, ANY OF THE NOTEHOLDERS, THE COLLATERAL MANAGER, THE INITIAL<br />

HEDGE COUNTERPARTY, ANY OTHER HEDGE COUNTERPARTIES, THE CAPITAL COMMITMENT REGISTRAR, THE LIQUIDITY FACILITY<br />

PROVIDER OR ANY OF THEIR RESPECT<strong>IV</strong>E AFFILIATES.<br />

THE NOTES OFFERED HEREBY HAVE NOT BEEN, AND WILL NOT BE, REGISTERED UNDER THE UNITED STATES SECURITIES ACT OF 1933, AS<br />

AMENDED (THE “SECURITIES ACT”), OR THE SECURITIES LAWS OF ANY STATE OF THE UNITED STATES OR ANY OTHER RELEVANT<br />

JURISDICTION. THE ISSUER HAS NOT BEEN AND WILL NOT BE REGISTERED UNDER THE UNITED STATES INVESTMENT COMPANY ACT OF 1940,<br />

AS AMENDED (THE “INVESTMENT COMPANY ACT”), BY REASON OF THE EXCEPTION CONTAINED IN SECTION 3(c)(7) THEREOF. THE NOTES ARE<br />

OFFERED HEREBY (I) IN THE UNITED STATES TO PERSONS WHO ARE BOTH QUALIFIED INSTITUTIONAL BUYERS (AS DEFINED IN RULE 144A<br />

UNDER THE SECURITIES ACT) AND QUALIFIED PURCHASERS (FOR PURPOSES OF THE INVESTMENT COMPANY ACT) (THE “RULE 144A NOTES”)<br />

AND (II) OUTSIDE THE UNITED STATES TO PERSONS WHO ARE NEITHER U.S. PERSONS (AS DEFINED IN REGULATION S UNDER THE SECURITIES<br />

ACT) NOR U.S. RESIDENTS (AS DETERMINED FOR THE PURPOSES OF THE INVESTMENT COMPANY ACT) IN OFFSHORE TRANSACTIONS IN<br />

RELIANCE ON REGULATION S (THE “REGULATION S NOTES”). EACH PURCHASER OF THE NOTES IN MAKING ITS PURCHASE WILL BE DEEMED<br />

TO HAVE MADE CERTAIN ACKNOWLEDGEMENTS, REPRESENTATIONS AND AGREEMENTS AS SET FORTH UNDER “PLAN OF DISTRIBUTION AND<br />

TRANSFER RESTRICTIONS”. PROSPECT<strong>IV</strong>E PURCHASERS ARE HEREBY NOTIFIED THAT THE SELLER OF THE NOTES MAY BE RELYING ON THE<br />

EXEMPTION FROM THE PROVISIONS OF SECTION 5 OF THE SECURITIES ACT PROVIDED BY RULE 144A. THE NOTES ARE SUBJECT TO OTHER<br />

RESTRICTIONS ON TRANSFERABILITY AND RESALE AS SET FORTH IN “PLAN OF DISTRIBUTION AND TRANSFER RESTRICTIONS”.<br />

Arranger and Initial Purchaser<br />

Dresdner Kleinwort<br />

18 July 2007

Save as provided below with respect to the Class A1A Notes, Regulation S Notes of each Class are each<br />

represented on issue by beneficial interests in one or more global certificates of such Class (each a “Regulation<br />

S Global Note”) in fully registered form, without interest coupons or principal receipts, which were deposited<br />

on or about the Issue Date with Euroclear Bank N.V./S.A. as operator of the Euroclear System (“Euroclear”)<br />

and Clearstream Banking, société anonyme (“Clearstream, Luxembourg”). Save as provided below with<br />

respect to the Class A1A Notes, Rule 144A Notes of each Class are represented on issue by beneficial interests<br />

in one or more global certificates of such Class (each a “Rule 144A Global Note”), in fully registered form,<br />

without interest coupons or principal receipts, which were deposited on or about the Issue Date with a custodian<br />

for, and registered in the name of, The Depository Trust Company (“DTC”) or its nominee. Ownership<br />

interests in the Regulation S Global Notes and the Rule 144A Global Notes (together, the “Global Notes”) are<br />

shown on, and transfers thereof will only be effected through, records maintained by Euroclear, Clearstream,<br />

Luxembourg and DTC and their respective participants. Until and including the 40th day after the later of the<br />

commencement of the offering and the closing of the offering of the Notes (the “Distribution Compliance<br />

Period”), beneficial interests in a Regulation S Global Note may be held only through Euroclear or Clearstream,<br />

Luxembourg. Notes in definitive certificated form will be issued only in limited circumstances. See “Form of<br />

the Notes” and “Book Entry Clearance Procedures” below.<br />

The Class A1A Notes are represented by one or more registered notes in definitive form issued pursuant to,<br />

and in the circumstances specified in, the Class A1A Note Purchase Agreement and sold in reliance on<br />

Regulation S or Rule 144A, and substantially in the form as set out in the Trust Deed in the applicable Minimum<br />

Denominations and integral multiples in excess of the applicable Authorised Denomination.<br />

Except for the information contained in this Prospectus in the section headed “Description of the Collateral<br />

Manager”, the Issuer accepts responsibility for the information contained in this Prospectus. To the best of the<br />

knowledge and belief of the Issuer (who has taken all reasonable care to ensure that such is the case) the<br />

information contained in this document is in accordance with the facts and does not omit anything likely to<br />

affect the import of such information.<br />

The Collateral Manager accepts responsibility for the information contained in this Prospectus in the section<br />

headed “Description of the Collateral Manager” to the extent that it is correct to the best of its knowledge as at<br />

the Issue Date. To the best of the knowledge and belief of the Collateral Manager (the Collateral Manager<br />

having taken all reasonable care to ensure that such is the case), the information in respect of which it accepts<br />

responsibility is in accordance with the facts and does not omit anything likely to affect the import of such<br />

information. The Collateral Manager does not accept any responsibility for the accuracy and completeness of<br />

any other information contained in this Prospectus nor otherwise for the structuring and operation of any<br />

arrangements relating to the Notes (save in its capacity as the Collateral Manager) referred to herein.<br />

Save, in the case of the Collateral Manager, for the section described immediately above in respect of the<br />

Collateral Manager, none of Dresdner Bank AG London Branch, in its capacity as arranger (the “Arranger”)<br />

and as initial purchaser of the Notes (the “Initial Purchaser”), the Trustee, the Collateral Manager, The Bank of<br />

New York (the “Initial Hedge Counterparty”), the Collateral Administrator, the <strong>Capital</strong> Commitment<br />

Registrar, the Liquidity Facility Provider, the Custodian, the Account Bank, the Paying Agents, the Registrar,<br />

the Transfer Agents, any Class A1A Noteholders or any Affiliate of any of them has separately verified the<br />

information contained in this Prospectus and accordingly none of the Arranger, the Initial Purchaser, the<br />

Trustee, the Collateral Manager, the Initial Hedge Counterparty, the Collateral Administrator, the <strong>Capital</strong><br />

Commitment Registrar, the Liquidity Facility Provider, the Custodian, the Account Bank, the Paying Agents,<br />

the Registrar, the Transfer Agents, any Class A1A Noteholder or any Affiliate of any of them makes any<br />

representation, recommendation or warranty, express or implied, regarding the accuracy, adequacy,<br />

reasonableness or completeness of the information contained in this Prospectus or in any further information,<br />

notice or other document which may at any time be supplied in connection with the Notes or their distribution or<br />

accepts any responsibility or liability therefor. Each person receiving this Prospectus acknowledges that such<br />

person has not relied on the Arranger, the Initial Purchaser, the Trustee, the Collateral Manager, the Initial<br />

Hedge Counterparty, the Collateral Administrator, the <strong>Capital</strong> Commitment Registrar, the Liquidity Facility<br />

Provider, the Custodian, the Account Bank, the Paying Agents, the Registrar, the Transfer Agents, any Class<br />

A1A Noteholder or any Affiliate of any of them in connection with its investigation of the accuracy of such<br />

information or its investment decision.<br />

Each person contemplating making an investment in the Notes must make its own investigation and<br />

analysis of the creditworthiness of the Issuer and its own determination of the suitability of any such investment,<br />

3

with particular reference to its own investment objectives and experience and any other factors which may be<br />

relevant to it in connection with such investment.<br />

This Prospectus does not constitute an offer of, or an invitation by or on behalf of, the Issuer, the Initial<br />

Purchaser, or any Affiliate of the Initial Purchaser to subscribe for or purchase, any of the Notes in any<br />

jurisdiction to any person to whom it is unlawful to make such an offer or invitation in such jurisdiction.<br />

The distribution of this Prospectus and the offering of the Notes in certain jurisdictions may be restricted by<br />

law. For a description of certain restrictions on offers and sales of Notes and the distribution and issue of this<br />

Prospectus and other documents, see “Plan of Distribution and Transfer Restrictions” below.<br />

In connection with the issue and sale of the Notes, no person is authorised to give any information or to<br />

make any representation not contained in this Prospectus and, if given or made, such information or<br />

representation must not be relied upon as having been authorised by or on behalf of the Issuer, the Initial<br />

