Gresham Capital CLO IV B.V. - Irish Stock Exchange

Gresham Capital CLO IV B.V. - Irish Stock Exchange

Gresham Capital CLO IV B.V. - Irish Stock Exchange

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

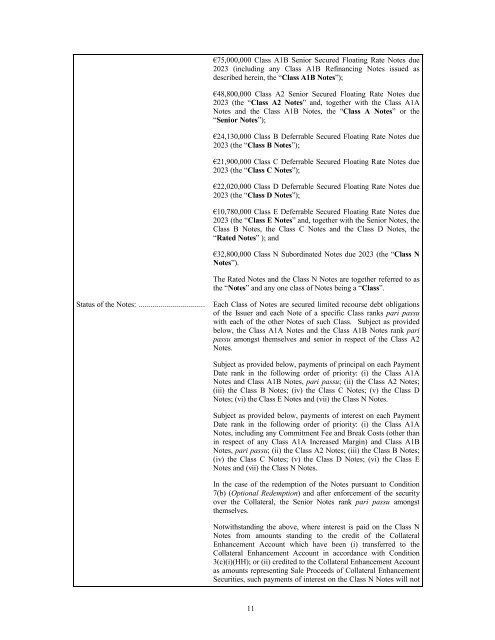

€75,000,000 Class A1B Senior Secured Floating Rate Notes due<br />

2023 (including any Class A1B Refinancing Notes issued as<br />

described herein, the “Class A1B Notes”);<br />

€48,800,000 Class A2 Senior Secured Floating Rate Notes due<br />

2023 (the “Class A2 Notes” and, together with the Class A1A<br />

Notes and the Class A1B Notes, the “Class A Notes” or the<br />

“Senior Notes”);<br />

€24,130,000 Class B Deferrable Secured Floating Rate Notes due<br />

2023 (the “Class B Notes”);<br />

€21,900,000 Class C Deferrable Secured Floating Rate Notes due<br />

2023 (the “Class C Notes”);<br />

€22,020,000 Class D Deferrable Secured Floating Rate Notes due<br />

2023 (the “Class D Notes”);<br />

€10,780,000 Class E Deferrable Secured Floating Rate Notes due<br />

2023 (the “Class E Notes” and, together with the Senior Notes, the<br />

Class B Notes, the Class C Notes and the Class D Notes, the<br />

“Rated Notes” ); and<br />

€32,800,000 Class N Subordinated Notes due 2023 (the “Class N<br />

Notes”).<br />

The Rated Notes and the Class N Notes are together referred to as<br />

the “Notes” and any one class of Notes being a “Class”.<br />

Status of the Notes: .................................<br />

Each Class of Notes are secured limited recourse debt obligations<br />

of the Issuer and each Note of a specific Class ranks pari passu<br />

with each of the other Notes of such Class. Subject as provided<br />

below, the Class A1A Notes and the Class A1B Notes rank pari<br />

passu amongst themselves and senior in respect of the Class A2<br />

Notes.<br />

Subject as provided below, payments of principal on each Payment<br />

Date rank in the following order of priority: (i) the Class A1A<br />

Notes and Class A1B Notes, pari passu; (ii) the Class A2 Notes;<br />

(iii) the Class B Notes; (iv) the Class C Notes; (v) the Class D<br />

Notes; (vi) the Class E Notes and (vii) the Class N Notes.<br />

Subject as provided below, payments of interest on each Payment<br />

Date rank in the following order of priority: (i) the Class A1A<br />

Notes, including any Commitment Fee and Break Costs (other than<br />

in respect of any Class A1A Increased Margin) and Class A1B<br />

Notes, pari passu; (ii) the Class A2 Notes; (iii) the Class B Notes;<br />

(iv) the Class C Notes; (v) the Class D Notes; (vi) the Class E<br />

Notes and (vii) the Class N Notes.<br />

In the case of the redemption of the Notes pursuant to Condition<br />

7(b) (Optional Redemption) and after enforcement of the security<br />

over the Collateral, the Senior Notes rank pari passu amongst<br />

themselves.<br />

Notwithstanding the above, where interest is paid on the Class N<br />

Notes from amounts standing to the credit of the Collateral<br />

Enhancement Account which have been (i) transferred to the<br />

Collateral Enhancement Account in accordance with Condition<br />

3(c)(i)(HH); or (ii) credited to the Collateral Enhancement Account<br />

as amounts representing Sale Proceeds of Collateral Enhancement<br />

Securities, such payments of interest on the Class N Notes will not<br />

11