Gresham Capital CLO IV B.V. - Irish Stock Exchange

Gresham Capital CLO IV B.V. - Irish Stock Exchange

Gresham Capital CLO IV B.V. - Irish Stock Exchange

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

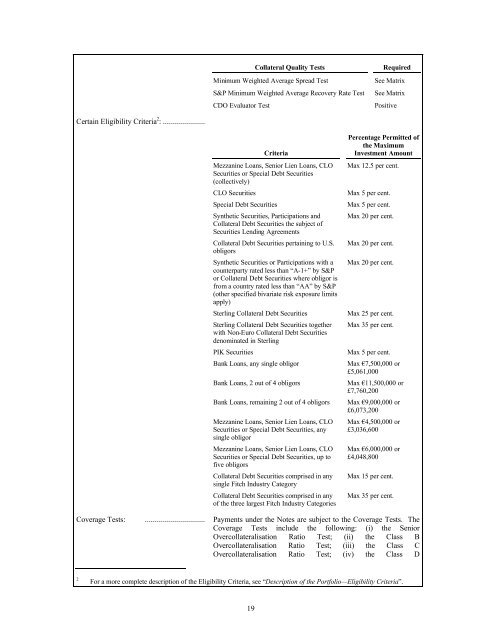

Collateral Quality Tests<br />

Minimum Weighted Average Spread Test<br />

S&P Minimum Weighted Average Recovery Rate Test<br />

CDO Evaluator Test<br />

Required<br />

See Matrix<br />

See Matrix<br />

Positive<br />

Certain Eligibility Criteria 2 : .....................<br />

Criteria<br />

Mezzanine Loans, Senior Lien Loans, <strong>CLO</strong><br />

Securities or Special Debt Securities<br />

(collectively)<br />

<strong>CLO</strong> Securities<br />

Special Debt Securities<br />

Synthetic Securities, Participations and<br />

Collateral Debt Securities the subject of<br />

Securities Lending Agreements<br />

Collateral Debt Securities pertaining to U.S.<br />

obligors<br />

Synthetic Securities or Participations with a<br />

counterparty rated less than “A-1+” by S&P<br />

or Collateral Debt Securities where obligor is<br />

from a country rated less than “AA” by S&P<br />

(other specified bivariate risk exposure limits<br />

apply)<br />

Sterling Collateral Debt Securities<br />

Sterling Collateral Debt Securities together<br />

with Non-Euro Collateral Debt Securities<br />

denominated in Sterling<br />

PIK Securities<br />

Bank Loans, any single obligor<br />

Bank Loans, 2 out of 4 obligors<br />

Bank Loans, remaining 2 out of 4 obligors<br />

Mezzanine Loans, Senior Lien Loans, <strong>CLO</strong><br />

Securities or Special Debt Securities, any<br />

single obligor<br />

Mezzanine Loans, Senior Lien Loans, <strong>CLO</strong><br />

Securities or Special Debt Securities, up to<br />

five obligors<br />

Collateral Debt Securities comprised in any<br />

single Fitch Industry Category<br />

Collateral Debt Securities comprised in any<br />

of the three largest Fitch Industry Categories<br />

Percentage Permitted of<br />

the Maximum<br />

Investment Amount<br />

Max 12.5 per cent.<br />

Max 5 per cent.<br />

Max 5 per cent.<br />

Max 20 per cent.<br />

Max 20 per cent.<br />

Max 20 per cent.<br />

Max 25 per cent.<br />

Max 35 per cent.<br />

Max 5 per cent.<br />

Max €7,500,000 or<br />

£5,061,000<br />

Max €11,500,000 or<br />

£7,760,200<br />

Max €9,000,000 or<br />

£6,073,200<br />

Max €4,500,000 or<br />

£3,036,600<br />

Max €6,000,000 or<br />

£4,048,800<br />

Max 15 per cent.<br />

Max 35 per cent.<br />

Coverage Tests: .............................. Payments under the Notes are subject to the Coverage Tests. The<br />

Coverage Tests include the following: (i) the Senior<br />

Overcollateralisation Ratio Test; (ii) the Class B<br />

Overcollateralisation Ratio Test; (iii) the Class C<br />

Overcollateralisation Ratio Test; (iv) the Class D<br />

2<br />

For a more complete description of the Eligibility Criteria, see “Description of the Portfolio—Eligibility Criteria”.<br />

19