VALLAURIS II CLO PLC - Irish Stock Exchange

VALLAURIS II CLO PLC - Irish Stock Exchange

VALLAURIS II CLO PLC - Irish Stock Exchange

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Upon the occurrence of any Event of Default or Termination Event, a Hedge Agreement may<br />

be terminated in accordance with the detailed provisions thereof and a lump sum determined by<br />

reference to market quotations obtained for the entry into of a replacement swap on the same terms<br />

as that terminated or as otherwise described in the applicable Hedge Agreement (the ‘‘Termination<br />

Payment’’) may become payable by the Issuer to the applicable Hedge Counterparty or vice versa.<br />

11. The Collateral Quality Tests<br />

The Collateral Quality Tests will be used primarily as the criteria for purchasing Collateral Debt<br />

Obligations. The Collateral Quality Tests will consist of the Minimum Diversity Test, the Maximum<br />

Weighted Average Life Test, the Maximum Portfolio Rating Test, the Minimum Weighted Average<br />

Spread Test, the Moody’s Minimum Weighted Average Recovery Rate Test, the S&P Minimum<br />

Weighted Average Recovery Rate Test, the S&P CDO Monitor Test, and the S&P CDO Evaluator<br />

Test. The Collateral Administrator will (subject to the proviso below) carry out the Collateral Quality<br />

Tests (i) as at the Initial Effective Date, (ii) as at the Final Effective Date, (iii) after the Initial<br />

Effective Date, upon a substitution (including both the date of sale and reinvestment if not the same<br />

date) of, or a default under, a Collateral Debt Obligation or acquisition of any Additional Collateral<br />

Debt Obligation, (iv) the last Business Day of each Month and (v) with reasonable notice (not being<br />

less than two Business Days’ notice), on any Business Day requested by the Rating Agencies (any<br />

such date, a ‘‘Measurement Date’’), provided that the S&P CDO Monitor Test will only be carried out<br />

on a Measurement Date falling on or after the Final Effective Date until the end of the Reinvestment<br />

Period and provided further that the S&P CDO Evaluator Test will only be carried out on a<br />

Measurement Date falling on or after the end of the Reinvestment Period.<br />

The Collateral Administrator will carry out the Collateral Quality Tests on each Measurement<br />

Date. For the purpose of the Minimum Diversity Test, the Maximum Portfolio Rating Test and the<br />

Minimum Weighted Average Spread Test, the Issuer shall, not later than five Business Days prior to<br />

the Final Effective Date and may at any time thereafter, upon five Business Days’ notice, notify the<br />

Collateral Manager, the Trustee, the Collateral Administrator and the Rating Agencies of the quality<br />

case which is to apply in respect of such tests, as referred to in the Moody’s Test Matrix and<br />

provided that the quality case applicable to the Maximum Portfolio Rating Test shall be determined<br />

by reference to the quality cases which are to apply by reference to the quality cases which are to<br />

apply (each of the quality cases being a ‘‘Quality Case’’) set out below for any given case:<br />

(a) the applicable Moody’s Test Matrix for performing the Moody’s Minimum Diversity Test will<br />

be the Moody’s Test Matrix in which the elected case is set out;<br />

(b) the applicable column for performing the Moody’s Maximum Rating Factor Test will be the<br />

column in the applicable Moody’s Test Matrix in which the elected case is set out.<br />

(c) the applicable row for determining the Minimum Weighted Average Spread will be the row in<br />

the applicable Moody’s Test Matrix in which the elected case is set out; and<br />

(d) the applicable row and column for performing the Moody’s Minimum Weighted Average<br />

Recovery Rate Test will be the row and column in the applicable Moody’s Test Matrix in which<br />

the elected case is set out.<br />

In no circumstances shall the Issuer be under any obligation to elect that a different Quality Case<br />

shall apply.<br />

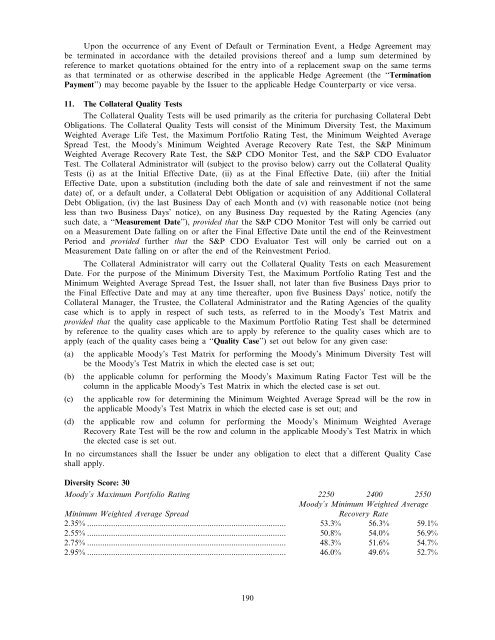

Diversity Score: 30<br />

Moody’s Maximum Portfolio Rating 2250 2400 2550<br />

Moody’s Minimum Weighted Average<br />

Minimum Weighted Average Spread<br />

Recovery Rate<br />

2.35% ........................................................................................... 53.3% 56.3% 59.1%<br />

2.55% ........................................................................................... 50.8% 54.0% 56.9%<br />

2.75% ........................................................................................... 48.3% 51.6% 54.7%<br />

2.95% ........................................................................................... 46.0% 49.6% 52.7%<br />

190