ISRA VISION Buy EUR 26.00 - ISRA VISION AG

ISRA VISION Buy EUR 26.00 - ISRA VISION AG

ISRA VISION Buy EUR 26.00 - ISRA VISION AG

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>ISRA</strong> <strong>VISION</strong><br />

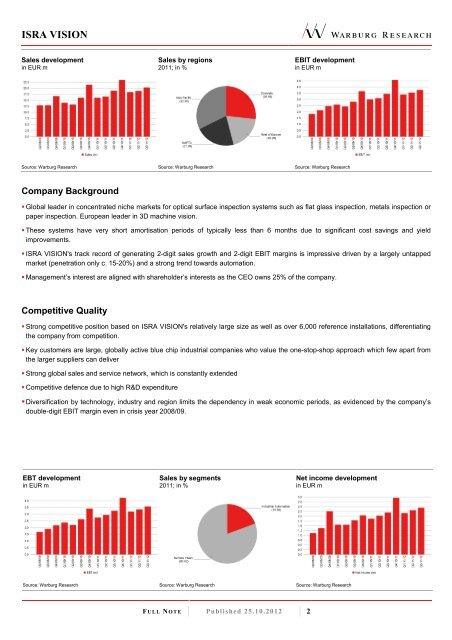

Sales development<br />

in <strong>EUR</strong> m<br />

Sales by regions<br />

2011; in %<br />

EBIT development<br />

in <strong>EUR</strong> m<br />

Source: Warburg Research<br />

Source: Warburg Research<br />

Source: Warburg Research<br />

Company Background<br />

• Global leader in concentrated niche markets for optical surface inspection systems such as flat glass inspection, metals inspection or<br />

paper inspection. European leader in 3D machine vision.<br />

• These systems have very short amortisation periods of typically less than 6 months due to significant cost savings and yield<br />

improvements.<br />

• <strong>ISRA</strong> <strong>VISION</strong>'s track record of generating 2-digit sales growth and 2-digit EBIT margins is impressive driven by a largely untapped<br />

market (penetration only c. 15-20%) and a strong trend towards automation.<br />

• Management’s interest are aligned with shareholder’s interests as the CEO owns 25% of the company.<br />

Competitive Quality<br />

• Strong competitive position based on <strong>ISRA</strong> <strong>VISION</strong>'s relatively large size as well as over 6,000 reference installations, differentiating<br />

the company from competition.<br />

• Key customers are large, globally active blue chip industrial companies who value the one-stop-shop approach which few apart from<br />

the larger suppliers can deliver<br />

• Strong global sales and service network, which is constantly extended<br />

• Competitive defence due to high R&D expenditure<br />

• Diversification by technology, industry and region limits the dependency in weak economic periods, as evidenced by the company’s<br />

double-digit EBIT margin even in crisis year 2008/09.<br />

EBT development<br />

in <strong>EUR</strong> m<br />

Sales by segments<br />

2011; in %<br />

Net income development<br />

in <strong>EUR</strong> m<br />

Source: Warburg Research<br />

Source: Warburg Research<br />

Source: Warburg Research<br />

F U L L N O T E Published 25.10.2012 2