Purchaser or Affiliates of the Initial Purchaser. The delivery of this Prospectus at any time does not imply that<br />

the information contained in it is correct as at any time subsequent to its date.<br />

THE NOTES HAVE NOT BEEN APPROVED OR DISAPPROVED BY THE UNITED STATES<br />

SECURITIES AND EXCHANGE COMMISSION OR ANY STATE SECURITIES COMMISSION OR<br />

OTHER REGULATORY AUTHORITY, AND NONE OF THE FOREGOING AUTHORITIES HAS<br />

CONFIRMED THE ACCURACY OR DETERMINED THE ADEQUACY OF THIS PROSPECTUS.<br />

ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENCE.<br />

THE NOTES CANNOT BE OFFERED OR SOLD IN THE UNITED STATES OR TO U.S. PERSONS<br />

UNLESS THEY ARE REGISTERED UNDER THE SECURITIES ACT AND APPLICABLE STATE<br />

SECURITIES LAWS OR AN EXEMPTION FROM SUCH REGISTRATION IS AVAILABLE. FOR A<br />

DESCRIPTION OF CERTAIN RESTRICTIONS ON RESALE AND TRANSFER, SEE “PLAN OF<br />

DISTRIBUTION AND TRANSFER RESTRICTIONS”.<br />

NOTICE TO NEW HAMPSHIRE RESIDENTS<br />

NEITHER THE FACT THAT A REGISTRATION STATEMENT OR AN<br />

APPLICATION FOR A LICENSE HAS BEEN FILED UNDER NEW HAMPSHIRE<br />

REVISED STATUTES ANNOTATED, CHAPTER 421-B (“RSA 421-B”), WITH THE<br />

STATE OF NEW HAMPSHIRE NOR THE FACT THAT A SECURITY IS<br />

EFFECT<strong>IV</strong>ELY REGISTERED OR A PERSON IS LICENSED IN THE STATE OF<br />

NEW HAMPSHIRE CONSTITUTES A FINDING BY THE SECRETARY OF STATE<br />

OF NEW HAMPSHIRE THAT ANY DOCUMENT FILED UNDER RSA-421 B IS<br />

TRUE, COMPLETE AND NOT MISLEADING. NEITHER ANY SUCH FACT NOR<br />

THE FACT THAT AN EXEMPTION OR EXCEPTION IS AVAILABLE FOR A<br />

SECURITY OR A TRANSACTION MEANS THAT THE SECRETARY OF STATE<br />

HAS PASSED IN ANY WAY UPON THE MERITS OR QUALIFICATIONS OF, OR<br />

RECOMMENDED OR G<strong>IV</strong>EN APPROVAL TO, ANY PERSON, SECURITY, OR<br />

TRANSACTION. IT IS UNLAWFUL TO MAKE, OR CAUSE TO BE MADE, TO<br />

ANY PROSPECT<strong>IV</strong>E PURCHASER, CUSTOMER, OR CLIENT ANY<br />

REPRESENTATION INCONSISTENT WITH THE PROVISIONS OF THIS<br />

PARAGRAPH.<br />

NOTICE TO UNITED KINGDOM INVESTORS<br />

WITHIN THE UNITED KINGDOM, THIS PROSPECTUS IS DIRECTED ONLY AT PERSONS WHO<br />

HAVE PROFESSIONAL EXPERIENCE IN MATTERS RELATING TO INVESTMENTS AND WHO<br />

QUALIFY EITHER AS INVESTMENT PROFESSIONALS IN ACCORDANCE WITH ARTICLE 19(5), OR<br />

AS HIGH NET WORTH COMPANIES, UNINCORPORATED ASSOCIATIONS, PARTNERSHIPS OR<br />

TRUSTEES IN ACCORDANCE WITH ARTICLE 49(2) OF THE FINANCIAL SERVICES AND MARKETS<br />

ACT 2000 (FINANCIAL PROMOTION) ORDER 2005 (TOGETHER, “EXEMPT PERSONS”). IT MAY<br />

NOT BE PASSED ON EXCEPT TO EXEMPT PERSONS OR OTHER PERSONS IN CIRCUMSTANCES IN<br />

WHICH SECTION 21(1) OF THE FINANCIAL SERVICES AND MARKETS ACT 2000 DOES NOT APPLY<br />

4

TO THE ISSUER (ALL SUCH PERSONS TOGETHER BEING REFERRED TO AS “RELEVANT<br />

PERSONS”). THIS PROSPECTUS MUST NOT BE ACTED ON OR RELIED ON BY PERSONS WHO<br />

ARE NOT RELEVANT PERSONS. ANY INVESTMENT OR INVESTMENT ACT<strong>IV</strong>ITY TO WHICH THIS<br />

PROSPECTUS RELATES IS AVAILABLE ONLY TO RELEVANT PERSONS AND WILL BE ENGAGED<br />

IN ONLY WITH RELEVANT PERSONS. ANY PERSONS OTHER THAN RELEVANT PERSONS<br />

SHOULD NOT ACT OR RELY ON THIS PROSPECTUS.<br />

NOTICE TO DANISH INVESTORS<br />

THIS DOCUMENT AND THE NOTES OFFERED HEREIN HAVE NOT BEEN FILED WITH OR<br />

APPROVED BY THE DANISH FINANCIAL SUPERVISORY AUTHORITY OR ANY OTHER<br />

REGULATORY AUTHORITY IN THE KINGDOM OF DENMARK NOR DOES THIS DOCUMENT<br />

CONSTITUTE A PROSPECTUS OR OTHER PROMOTIONAL MATERIAL FOR THE PUBLIC OFFERING<br />

OF THE NOTES IN ACCORDANCE WITH DANISH LAW. ACCORDINGLY, THE NOTES OFFERED<br />

HEREIN MAY NOT BE OFFERED OR SOLD, INCLUDING ANY SUBSEQUENT RESALE OR OTHER<br />

TRANSFER OF THE NOTES, DIRECTLY OR INDIRECTLY, IN DENMARK, NOR MAY THIS<br />

DOCUMENT BE MARKETED OR DISTRIBUTED IN DENMARK EXCEPT IF IT IS IN COMPLIANCE<br />

WITH THE DANISH SECURITIES TRADING ACT AND ANY EXECUT<strong>IV</strong>E ORDERS ISSUED<br />

THEREUNDER, INCLUDING EXECUT<strong>IV</strong>E ORDER NO. 306 OF 28 APRIL 2005 AND EXECUT<strong>IV</strong>E<br />

