VALLAURIS II CLO PLC - Irish Stock Exchange

VALLAURIS II CLO PLC - Irish Stock Exchange

VALLAURIS II CLO PLC - Irish Stock Exchange

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

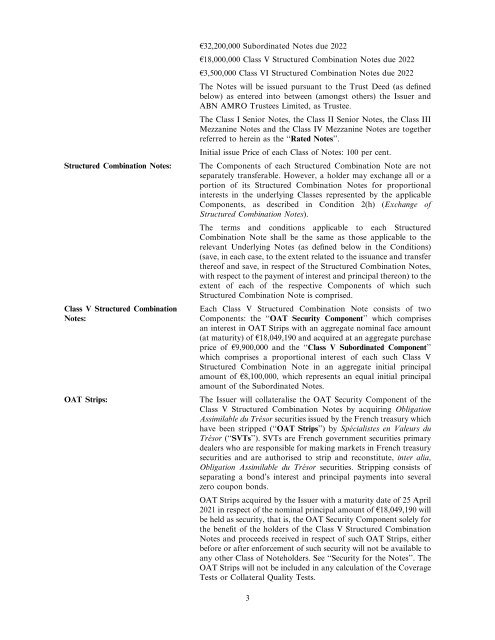

Structured Combination Notes:<br />

Class V Structured Combination<br />

Notes:<br />

OAT Strips:<br />

A32,200,000 Subordinated Notes due 2022<br />

A18,000,000 Class V Structured Combination Notes due 2022<br />

A3,500,000 Class VI Structured Combination Notes due 2022<br />

The Notes will be issued pursuant to the Trust Deed (as defined<br />

below) as entered into between (amongst others) the Issuer and<br />

ABN AMRO Trustees Limited, as Trustee.<br />

The Class I Senior Notes, the Class <strong>II</strong> Senior Notes, the Class <strong>II</strong>I<br />

Mezzanine Notes and the Class IV Mezzanine Notes are together<br />

referred to herein as the ‘‘Rated Notes’’.<br />

Initial issue Price of each Class of Notes: 100 per cent.<br />

The Components of each Structured Combination Note are not<br />

separately transferable. However, a holder may exchange all or a<br />

portion of its Structured Combination Notes for proportional<br />

interests in the underlying Classes represented by the applicable<br />

Components, as described in Condition 2(h) (<strong>Exchange</strong> of<br />

Structured Combination Notes).<br />

The terms and conditions applicable to each Structured<br />

Combination Note shall be the same as those applicable to the<br />

relevant Underlying Notes (as defined below in the Conditions)<br />

(save, in each case, to the extent related to the issuance and transfer<br />

thereof and save, in respect of the Structured Combination Notes,<br />

with respect to the payment of interest and principal thereon) to the<br />

extent of each of the respective Components of which such<br />

Structured Combination Note is comprised.<br />

Each Class V Structured Combination Note consists of two<br />

Components: the ‘‘OAT Security Component’’ which comprises<br />

an interest in OAT Strips with an aggregate nominal face amount<br />

(at maturity) of A18,049,190 and acquired at an aggregate purchase<br />

price of A9,900,000 and the ‘‘Class V Subordinated Component’’<br />

which comprises a proportional interest of each such Class V<br />

Structured Combination Note in an aggregate initial principal<br />

amount of A8,100,000, which represents an equal initial principal<br />

amount of the Subordinated Notes.<br />

The Issuer will collateralise the OAT Security Component of the<br />

Class V Structured Combination Notes by acquiring Obligation<br />

Assimilable du Trésor securities issued by the French treasury which<br />

have been stripped (‘‘OAT Strips’’) by Spécialistes en Valeurs du<br />

Trésor (‘‘SVTs’’). SVTs are French government securities primary<br />

dealers who are responsible for making markets in French treasury<br />

securities and are authorised to strip and reconstitute, inter alia,<br />

Obligation Assimilable du Trésor securities. Stripping consists of<br />

separating a bond’s interest and principal payments into several<br />

zero coupon bonds.<br />

OAT Strips acquired by the Issuer with a maturity date of 25 April<br />

2021 in respect of the nominal principal amount of A18,049,190 will<br />

be held as security, that is, the OAT Security Component solely for<br />

the benefit of the holders of the Class V Structured Combination<br />

Notes and proceeds received in respect of such OAT Strips, either<br />

before or after enforcement of such security will not be available to<br />

any other Class of Noteholders. See ‘‘Security for the Notes’’. The<br />

OAT Strips will not be included in any calculation of the Coverage<br />

Tests or Collateral Quality Tests.<br />

3