Gresham Capital CLO IV B.V. - Irish Stock Exchange

Gresham Capital CLO IV B.V. - Irish Stock Exchange

Gresham Capital CLO IV B.V. - Irish Stock Exchange

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

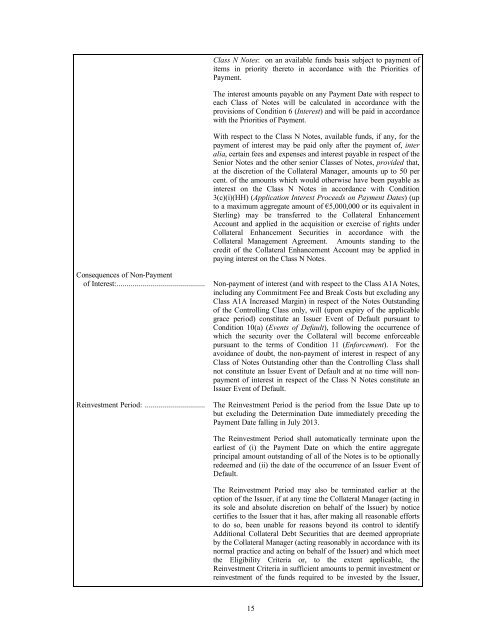

Class N Notes: on an available funds basis subject to payment of<br />

items in priority thereto in accordance with the Priorities of<br />

Payment.<br />

The interest amounts payable on any Payment Date with respect to<br />

each Class of Notes will be calculated in accordance with the<br />

provisions of Condition 6 (Interest) and will be paid in accordance<br />

with the Priorities of Payment.<br />

With respect to the Class N Notes, available funds, if any, for the<br />

payment of interest may be paid only after the payment of, inter<br />

alia, certain fees and expenses and interest payable in respect of the<br />

Senior Notes and the other senior Classes of Notes, provided that,<br />

at the discretion of the Collateral Manager, amounts up to 50 per<br />

cent. of the amounts which would otherwise have been payable as<br />

interest on the Class N Notes in accordance with Condition<br />

3(c)(i)(HH) (Application Interest Proceeds on Payment Dates) (up<br />

to a maximum aggregate amount of €5,000,000 or its equivalent in<br />

Sterling) may be transferred to the Collateral Enhancement<br />

Account and applied in the acquisition or exercise of rights under<br />

Collateral Enhancement Securities in accordance with the<br />

Collateral Management Agreement. Amounts standing to the<br />

credit of the Collateral Enhancement Account may be applied in<br />

paying interest on the Class N Notes.<br />

Consequences of Non-Payment<br />

of Interest:............................................<br />

Reinvestment Period: ..............................<br />

Non-payment of interest (and with respect to the Class A1A Notes,<br />

including any Commitment Fee and Break Costs but excluding any<br />

Class A1A Increased Margin) in respect of the Notes Outstanding<br />

of the Controlling Class only, will (upon expiry of the applicable<br />

grace period) constitute an Issuer Event of Default pursuant to<br />

Condition 10(a) (Events of Default), following the occurrence of<br />

which the security over the Collateral will become enforceable<br />

pursuant to the terms of Condition 11 (Enforcement). For the<br />

avoidance of doubt, the non-payment of interest in respect of any<br />

Class of Notes Outstanding other than the Controlling Class shall<br />

not constitute an Issuer Event of Default and at no time will nonpayment<br />

of interest in respect of the Class N Notes constitute an<br />

Issuer Event of Default.<br />

The Reinvestment Period is the period from the Issue Date up to<br />

but excluding the Determination Date immediately preceding the<br />

Payment Date falling in July 2013.<br />

The Reinvestment Period shall automatically terminate upon the<br />

earliest of (i) the Payment Date on which the entire aggregate<br />

principal amount outstanding of all of the Notes is to be optionally<br />

redeemed and (ii) the date of the occurrence of an Issuer Event of<br />

Default.<br />

The Reinvestment Period may also be terminated earlier at the<br />

option of the Issuer, if at any time the Collateral Manager (acting in<br />

its sole and absolute discretion on behalf of the Issuer) by notice<br />

certifies to the Issuer that it has, after making all reasonable efforts<br />

to do so, been unable for reasons beyond its control to identify<br />

Additional Collateral Debt Securities that are deemed appropriate<br />

by the Collateral Manager (acting reasonably in accordance with its<br />

normal practice and acting on behalf of the Issuer) and which meet<br />

the Eligibility Criteria or, to the extent applicable, the<br />

Reinvestment Criteria in sufficient amounts to permit investment or<br />

reinvestment of the funds required to be invested by the Issuer,<br />

15