ORDER NO. 307 OF 28 APRIL 2005 ON THE FIRST PUBLIC OFFER OF CERTAIN SECURITIES, EACH<br />

AS AMENDED OR REPLACED FROM TIME TO TIME.<br />

NOTICE TO FRENCH INVESTORS<br />

THE NOTES HAVE NOT BEEN AND WILL NOT BE OFFERED OR SOLD TO THE PUBLIC IN<br />

FRANCE (APPEL PUBLIC Á L’ÉPARGNE), DIRECTLY OR INDIRECTLY, AND NO OFFERING OR<br />

MARKETING MATERIALS RELATING TO THE NOTES MUST BE MADE AVAILABLE OR<br />

DISTRIBUTED IN ANY WAY THAT WOULD CONSTITUTE, DIRECTLY OR INDIRECTLY, AN OFFER<br />

TO THE PUBLIC IN THE REPUBLIC OF FRANCE.<br />

THE NOTES MAY ONLY BE OFFERED OR SOLD IN THE REPUBLIC OF FRANCE TO<br />

PROVIDERS OF INVESTMENT SERVICES RELATING TO PORTFOLIO MANAGEMENT FOR THE<br />

ACCOUNT OF THIRD PARTIES, AND/OR QUALIFIED INVESTORS (INVESTISSEURS QUALIFIÉS)<br />

AND/OR TO A LIMITED GROUP OF INVESTORS (CERCLE RESTREINT D’INVESTISSEURS), AS<br />

DEFINED IN AND IN ACCORDANCE WITH ARTICLES L.411-1, L.411-2 AND D.411-1 OF THE<br />

FRENCH CODE MONÉTAIRE ET FINANCIER.<br />

ANY CONTACTS WITH POTENTIAL INVESTORS IN FRANCE DO NOT AND WILL NOT<br />

CONSTITUTE FINANCIAL OR BANKING SOLICITATION (DÉMARCHAGE BANCAIRE OU<br />

FINANCIER) AS DEFINED IN ARTICLES L.341-1 ET SEQ. OF THE FRENCH CODE MONÉTAIRE ET<br />

FINANCIER.<br />

PROSPECT<strong>IV</strong>E INVESTORS ARE INFORMED THAT:<br />

(A) THIS PROSPECTUS HAS NOT BEEN SUBMITTED FOR CLEARANCE TO THE FRENCH<br />

FINANCIAL MARKET AUTHORITY (AUTORITÉ DES MARCHÉS FINANCIERS) AND DOES<br />

NOT CONSTITUTE AN OFFER FOR SALE OR SUBSCRIPTION OF THE NOTES;<br />

(B) ANY QUALIFIED INVESTORS (INVESTISSEURS QUALIFIÉS) AS DEFINED UNDER ARTICLE<br />

D.411-1 I OR II OF THE FRENCH CODE MONÉTAIRE ET FINANCIER, SUBSCRIBING FOR THE<br />

NOTES, SHOULD BE ACTING FOR THEIR OWN ACCOUNT; AND<br />

(C) THE DIRECT AND INDIRECT DISTRIBUTION OR SALE TO THE PUBLIC OF THE NOTES<br />

ACQUIRED BY THEM MAY ONLY BE MADE IN COMPLIANCE WITH ARTICLES L.411-1,<br />

L.411-2, L.412-1 AND L.621-8 OF THE FRENCH CODE MONÉTAIRE ET FINANCIER.<br />

NOTICE TO GERMAN INVESTORS<br />

THE NOTES MAY BE QUALIFIED AS A FOREIGN INVESTMENT FUND SUBJECT TO THE<br />

GERMAN INVESTMENT ACT (INVESTMENTGESETZ - “INVG”) OF 15 DECEMBER 2003, AS<br />

AMENDED. NO AUTHORISATION FROM THE GERMAN FEDERAL FINANCIAL SUPERVISORY<br />

5

AUTHORITY (BUNDESANSTALT FÜR FINANZDIENSTLEISTUNGSAUFSICHT - “BAFIN”) HAS BEEN<br />

OBTAINED IN CONNECTION WITH THE OFFERING AND DISTRIBUTION OF THE NOTES IN THE<br />

FEDERAL REPUBLIC OF GERMANY. ACCORDINGLY, THE INITIAL PURCHASER HAS AGREED<br />

THAT THE NOTES MAY NOT BE PUBLICLY OFFERED OR DISTRIBUTED IN OR FROM THE<br />

FEDERAL REPUBLIC OF GERMANY, AND THE INITIAL PURCHASER HAS AGREED THAT<br />

NEITHER THIS PROSPECTUS NOR ANY OTHER OFFERING MATERIALS RELATING TO ANY OF<br />

THE NOTES MAY BE PUBLICLY DISTRIBUTED IN CONNECTION WITH ANY SUCH OFFERING OR<br />

DISTRIBUTION. THE INITIAL PURCHASER HAS REPRESENTED AND AGREED THAT (A) IT HAS<br />

NOT PREPARED OR PUBLISHED ANY SELLING PROSPECTUS (VERKAUFSPROSPEKT) WITHIN THE<br />

MEANING OF THE GERMAN SECURITIES PROSPECTUS ACT (WERTPAPIERPROSPEKTGESETZ –<br />

“WPPG”) AS OF 22 JUNE 2005, EFFECT<strong>IV</strong>E AS OF 1 JULY 2005, AS AMENDED, TO BE APPROVED<br />

BY THE BAFIN AND (B) IT HAS NOT OFFERED OR SOLD OR WILL NOT OFFER OR SELL OR<br />

PUBLICLY PROMOTE OR ADVERTISE IN THE FEDERAL REPUBLIC OF GERMANY OTHER THAT<br />

IN COMPLIANCE WITH THE PR<strong>IV</strong>ATE PLACEMENT RULES UNDER THE INVG, IF APPLICABLE,<br />

AND THE WPPG, OR ANY OTHER LAWS AND REGULATIONS APPLICABLE IN THE FEDERAL<br />

REPUBLIC OF GERMANY GOVERNING THE ISSUE, OFFERING AND SALE OF SECURITIES. THIS<br />

PROSPECTUS IS FOR THE RESPECT<strong>IV</strong>E RECIPIENT ONLY AND MAY NOT IN ANY WAY BE<br />

FORWARDED TO ANY OTHER PERSON OR TO THE PUBLIC IN GERMANY. ANY ON-SALE OF THE<br />

NOTES IS ONLY PERMISSIBLE IN ACCORDANCE WITH THE PR<strong>IV</strong>ATE PLACEMENT RULES<br />

UNDER THE INVG, IF APPLICABLE, AND THE WPPG. ANY USE IN THIS PROSPECTUS OF THE<br />

TERMS “FUND” OR “INVESTMENT”, OR TERMS WITH SIMILAR MEANINGS, SHOULD NOT BE<br />

INTERPRETED TO IMPLY THAT THE BAFIN HAS REVIEWED OR G<strong>IV</strong>EN THEIR APPROVAL TO ANY<br />

INFORMATION CONTAINED THEREIN.<br />

NOTICE TO U.S. INVESTORS<br />

EACH PURCHASER OF NOTES FROM THE INITIAL PURCHASER SOLD IN THE UNITED<br />

STATES IN RELIANCE ON THE EXEMPTION FROM THE REGISTRATION REQUIREMENTS OF THE<br />

SECURITIES ACT PROVIDED BY RULE 144A THEREOF, AND EACH SUBSEQUENT PURCHASER<br />

AND TRANSFEREE, SHALL BE DEEMED TO (I) REPRESENT THAT IT IS BOTH A QUALIFIED<br />

INSTITUTIONAL BUYER, AS DEFINED IN RULE 144A UNDER THE SECURITIES ACT (A<br />

“QUALIFIED INSTITUTIONAL BUYER”) AND A QUALIFIED PURCHASER, FOR PURPOSES OF<br />

THE INVESTMENT COMPANY ACT (A “QUALIFIED PURCHASER”), PURCHASING FOR ITS OWN<br />

ACCOUNT OR ONE OR MORE ACCOUNTS WITH RESPECT TO WHICH IT EXERCISES SOLE<br />

INVESTMENT DISCRETION, EACH OF WHICH IS BOTH A QUALIFIED INSTITUTIONAL BUYER<br />

AND A QUALIFIED PURCHASER, AND IN EACH CASE IS PURCHASING THE NOTES FOR<br />

INVESTMENT PURPOSES AND NOT WITH A VIEW TO THE RESALE, DISTRIBUTION OR OTHER<br />

DISPOSITION THEREOF, (II) REPRESENT THAT IT IS NOT (X) A DEALER OF THE TYPE<br />

DESCRIBED IN PARAGRAPH (A)(1)(II) OF RULE 144A UNLESS IT OWNS AND INVESTS ON A<br />

DISCRETIONARY BASIS NOT LESS THAN U.S.$25,000,000 IN SECURITIES OF ISSUERS THAT ARE<br />

NOT AFFILIATED TO IT, (Y) A PARTICIPANT-DIRECTED EMPLOYEE PLAN, SUCH AS A 401(K)<br />

PLAN, OR ANY OTHER TYPE OF PLAN REFERRED TO IN PARAGRAPH (A)(1)(I)(D) OR (A)(1)(I)(E)<br />

OF RULE 144A, OR A TRUST FUND REFERRED TO IN PARAGRAPH (A)(1)(I)(F) OF RULE 144A<br />

THAT HOLDS THE ASSETS OF SUCH A PLAN, UNLESS INVESTMENT DECISIONS WITH RESPECT<br />

TO THE PLAN ARE MADE SOLELY BY THE FIDUCIARY, TRUSTEE OR SPONSOR OF SUCH PLAN,<br />

OR (Z) FORMED FOR THE PURPOSE OF INVESTING IN THE ISSUER (EXCEPT WHERE EACH<br />

BENEFICIAL OWNER OF THE PURCHASER IS A QUALIFIED PURCHASER), (III) REPRESENT THAT<br />

IT, AND EACH ACCOUNT FOR WHICH IT IS PURCHASING, WILL HOLD AND TRANSFER AT<br />

LEAST THE MINIMUM DENOMINATION, (<strong>IV</strong>) ACKNOWLEDGE THAT THE ISSUER MAY RECE<strong>IV</strong>E<br />

