Gresham Capital CLO IV B.V. - Irish Stock Exchange

Gresham Capital CLO IV B.V. - Irish Stock Exchange

Gresham Capital CLO IV B.V. - Irish Stock Exchange

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

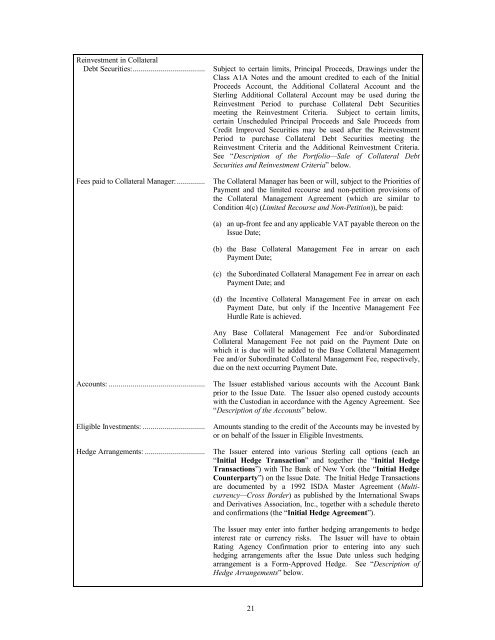

Reinvestment in Collateral<br />

Debt Securities:....................................<br />

Fees paid to Collateral Manager:..............<br />

Subject to certain limits, Principal Proceeds, Drawings under the<br />

Class A1A Notes and the amount credited to each of the Initial<br />

Proceeds Account, the Additional Collateral Account and the<br />

Sterling Additional Collateral Account may be used during the<br />

Reinvestment Period to purchase Collateral Debt Securities<br />

meeting the Reinvestment Criteria. Subject to certain limits,<br />

certain Unscheduled Principal Proceeds and Sale Proceeds from<br />

Credit Improved Securities may be used after the Reinvestment<br />

Period to purchase Collateral Debt Securities meeting the<br />

Reinvestment Criteria and the Additional Reinvestment Criteria.<br />

See “Description of the Portfolio—Sale of Collateral Debt<br />

Securities and Reinvestment Criteria” below.<br />

The Collateral Manager has been or will, subject to the Priorities of<br />

Payment and the limited recourse and non-petition provisions of<br />

the Collateral Management Agreement (which are similar to<br />

Condition 4(c) (Limited Recourse and Non-Petition)), be paid:<br />

(a) an up-front fee and any applicable VAT payable thereon on the<br />

Issue Date;<br />

(b) the Base Collateral Management Fee in arrear on each<br />

Payment Date;<br />

(c) the Subordinated Collateral Management Fee in arrear on each<br />

Payment Date; and<br />

(d) the Incentive Collateral Management Fee in arrear on each<br />

Payment Date, but only if the Incentive Management Fee<br />

Hurdle Rate is achieved.<br />

Any Base Collateral Management Fee and/or Subordinated<br />

Collateral Management Fee not paid on the Payment Date on<br />

which it is due will be added to the Base Collateral Management<br />

Fee and/or Subordinated Collateral Management Fee, respectively,<br />

due on the next occurring Payment Date.<br />

Accounts: ................................................<br />

Eligible Investments: ...............................<br />

Hedge Arrangements: ..............................<br />

The Issuer established various accounts with the Account Bank<br />

prior to the Issue Date. The Issuer also opened custody accounts<br />

with the Custodian in accordance with the Agency Agreement. See<br />

“Description of the Accounts” below.<br />

Amounts standing to the credit of the Accounts may be invested by<br />

or on behalf of the Issuer in Eligible Investments.<br />

The Issuer entered into various Sterling call options (each an<br />

“Initial Hedge Transaction” and together the “Initial Hedge<br />

Transactions”) with The Bank of New York (the “Initial Hedge<br />

Counterparty”) on the Issue Date. The Initial Hedge Transactions<br />

are documented by a 1992 ISDA Master Agreement (Multicurrency—Cross<br />

Border) as published by the International Swaps<br />

and Derivatives Association, Inc., together with a schedule thereto<br />

and confirmations (the “Initial Hedge Agreement”).<br />

The Issuer may enter into further hedging arrangements to hedge<br />

interest rate or currency risks. The Issuer will have to obtain<br />

Rating Agency Confirmation prior to entering into any such<br />

hedging arrangements after the Issue Date unless such hedging<br />

arrangement is a Form-Approved Hedge. See “Description of<br />

Hedge Arrangements” below.<br />

21