A LIST OF PARTICIPANTS HOLDING POSITIONS IN ITS SECURITIES FROM ONE OR MORE BOOK-<br />

ENTRY REGISTRIES AND (V) ACKNOWLEDGE THAT THE NOTES HAVE NOT BEEN AND WILL<br />

NOT BE REGISTERED UNDER THE SECURITIES ACT AND MAY NOT BE RE-OFFERED, RESOLD,<br />

PLEDGED OR OTHERWISE TRANSFERRED EXCEPT (1) TO A QUALIFIED PURCHASER THAT THE<br />

SELLER REASONABLY BELIEVES IS A QUALIFIED INSTITUTIONAL BUYER, PURCHASING FOR<br />

ITS OWN ACCOUNT OR ONE OR MORE ACCOUNTS WITH RESPECT TO WHICH IT EXERCISES<br />

SOLE INVESTMENT DISCRETION, EACH OF WHICH IS A QUALIFIED PURCHASER THAT THE<br />

SELLER REASONABLY BELIEVES IS A QUALIFIED INSTITUTIONAL BUYER, TO WHOM NOTICE<br />

IS G<strong>IV</strong>EN THAT THE RESALE, PLEDGE OR OTHER TRANSFER IS BEING MADE IN RELIANCE ON<br />

AN EXEMPTION FROM THE REGISTRATION REQUIREMENTS OF THE SECURITIES ACT AND<br />

FROM WHICH THE SAME REPRESENTATIONS AND ACKNOWLEDGEMENTS ARE RECE<strong>IV</strong>ED AS<br />

6

G<strong>IV</strong>EN BY THE PURCHASER IN THIS SENTENCE, NONE OF WHICH IS (X) A DEALER OF THE TYPE<br />

DESCRIBED IN PARAGRAPH (A)(1)(II) OF RULE 144A UNLESS IT OWNS AND INVESTS ON A<br />

DISCRETIONARY BASIS NOT LESS THAN U.S.$25,000,000 IN SECURITIES OF ISSUERS THAT ARE<br />

NOT AFFILIATED TO IT, (Y) A PARTICIPANT-DIRECTED EMPLOYEE PLAN, SUCH AS A 401(K)<br />

PLAN, OR ANY OTHER TYPE OF PLAN REFERRED TO IN PARAGRAPH (A)(1)(I)(D) OR (A)(1)(I)(E)<br />

OF RULE 144A, OR A TRUST FUND REFERRED TO IN PARAGRAPH (A)(1)(I)(F) OF RULE 144A<br />

THAT HOLDS THE ASSETS OF SUCH A PLAN, UNLESS INVESTMENT DECISIONS WITH RESPECT<br />

TO THE PLAN ARE MADE SOLELY BY THE FIDUCIARY, TRUSTEE OR SPONSOR OF SUCH PLAN,<br />

OR (Z) FORMED FOR THE PURPOSE OF INVESTING IN THE ISSUER (EXCEPT WHERE EACH<br />

BENEFICIAL OWNER OF THE PURCHASER IS A QUALIFIED PURCHASER), OR (2) TO A PERSON<br />

THAT IS NEITHER A U.S. PERSON NOR A U.S. RESIDENT IN AN “OFFSHORE TRANSACTION” IN<br />

RELIANCE ON REGULATION S. FOR A DESCRIPTION OF THESE AND CERTAIN OTHER<br />

RESTRICTIONS ON OFFERS AND SALES OF THE NOTES AND DISTRIBUTION OF THIS<br />

PROSPECTUS, SEE “PLAN OF DISTRIBUTION AND TRANSFER RESTRICTIONS”.<br />

EACH PURCHASER OF NOTES FROM THE INITIAL PURCHASER SOLD OUTSIDE THE UNITED<br />

STATES IN RELIANCE ON REGULATION S WILL BE DEEMED TO REPRESENT THAT IT (I) IS<br />

NEITHER A U.S. PERSON NOR A U.S. RESIDENT, (II) IS AWARE THAT THE SALE TO IT IS BEING<br />

MADE IN RELIANCE ON AN EXEMPTION FROM THE REGISTRATION REQUIREMENTS OF THE<br />

SECURITIES ACT PROVIDED BY REGULATION S THEREUNDER, (III) IS ACQUIRING SUCH NOTES<br />

FOR ITS OWN ACCOUNT OR ONE OR MORE ACCOUNTS WITH RESPECT TO WHICH IT<br />

EXERCISES SOLE INVESTMENT DISCRETION, NONE OF WHICH IS A U.S. PERSON OR A U.S.<br />

RESIDENT, AND (<strong>IV</strong>) IS NOT PURCHASING SUCH NOTES WITH A VIEW TO THE RESALE,<br />

DISTRIBUTION OR OTHER DISPOSITION THEREOF IN THE UNITED STATES OR TO A U.S. PERSON<br />

OR A U.S. RESIDENT.<br />

EACH PERSON RECE<strong>IV</strong>ING THIS PROSPECTUS ACKNOWLEDGES THAT SUCH PERSON HAS<br />

NOT RELIED UPON THE ISSUER OR THE INITIAL PURCHASER OR ANY OF ITS AFFILIATES IN<br />

CONNECTION WITH ITS INVESTIGATION OF THE ACCURACY OF THE INFORMATION<br />

CONTAINED IN THIS PROSPECTUS OR ITS INVESTMENT DECISIONS.<br />

NEITHER THE ISSUER NOR THE PORTFOLIO HAS BEEN REGISTERED AS AN “INVESTMENT<br />

COMPANY” UNDER THE INVESTMENT COMPANY ACT, IN RELIANCE ON THE EXCLUSION<br />

CONTAINED IN SECTION 3(C)(7) THEREOF. NO TRANSFER OF THE NOTES THAT WOULD HAVE<br />

THE EFFECT OF REQUIRING THE ISSUER OR THE PORTFOLIO TO REGISTER AS AN INVESTMENT<br />

COMPANY UNDER THE INVESTMENT COMPANY ACT WILL BE PERMITTED.<br />

THIS PROSPECTUS HAS BEEN PREPARED BY THE ISSUER SOLELY FOR USE IN CONNECTION<br />

WITH THE OFFERING AND THE LISTING OF THE NOTES DESCRIBED HEREIN (THE “OFFERING”).<br />

THE ISSUER AND THE INITIAL PURCHASER RESERVE THE RIGHT TO REJECT ANY OFFER TO<br />

PURCHASE NOTES IN WHOLE OR IN PART FOR ANY REASON, OR TO SELL LESS THAN THE<br />

STATED INITIAL PRINCIPAL AMOUNT OF ANY CLASS OF NOTES OFFERED HEREBY. THIS<br />

PROSPECTUS DOES NOT CONSTITUTE AN OFFER TO THE PUBLIC GENERALLY TO SUBSCRIBE<br />

FOR OR OTHERWISE ACQUIRE THE NOTES. EACH PROSPECT<strong>IV</strong>E PURCHASER OF THE NOTES<br />

MUST COMPLY WITH ALL APPLICABLE LAWS AND REGULATIONS IN FORCE IN ANY<br />

JURISDICTION IN WHICH IT PURCHASES, OFFERS OR SELLS NOTES OR POSSESSES OR<br />

DISTRIBUTES THIS PROSPECTUS, AND MUST OBTAIN ANY CONSENT, APPROVAL OR<br />

PERMISSION REQUIRED BY IT FOR THE PURCHASE, OFFER OR SALE BY IT OF THE NOTES<br />

UNDER THE LAWS AND REGULATIONS IN FORCE IN ANY JURISDICTION TO WHICH IT IS<br />

SUBJECT OR IN WHICH IT MAKES SUCH PURCHASES, OFFERS OR SALES, AND NEITHER THE<br />

ISSUER NOR THE INITIAL PURCHASER SHALL HAVE ANY RESPONSIBILITY THEREFOR.<br />

IRS CIRCULAR 230 LEGEND<br />

THIS PROSPECTUS WAS NOT INTENDED OR WRITTEN TO BE USED, AND CANNOT BE USED,<br />

FOR THE PURPOSE OF AVOIDING U.S. FEDERAL, STATE, OR LOCAL TAX PENALTIES. THIS<br />

PROSPECTUS WAS WRITTEN IN CONNECTION WITH THE PROMOTION OR MARKETING BY THE<br />

ISSUER, THE INITIAL PURCHASER AND/OR THE ARRANGER OF THE NOTES. EACH HOLDER<br />

SHOULD SEEK ADVICE BASED ON THEIR PARTICULAR CIRCUMSTANCES FROM AN<br />

INDEPENDENT TAX ADVISOR.<br />

7

AVAILABLE INFORMATION<br />

To permit compliance with Rule 144A under the Securities Act in connection with the sale of the Notes, the<br />

Issuer is required pursuant to the Trust Deed to furnish, upon request of a holder of a Note, to such holder and a<br />

prospective purchaser designated by such holder, the information required to be delivered under Rule<br />

144A(d)(4) under the Securities Act if at the time of the request the Issuer is not a reporting company under<br />

Section 13 or Section 15(d) of the United States Securities <strong>Exchange</strong> Act of 1934, as amended (the “<strong>Exchange</strong><br />

Act”), or exempt from reporting pursuant to Rule 12g3 2(b) under the <strong>Exchange</strong> Act. All information made<br />

available by the Issuer pursuant to the terms of this paragraph may also be obtained during usual business hours<br />

free of charge at the office of the Paying Agent in Ireland.<br />

ENFORCEABILITY OF CERTAIN C<strong>IV</strong>IL LIABILITIES<br />

The Issuer is a company with limited liability incorporated under the laws of The Netherlands. All of the<br />

Managing Directors of the Issuer and the independent auditors named in this Prospectus are resident outside of<br />

the United States and substantially all of the assets of the Issuer are located outside the United States. It may not<br />

be possible, therefore, for Noteholders (a) to effect service of process upon certain of the Managing Directors or<br />

officers of the Issuer or (b) to enforce against any of them in the courts of a foreign jurisdiction judgments of<br />

courts of the United States predicated upon the civil liability of such persons under the United States securities<br />

laws. There is also doubt as to the direct enforceability in The Netherlands against any of these persons, in<br />

original action, or in action for the enforcement of judgments of United States courts, of civil liabilities<br />

predicated solely upon the federal securities laws of the United States.<br />

STABILISATION<br />

In connection with the issue of the Notes, Dresdner Bank AG London Branch (the “Stabilising Manager”)<br />

(or persons acting on behalf of the Stabilising Manager) may over-allot Notes or effect transactions with a view<br />

to supporting the market price of the Notes at a level higher than that which might otherwise prevail. However,<br />

there is no assurance that the Stabilising Manager (or persons acting on behalf of the Stabilising Manager) will<br />

undertake stabilisation action. Any stabilisation action may begin on or after the date on which adequate public<br />

disclosure of the terms of the offer of the Notes is made and, if begun, may be ended at any time, but it must end<br />

no later than the earlier of 30 days after the Issue Date and 60 days after the date of the allotment of the Notes.<br />

Any stabilisation action or over-allotment shall be conducted by the Stabilising Manager (or persons acting on<br />

behalf of the Stabilising Manager) in accordance with all applicable laws and rules.<br />

DEFINED TERMS<br />

The Index of Defined Terms appearing at the end of this Prospectus contains references to the pages in this<br />

Prospectus where definitions of capitalised terms used herein can be found.<br />

Unless otherwise specified or the context requires, references to “Euro”, and “€” are to the currency<br />

introduced at the start of the third stage of European economic and monetary union pursuant to the Treaty<br />

establishing the European Community, as amended by the Treaty on European Union, and references to<br />

“Sterling”, “pounds sterling” and “£” are to the lawful currency for the time being of the United Kingdom.<br />

The language of the Prospectus is English. Certain legislative references and technical terms have been<br />

cited in their original language in order that the correct technical meaning may be ascribed to them under<br />

applicable law.<br />

8

TABLE OF CONTENTS<br />

Summary....................................................................................................................................................... 10<br />

Risk Factors................................................................................................................................................... 27<br />

Conditions of the Notes.................................................................................................................................. 50<br />

Use of Proceeds ........................................................................................................................................... 134<br />

Form of the Notes ........................................................................................................................................ 135<br />

Book Entry Clearance Procedures ................................................................................................................ 138<br />

Rating of the Rated Notes ............................................................................................................................ 142<br />

Description of the Issuer .............................................................................................................................. 144<br />

Description of the Collateral Manager .......................................................................................................... 147<br />

Description of the Portfolio.......................................................................................................................... 150<br />

Description of the Collateral Management Agreement .................................................................................. 179<br />

Description of the Liquidity Facility Agreement........................................................................................... 182<br />

Description of the Reports............................................................................................................................ 185<br />

Description of the Hedge Arrangements ....................................................................................................... 189<br />

Description of the Class A1A Note Purchase Agreement .............................................................................. 190<br />

Description of the Accounts ......................................................................................................................... 193<br />

Tax Considerations ...................................................................................................................................... 198<br />

ERISA Considerations ................................................................................................................................. 214<br />

Plan of Distribution and Transfer Restrictions .............................................................................................. 217<br />

General Information..................................................................................................................................... 226<br />

Index of Defined Terms ............................................................................................................................... 228<br />

9

SUMMARY<br />

This summary does not include all relevant information relating to the transaction described herein,<br />

particularly with respect to the risks and special considerations involved with such a transaction and is<br />

qualified in its entirety by reference to the detailed information appearing elsewhere in this Prospectus and the<br />

related documents referred to herein. Prospective investors are advised to carefully read, and should rely<br />

solely on, the detailed information appearing elsewhere in this Prospectus relating to the Notes in making their<br />

investment decision. <strong>Capital</strong>ised terms not specifically defined in this summary have the meanings set out in<br />

Condition 1 (Definitions) under “Conditions of the Notes” below.<br />

The Issuer:...............................................<br />

<strong>Gresham</strong> <strong>Capital</strong> <strong>CLO</strong> <strong>IV</strong> B.V. (the “Issuer”), a private company<br />

with limited liability (besloten vennootschap met beperkte<br />

aansprakelijkheid) incorporated under the laws of The Netherlands,<br />

having its registered office at Rivierstaete Building, Amsteldijk<br />

166, 1079 LH Amsterdam, The Netherlands.<br />

The entire issued share capital of the Issuer is held by a foundation<br />

(stichting), Stichting <strong>Gresham</strong> <strong>Capital</strong> <strong>CLO</strong> <strong>IV</strong> B.V., established<br />

under the laws of The Netherlands.<br />

The Issuer has been incorporated for the sole purpose of acquiring<br />

the Portfolio, issuing the Notes and engaging in certain related<br />

transactions.<br />

The Collateral Manager: .........................<br />

The Collateral Administrator: ..................<br />

The Trustee: ............................................<br />

Investec Principal Finance, a business unit division of Investec<br />

Bank (UK) Ltd. (the “Collateral Manager”), manages the<br />

Portfolio under a collateral management agreement entered into on<br />

or about 5 July 2007 (the “Issue Date”) between, amongst others,<br />

the Issuer and the Collateral Manager (the “Collateral<br />

Management Agreement”). Pursuant to the Collateral<br />

Management Agreement, the Collateral Manager, amongst other<br />

things, manages the selection, acquisition and disposal of the<br />

Collateral Debt Securities and other collateral (including exercising<br />

rights and remedies associated with the Collateral Debt Securities)<br />

in accordance with the terms of the Collateral Management<br />

Agreement.<br />

Certain administrative functions with respect to the Portfolio,<br />

including the calculation of the Coverage Tests, the preparation of<br />

certain reports in respect of the Portfolio, the operation of the<br />

Accounts and the application of monies in accordance with the<br />

Priorities of Payment, are performed by Law Debenture Asset<br />

Backed Solutions Limited (in such capacity, the “Collateral<br />

Administrator”) under the Collateral Administration Agreement.<br />

The Law Debenture Trust Corporation p.l.c., acting through its<br />

office at 100 Wood Street, London EC2V 7EX, will be the trustee<br />

for the Noteholders (the “Trustee”).<br />

The Trustee may retire by giving the Issuer not less than three<br />

months’ written notice or the Trustee may be removed by an<br />

Extraordinary Resolution of the Controlling Class on not less than<br />

90 days’ written notice. Any retirement or removal of the Trustee<br />

shall not be effective until a successor trustee has been appointed.<br />

Overview of the Notes: ............................<br />

The Notes were issued and are secured pursuant to a trust deed (the<br />

“Trust Deed”) between, amongst others, the Issuer and the Trustee<br />

dated on or about the Issue Date.<br />

Up to €75,000,000 Class A1A Senior Secured Floating Rate<br />

Variable Funding Notes due 2023 (the “Class A1A Notes”);<br />

10

€75,000,000 Class A1B Senior Secured Floating Rate Notes due<br />

2023 (including any Class A1B Refinancing Notes issued as<br />

described herein, the “Class A1B Notes”);<br />

€48,800,000 Class A2 Senior Secured Floating Rate Notes due<br />

2023 (the “Class A2 Notes” and, together with the Class A1A<br />

Notes and the Class A1B Notes, the “Class A Notes” or the<br />

“Senior Notes”);<br />

€24,130,000 Class B Deferrable Secured Floating Rate Notes due<br />

2023 (the “Class B Notes”);<br />

€21,900,000 Class C Deferrable Secured Floating Rate Notes due<br />

2023 (the “Class C Notes”);<br />

€22,020,000 Class D Deferrable Secured Floating Rate Notes due<br />

2023 (the “Class D Notes”);<br />

€10,780,000 Class E Deferrable Secured Floating Rate Notes due<br />

2023 (the “Class E Notes” and, together with the Senior Notes, the<br />

Class B Notes, the Class C Notes and the Class D Notes, the<br />

“Rated Notes” ); and<br />

€32,800,000 Class N Subordinated Notes due 2023 (the “Class N<br />

Notes”).<br />

The Rated Notes and the Class N Notes are together referred to as<br />

the “Notes” and any one class of Notes being a “Class”.<br />

Status of the Notes: .................................<br />

Each Class of Notes are secured limited recourse debt obligations<br />

of the Issuer and each Note of a specific Class ranks pari passu<br />

with each of the other Notes of such Class. Subject as provided<br />

below, the Class A1A Notes and the Class A1B Notes rank pari<br />

passu amongst themselves and senior in respect of the Class A2<br />

Notes.<br />

Subject as provided below, payments of principal on each Payment<br />

Date rank in the following order of priority: (i) the Class A1A<br />

Notes and Class A1B Notes, pari passu; (ii) the Class A2 Notes;<br />

(iii) the Class B Notes; (iv) the Class C Notes; (v) the Class D<br />

Notes; (vi) the Class E Notes and (vii) the Class N Notes.<br />

Subject as provided below, payments of interest on each Payment<br />

Date rank in the following order of priority: (i) the Class A1A<br />

Notes, including any Commitment Fee and Break Costs (other than<br />

in respect of any Class A1A Increased Margin) and Class A1B<br />

Notes, pari passu; (ii) the Class A2 Notes; (iii) the Class B Notes;<br />

(iv) the Class C Notes; (v) the Class D Notes; (vi) the Class E<br />

Notes and (vii) the Class N Notes.<br />

In the case of the redemption of the Notes pursuant to Condition<br />

7(b) (Optional Redemption) and after enforcement of the security<br />

over the Collateral, the Senior Notes rank pari passu amongst<br />

themselves.<br />

Notwithstanding the above, where interest is paid on the Class N<br />

Notes from amounts standing to the credit of the Collateral<br />

Enhancement Account which have been (i) transferred to the<br />

Collateral Enhancement Account in accordance with Condition<br />

3(c)(i)(HH); or (ii) credited to the Collateral Enhancement Account<br />

as amounts representing Sale Proceeds of Collateral Enhancement<br />

Securities, such payments of interest on the Class N Notes will not<br />

11

e paid in accordance with the Priorities of Payment and may rank<br />

senior to payments in respect of the other Classes of Notes on a<br />

Payment Date.<br />

See “Summary of Terms—Priorities of Payment” and “Description<br />

of the Accounts—Collateral Enhancement Account” below.<br />

Ratings: ...................................................<br />

It was a condition of the issuance of the Notes that the respective<br />

Classes of Notes be assigned at least the following ratings:<br />

Senior Notes: “AAA” by Fitch and “AAA” by S&P.<br />

Class B Notes: “AA” by Fitch and “AA” by S&P.<br />

Class C Notes: “A” by Fitch and “A” by S&P.<br />

Class D Notes: “BBB” by Fitch and “BBB” by S&P.<br />

Class E Notes: “BB” by Fitch and “BB” by S&P.<br />

The Collateral Manager will request that Fitch and S&P each<br />

confirms its rating of the Senior Notes and each other Class of the<br />

Rated Notes within 30 days after the Target Date.<br />

Use of Proceeds: ......................................<br />

The net proceeds of the issue and offering of the Notes were<br />

applied by the Issuer as follows:<br />

(a) to fund or make provision for certain fees and expenses of the<br />

Issuer up to a maximum of €7,370,000;<br />

(b) to pay an up-front fee of €2,631,065 and any applicable VAT<br />

with respect thereto to the Collateral Manager on the Issue<br />

Date;<br />

(c) to pay the premium in respect of the Issuer entering into the<br />

Initial Hedge Agreement; and<br />

(d) any proceeds remaining were deposited by the Issuer into the<br />

Initial Proceeds Account for the purchase, together with any<br />

Drawing made under the Class A1A Note Purchase<br />

Agreement, of Collateral Debt Securities during the Ramp-Up<br />

Period subject to the conditions set out herein. See “Use of<br />

Proceeds” below.<br />

Class A1A Note Purchase Agreement: .....<br />

Drawings made under the Class A1A Note Purchase Agreement<br />

shall be used by the Issuer in the acquisition of Collateral Debt<br />

Securities during the Ramp-Up Period and the Reinvestment<br />

Period. Euro Drawings shall be used to purchase additional Euro<br />

Collateral Debt Securities and Non-Euro Collateral Debt Securities<br />

during the Ramp-Up Period and the Reinvestment Period and<br />

Sterling Drawings shall be used to purchase Sterling Collateral<br />

Debt Securities during the Ramp-Up Period and the Reinvestment<br />

Period.<br />

The maximum aggregate principal amount of the Note Purchase<br />

Facility is €75,000,000 or its Sterling equivalent converted at the<br />

Issue Date Spot Rate in the case of any amounts drawn in Sterling<br />

(the “Total Commitments”).<br />

Drawings made under the Class A1A Note Purchase Agreement<br />

may be repaid on dates other than Payment Dates. Any Break<br />

Costs which will be calculated pursuant to the Class A1A Note<br />

12

Purchase Agreement, shall be payable on the relevant Payment<br />

Date.<br />

The holder of the Class A1A Notes or its guarantor, as the case<br />

may be, must satisfy certain Rating Requirements. If the holder of<br />

the Class A1A Notes or its guarantor, as the case may be, fails to<br />

satisfy the Rating Requirements set out in the Class A1A Note<br />

Purchase Agreement or otherwise defaults on its obligation to<br />

provide Drawings under the Class A1A Note Purchase Agreement,<br />

the holder of the Class A1A Notes shall be required to take such<br />

action as set out more specifically in the Class A1A Note Purchase<br />

Agreement.<br />

The Issuer may, in due course and from time to time, seek to<br />

refinance the Class A1A Notes through the issuance of Class A1B<br />

Refinancing Notes (denominated in Euro and having the same<br />

terms and conditions (in all respects save as to the first period of<br />

interest) as the Class A1B Notes), which, following their issuance,<br />

will be consolidated, rank pari passu and form a single series, with<br />

the Class A1B Notes (the “Class A1B Refinancing Notes”).<br />

Accordingly, the Class A1B Refinancing Notes will accrue interest<br />

at the same rate as the Class A1B Notes.<br />

If any Class A1B Refinancing Notes are issued, the Issuer shall<br />

repay Drawings on the date of the issuance of such Class A1B<br />

Refinancing Notes, subject to the Priorities of Payment, in an<br />

amount equal to the lesser of (1) the Total Outstandings and (2) the<br />

net proceeds of the issuance of such Class A1B Refinancing Notes<br />

and the Total Commitments shall automatically be cancelled.<br />

At no time will the aggregate principal amounts Outstanding under<br />

the Class A1B Notes and the Class A2 Notes, together with the<br />

aggregate at that time of all principal amounts drawn and any<br />

amount available for drawing under the Class A1A Notes, exceed<br />

€198,800,000 (converting any Sterling Drawing under the Class<br />

A1A Notes into Euro using the Issue Date Spot Rate).<br />

The “Issue Date Spot Rate” means €1.0 to £0.6748.<br />

No Notes other than the Class A1B Refinancing Notes will be<br />

issued to refinance amounts owing under the Class A1A Note<br />

Purchase Agreement.<br />

See “Description of the Class A1A Note Purchase Agreement”<br />

below.<br />

Sterling Funding Mismatch:.....................<br />

Voting Rights of the<br />

Class A1A Noteholders: ......................<br />

In the event of a Sterling Funding Mismatch, such Sterling Funding<br />

Mismatch shall be cured using Interest Proceeds as further<br />

described in Condition 3(c)(i) (Application of Interest Proceeds on<br />

Payment Dates) and using Principal Proceeds as further described<br />

in Condition 3(c)(iii) (Application of Principal Proceeds on<br />

Payment Dates).<br />

For the purposes of voting on resolutions and issuing directions and<br />

any other decisions required to be made by any Class of<br />

Noteholders from time to time, in the case of the Class A1A<br />

Noteholders, votes shall be determined by reference to the Total<br />

Commitments at such time.<br />

13

Commitment Fee .....................................<br />

The Issuer shall pay to the Class A1A Noteholders a commitment<br />

fee (the “Commitment Fee”) in Euro in respect of each Interest<br />

Accrual Period which:<br />

(a) shall be calculated on the basis of actual days elapsed in such<br />

Interest Accrual Period and a 360 day year at the rate of 0.15<br />

per cent. per annum of the daily weighted average amount of<br />

the Undrawn Amount during such Interest Accrual Period; and<br />

(b) shall be paid to the Class A1A Noteholders, in respect of each<br />

Interest Accrual Period, on the Payment Date immediately<br />

following the end of such Interest Accrual Period in<br />

accordance with the Priorities of Payment.<br />

Priorities of Payment: ..............................<br />

Prior to enforcement of the security constituted by the Trust Deed<br />

and optional redemption under Condition 7(b) (Optional<br />

Redemption), Interest Proceeds and Principal Proceeds shall be<br />

applied in payment of interest and principal payable in respect of<br />

the Notes and amounts payable to the other creditors of the Issuer<br />

in accordance with the Priorities of Payment set out in Condition<br />

3(c) (Priorities of Payment).<br />

On and following enforcement of the security constituted by the<br />

Trust Deed or optional redemption under Condition 7(b) (Optional<br />

Redemption), Interest Proceeds and Principal Proceeds shall be<br />

applied in accordance with the Priorities of Payment specified in<br />

Condition 11 (Enforcement).<br />

Interest Payments: ...................................<br />

Subject to the provisions below, the first Interest Accrual Period in<br />

respect of the Notes (other than the Class A1A Notes and the Class<br />

A1B Refinancing Notes) commenced on (and includes) the Issue<br />

Date and shall end on (and exclude) the Payment Date falling in<br />

January 2008 and, thereafter, interest in respect of the Notes of<br />

each Class will be payable semi-annually in arrear on the 18 th day<br />

of January and July of each year (subject in each case to adjustment<br />

for non-Business Days), at maturity and upon any redemption of<br />

the Notes (each such date a “Payment Date”), provided that the<br />

first Payment Date is 18 January 2008.<br />

Each Class of Notes bears interest at the following rates:<br />

Class A1A Notes: the rate determined in accordance with<br />

Condition 6 (Interest);<br />

Class A1B Notes: Applicable EURIBOR plus 0.23 per cent. per<br />

annum (the “Class A1B Note Interest Rate”) (and including any<br />

Class A1B Refinancing Notes, if issued);<br />

Class A2 Notes: Applicable EURIBOR plus 0.32 per cent. per<br />

annum (the “Class A2 Note Interest Rate”);<br />

Class B Notes: Applicable EURIBOR plus 0.42 per cent. per<br />

annum (the “Class B Note Interest Rate”);<br />

Class C Notes: Applicable EURIBOR plus 0.70 per cent. per<br />

annum (the “Class C Note Interest Rate”);<br />

Class D Notes: Applicable EURIBOR plus 1.70 per cent. per<br />

annum (the “Class D Note Interest Rate”);<br />

Class E Notes: Applicable EURIBOR plus 3.95 per cent. per<br />

annum (the “Class E Note Interest Rate”); and<br />

14

Class N Notes: on an available funds basis subject to payment of<br />

items in priority thereto in accordance with the Priorities of<br />

Payment.<br />

The interest amounts payable on any Payment Date with respect to<br />

each Class of Notes will be calculated in accordance with the<br />

provisions of Condition 6 (Interest) and will be paid in accordance<br />

with the Priorities of Payment.<br />

With respect to the Class N Notes, available funds, if any, for the<br />

payment of interest may be paid only after the payment of, inter<br />

alia, certain fees and expenses and interest payable in respect of the<br />

Senior Notes and the other senior Classes of Notes, provided that,<br />

at the discretion of the Collateral Manager, amounts up to 50 per<br />

cent. of the amounts which would otherwise have been payable as<br />

interest on the Class N Notes in accordance with Condition<br />

3(c)(i)(HH) (Application Interest Proceeds on Payment Dates) (up<br />

to a maximum aggregate amount of €5,000,000 or its equivalent in<br />

Sterling) may be transferred to the Collateral Enhancement<br />

Account and applied in the acquisition or exercise of rights under<br />

Collateral Enhancement Securities in accordance with the<br />

Collateral Management Agreement. Amounts standing to the<br />

credit of the Collateral Enhancement Account may be applied in<br />

paying interest on the Class N Notes.<br />

Consequences of Non-Payment<br />

of Interest:............................................<br />

Reinvestment Period: ..............................<br />

Non-payment of interest (and with respect to the Class A1A Notes,<br />

including any Commitment Fee and Break Costs but excluding any<br />

Class A1A Increased Margin) in respect of the Notes Outstanding<br />

of the Controlling Class only, will (upon expiry of the applicable<br />

grace period) constitute an Issuer Event of Default pursuant to<br />

Condition 10(a) (Events of Default), following the occurrence of<br />

which the security over the Collateral will become enforceable<br />

pursuant to the terms of Condition 11 (Enforcement). For the<br />

avoidance of doubt, the non-payment of interest in respect of any<br />

Class of Notes Outstanding other than the Controlling Class shall<br />

not constitute an Issuer Event of Default and at no time will nonpayment<br />

of interest in respect of the Class N Notes constitute an<br />

Issuer Event of Default.<br />

The Reinvestment Period is the period from the Issue Date up to<br />

but excluding the Determination Date immediately preceding the<br />

Payment Date falling in July 2013.<br />

The Reinvestment Period shall automatically terminate upon the<br />

earliest of (i) the Payment Date on which the entire aggregate<br />

principal amount outstanding of all of the Notes is to be optionally<br />

redeemed and (ii) the date of the occurrence of an Issuer Event of<br />

Default.<br />

The Reinvestment Period may also be terminated earlier at the<br />

option of the Issuer, if at any time the Collateral Manager (acting in<br />

its sole and absolute discretion on behalf of the Issuer) by notice<br />

certifies to the Issuer that it has, after making all reasonable efforts<br />

to do so, been unable for reasons beyond its control to identify<br />

Additional Collateral Debt Securities that are deemed appropriate<br />

by the Collateral Manager (acting reasonably in accordance with its<br />

normal practice and acting on behalf of the Issuer) and which meet<br />

the Eligibility Criteria or, to the extent applicable, the<br />

Reinvestment Criteria in sufficient amounts to permit investment or<br />

reinvestment of the funds required to be invested by the Issuer,<br />

15

provided that the Issuer has obtained the consent of the holders of<br />

at least 50 per cent. of the aggregate principal amount outstanding<br />

of the Class N Notes (including for this purpose any of the Notes<br />

held by the Collateral Manager and its Affiliates) that the<br />

Reinvestment Period may be terminated prior to but excluding the<br />

Determination Date immediately preceding the Payment Date<br />

falling in July 2013.<br />

Maturity and Average Life<br />

and Duration: ......................................<br />

Redemption of the Notes: ........................<br />

The Notes of each Class Outstanding will mature at their principal<br />

amounts outstanding on 18 July 2023 (subject to adjustment for<br />

non-Business Days) (the “Maturity Date”), in each case unless<br />

repaid or redeemed prior to the Maturity Date. The average life of<br />

each Class of the Notes is expected to be equal to or shorter than<br />

the number of years between the Issue Date and the Maturity Date.<br />

Principal payments on the Notes will be made in the following<br />

circumstances, each as described in further detail below:<br />

(a) Final Redemption: On the Maturity Date. See Condition 7(a)<br />

(Final Redemption).<br />

(b) Optional Redemption; Class N Noteholders: All (but not<br />

some) of the Notes shall be redeemed at their applicable<br />

Redemption Prices by the Issuer at the request in writing of the<br />

holders of at least 66⅔ per cent. of the aggregate principal<br />

amount of Class N Notes Outstanding on any Payment Date<br />

falling on or after the fifth anniversary of the Issue Date or, on<br />

any Payment Date following the occurrence of a Collateral<br />

Tax Event, subject to certain conditions. See Condition<br />

7(b)(i)(A) (Optional Redemption—Redemption of the Class N<br />

Noteholders).<br />

(c) Optional Redemption; Tax Reasons: All (but not some) of the<br />

Notes shall be redeemed at their applicable Redemption Prices<br />

by the Issuer with the consent in writing of the holders of at<br />

least 66⅔ per cent. of the aggregate principal amount of Class<br />

N Notes Outstanding or the consent in writing of the Trustee<br />

acting on the directions of the holders of at least 66⅔ per cent.<br />

of the aggregate principal amount outstanding of the<br />

Controlling Class on any Payment Date following the<br />

occurrence of a Tax Event, subject to certain conditions. See<br />

Condition 7(b)(i)(B) (Redemption for Tax Reasons).<br />

(d) Mandatory Redemption; Breach of Coverage Test: In the<br />

event that any one of the Coverage Tests (as determined by the<br />

Collateral Administrator) is not satisfied on any Determination<br />

Date, on the Payment Date following such Determination<br />

Date, Interest Proceeds and thereafter Principal Proceeds will<br />

be used, each subject to the applicable Priorities of Payment, to<br />

redeem the Notes, in whole or in part, to the extent necessary<br />

to ensure the relevant Coverage Tests are satisfied if<br />

recalculated following such redemption. See Condition 7(c)(i)<br />

(Redemption upon Breach of Coverage Test).<br />

(e) Mandatory Redemption; Target Date Rating Downgrade: If a<br />

Target Date Rating Downgrade occurs and is continuing on the<br />

Business Day prior to a Payment Date, Interest Proceeds and,<br />

thereafter, Principal Proceeds will be applied, subject to the<br />

Priorities of Payment, on such Payment Date to redeem the<br />

Notes, in whole or in part, until the Rating Agencies confirm<br />

16

in writing that each such rating is reinstated. See Condition<br />

7(c)(ii) (Redemption Following Target Rate Rating<br />

Downgrade).<br />

(f)<br />

Mandatory Redemption After the Reinvestment Period: On<br />

each Payment Date after the end of the Reinvestment Period,<br />

Principal Proceeds (other than certain Unscheduled Principal<br />

Proceeds and Sale Proceeds from Credit Improved Securities,<br />

which at the option of the Collateral Manager may be invested<br />

in Collateral Debt Securities) will be applied, subject to the<br />

Priorities of Payment, to redeem the Notes. See Condition<br />

7(c)(iii) (Redemption Following Expiry of the Reinvestment<br />

Period).<br />

(g) Mandatory Redemption Upon Breach of Reinvestment OC<br />

Test: On each Payment Date after the end of the Reinvestment<br />

Period, in the event that the Reinvestment OC Test (as<br />

calculated by the Collateral Administrator) is not satisfied on<br />

the immediately preceding Measurement Date, Interest<br />

Proceeds net of the amounts payable under Condition<br />

3(c)(i)(A) to (Z) (inclusive) will be used, subject to the<br />

Priorities of Payment, to redeem the Notes, in whole or in part,<br />

to the extent necessary to cause the Reinvestment OC Test to<br />

be met if recalculated following such redemption or<br />

repayment. See Condition 7(c)(iv) (Redemption upon Breach<br />

of Reinvestment OC Test).<br />

(h) Redemption upon Sterling Funding Mismatch: On each<br />

Payment Date, in the event that there is a Sterling Funding<br />

Mismatch, Interest Proceeds and Principal Proceeds will be<br />

used in accordance with the Priorities of Payment to repay the<br />

Sterling Drawings (on a pro rata basis), in whole or in part, to<br />

the extent necessary to cure such Sterling Funding Mismatch.<br />

See Condition 7(c)(v) (Redemption upon Sterling Funding<br />

Mismatch).<br />

(i)<br />

(j)<br />

Special Redemption at the option of the Collateral Manager:<br />

Save as provided below, principal on the Notes shall be paid in<br />

accordance with Condition 3(c)(iii)(O) (Application of<br />

Principal Proceeds on Payment Dates) by the Issuer on the<br />

direction of the Collateral Manager (acting in its sole and<br />

absolute discretion on behalf of the Issuer) if, at any time<br />

during the Reinvestment Period, the Collateral Manager<br />

(acting on behalf of the Issuer) by notice certifies to the Issuer<br />

and the Trustee that for a period of 90 days following receipt<br />

of such funds it has been unable to identify Additional<br />

Collateral Debt Securities that are deemed appropriate by the<br />

Collateral Manager (in its discretion and acting on behalf of<br />

the Issuer) and which meet the Eligibility Criteria or, to the<br />

extent applicable, the Reinvestment Criteria and the Additional<br />

Reinvestment Criteria, in sufficient amounts to permit the<br />

investment or reinvestment of all or a portion of the funds then<br />

held in the Principal Collection Account that are to be invested<br />

in Additional Collateral Debt Securities (a “Special<br />

Redemption”). See Condition 7(d) (Redemption at the Option<br />

of the Collateral Manager).<br />

Redemption of Class A1A Notes: The Class A1A Notes may<br />

be redeemed by the Issuer subject to and in accordance with<br />

the terms of the Class A1A Note Purchase Agreement.<br />

17

Security for the Notes: .............................<br />

Purchase of Collateral Debt Securities:.....<br />

The Notes are limited recourse debt obligations of the Issuer<br />

secured in favour of the Trustee for the benefit of the Secured<br />

Parties by, amongst other things, (a) a first fixed charge over and/or<br />

assignment by way of security of all rights of the Issuer in respect<br />

of: (i) the Portfolio, (ii) any Eligible Investments, (iii) the Accounts<br />

and (iv) the Transaction Documents, and (b) a floating charge over<br />

all the other assets (including all cash and other property) and<br />

undertakings of the Issuer (present and future) excluding (A) any<br />

and all assets, property or rights which are located in, or governed<br />

by the laws of, The Netherlands (except for contractual rights or<br />

receivables (rechten of vorderingen op naam) which are assigned<br />

or charged to the Trustee); (B) any and all Dutch Ineligible<br />

Securities; (C) the Issuer’s rights under the Management<br />

Agreement; (D) the Issuer’s rights in respect of and any and all<br />

amounts standing to the credit of the Issuer Dutch Account<br />

(together, the “Collateral”). See Condition 4(a) (Security) and<br />

“Description of the Portfolio” below.<br />

The Issuer has purchased or entered into agreements to purchase<br />

Collateral Debt Securities the aggregate Principal Balance of which<br />

were equal to at least 70 per cent. of the Target Par Amount on or<br />

prior to the Issue Date. The Collateral Manager, on behalf of the<br />

Issuer, will purchase additional Collateral Debt Securities during<br />

the Ramp-Up Period using the proceeds of the issue of the Notes,<br />

drawings under the Class A1A Notes and Principal Proceeds.<br />

Subject to the terms and conditions described in this Prospectus,<br />

the Collateral Manager, on behalf of the Issuer, may also purchase<br />

Additional Collateral Debt Securities during and after the<br />

Reinvestment Period. See “Description of the Portfolio—Ramp-Up<br />

Period” and “Description of the Portfolio—Sale of Collateral Debt<br />

Securities and Reinvestment Criteria” below.<br />

It is intended that the aggregate Principal Balance of Collateral<br />

Debt Securities as at the end of the Ramp-Up Period will be<br />

€300,000,000 (the “Target Par Amount”) (the Sterling amount of<br />

any Sterling denominated Collateral Debt Securities to be<br />

converted into Euro at the Issue Date Spot Rate).<br />

Collateral Quality Tests,<br />

Eligibility Criteria and the<br />

Coverage Tests:....................................<br />

The Collateral Quality Tests, paragraph (c) of the Eligibility<br />

Criteria and the Coverage Tests were not required to be satisfied on<br />

the Issue Date but are expected to be satisfied as at the Target Date.<br />

In addition, after the Target Date, the Reinvestment Criteria and the<br />

Additional Reinvestment Criteria must be satisfied before and after<br />

giving effect to the purchase of any Additional Collateral Debt<br />

Securities to the extent required pursuant to the Collateral<br />

Management Agreement. See “Description of the Portfolio”.<br />

Collateral Quality Tests 1 : ........................<br />

Collateral Quality Tests<br />

Maximum Weighted Average Fitch Rating Factor Test<br />

Minimum Fitch Weighted Average Recovery Rate Test<br />

Weighted Average Life Test<br />

Required<br />

See Matrix<br />

See Matrix<br />

See Matrix<br />

1<br />

For a more complete description of each of the Collateral Quality Tests, see “Description of the Portfolio—The<br />

Collateral Quality Tests”.<br />

18

Collateral Quality Tests<br />

Minimum Weighted Average Spread Test<br />

S&P Minimum Weighted Average Recovery Rate Test<br />

CDO Evaluator Test<br />

Required<br />

See Matrix<br />

See Matrix<br />

Positive<br />

Certain Eligibility Criteria 2 : .....................<br />

Criteria<br />

Mezzanine Loans, Senior Lien Loans, <strong>CLO</strong><br />

Securities or Special Debt Securities<br />

(collectively)<br />

<strong>CLO</strong> Securities<br />

Special Debt Securities<br />

Synthetic Securities, Participations and<br />

Collateral Debt Securities the subject of<br />

Securities Lending Agreements<br />

Collateral Debt Securities pertaining to U.S.<br />

obligors<br />

Synthetic Securities or Participations with a<br />

counterparty rated less than “A-1+” by S&P<br />

or Collateral Debt Securities where obligor is<br />

from a country rated less than “AA” by S&P<br />

(other specified bivariate risk exposure limits<br />

apply)<br />

Sterling Collateral Debt Securities<br />

Sterling Collateral Debt Securities together<br />

with Non-Euro Collateral Debt Securities<br />

denominated in Sterling<br />

PIK Securities<br />

Bank Loans, any single obligor<br />

Bank Loans, 2 out of 4 obligors<br />

Bank Loans, remaining 2 out of 4 obligors<br />

Mezzanine Loans, Senior Lien Loans, <strong>CLO</strong><br />

Securities or Special Debt Securities, any<br />

single obligor<br />

Mezzanine Loans, Senior Lien Loans, <strong>CLO</strong><br />

Securities or Special Debt Securities, up to<br />

five obligors<br />

Collateral Debt Securities comprised in any<br />

single Fitch Industry Category<br />

Collateral Debt Securities comprised in any<br />

of the three largest Fitch Industry Categories<br />

Percentage Permitted of<br />

the Maximum<br />

Investment Amount<br />

Max 12.5 per cent.<br />

Max 5 per cent.<br />

Max 5 per cent.<br />

Max 20 per cent.<br />

Max 20 per cent.<br />

Max 20 per cent.<br />

Max 25 per cent.<br />

Max 35 per cent.<br />

Max 5 per cent.<br />

Max €7,500,000 or<br />

£5,061,000<br />

Max €11,500,000 or<br />

£7,760,200<br />

Max €9,000,000 or<br />

£6,073,200<br />

Max €4,500,000 or<br />

£3,036,600<br />

Max €6,000,000 or<br />

£4,048,800<br />

Max 15 per cent.<br />

Max 35 per cent.<br />

Coverage Tests: .............................. Payments under the Notes are subject to the Coverage Tests. The<br />

Coverage Tests include the following: (i) the Senior<br />

Overcollateralisation Ratio Test; (ii) the Class B<br />

Overcollateralisation Ratio Test; (iii) the Class C<br />

Overcollateralisation Ratio Test; (iv) the Class D<br />

2<br />

For a more complete description of the Eligibility Criteria, see “Description of the Portfolio—Eligibility Criteria”.<br />

19

Overcollateralisation Ratio Test; (v) the Class E<br />

Overcollateralisation Ratio Test; and (vi) the Senior Interest<br />

Coverage Test. A breach of a Coverage Test will cause redemption<br />

of the Notes of the Class to which such Coverage Test relates and<br />

all prior ranking Classes of Notes in accordance with the Priorities<br />

of Payment on the related Payment Date; such redemption to be<br />

applied out of Interest Proceeds and Principal Proceeds.<br />

Each of the Coverage Tests shall be satisfied on a Measurement<br />

Date on or after the Target Date if the corresponding<br />

Overcollateralisation Ratio on such Measurement Date is at least<br />

equal to the percentage specified in the table below in relation to<br />

the respective Coverage Test.<br />

Class<br />

A<br />

B<br />

C<br />

D<br />

E<br />