ISRA VISION Buy EUR 26.00 - ISRA VISION AG

ISRA VISION Buy EUR 26.00 - ISRA VISION AG

ISRA VISION Buy EUR 26.00 - ISRA VISION AG

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>ISRA</strong> <strong>VISION</strong><br />

<strong>ISRA</strong> <strong>VISION</strong> boasts a total of over 6,000 reference installations. These installations<br />

are valued by customers in view of a system’s long lifetime and high total system costs<br />

of several million Euros compared to only <strong>EUR</strong> 100k for a machine vision system. These<br />

references are required to be specific with respect to a customer’s industry – such as<br />

metals, glass, plastic, solar, paper, print etc. and automotive – and with respect to a<br />

certain process step within this industry (e.g. pre-dryer, dryer, reeler etc. in a paper<br />

manufacturing process).<br />

Blue chip customer-list without overdependence. With the various and diverse<br />

application areas of the product portfolio, a broad variety of industries are supplied by<br />

<strong>ISRA</strong> <strong>VISION</strong>. The customer list includes mainly globally producing, blue-chip industrials<br />

including Daimler, Audi, VW, Ford, GM, Nissan, Hyundai, Renault, Porsche, Volvo,<br />

Saint-Gobain, NSG Group, Pilkington, Asahi Glass, Schott, Bosch, Q.Cells, Solarwatt,<br />

Epcos, aleo, First Solar, JFE, Nippon Steel, Bao Steel, posco, riva, Corus,<br />

ThyssenKrupp, ArcelorMittal, ChinaSteel, Constantia Packaging, MAN, UPM, M-real,<br />

Kimberly-Clark, StoraEnso, International Paper, manroland, Du Pont, Bayer. No single<br />

customer accounts for more than 2% of sales. <strong>ISRA</strong> <strong>VISION</strong> maintains long-term<br />

(contractual) relationships with several customers, providing a high revenue visibility.<br />

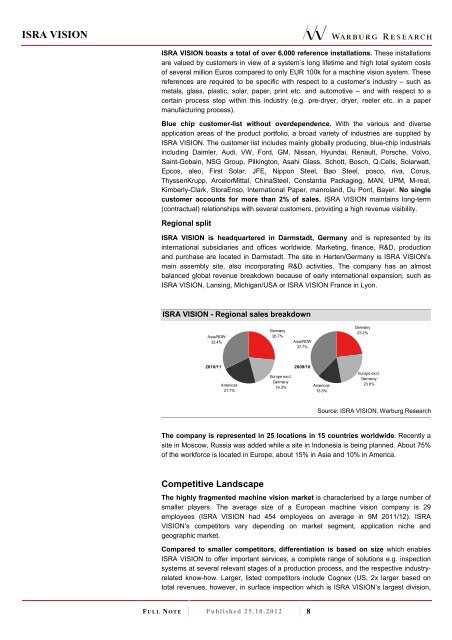

Regional split<br />

<strong>ISRA</strong> <strong>VISION</strong> is headquartered in Darmstadt, Germany and is represented by its<br />

international subsidiaries and offices worldwide. Marketing, finance, R&D, production<br />

and purchase are located in Darmstadt. The site in Herten/Germany is <strong>ISRA</strong> <strong>VISION</strong>’s<br />

main assembly site, also incorporating R&D activities. The company has an almost<br />

balanced global revenue breakdown because of early international expansion, such as<br />

<strong>ISRA</strong> <strong>VISION</strong>, Lansing, Michigan/USA or <strong>ISRA</strong> <strong>VISION</strong> France in Lyon.<br />

<strong>ISRA</strong> <strong>VISION</strong> - Regional sales breakdown<br />

Asia/ROW<br />

32.4%<br />

Germany<br />

26.7%<br />

Asia/ROW<br />

37.7%<br />

Germany<br />

23.2%<br />

2010/11 2009/10<br />

Americas<br />

21.7%<br />

Europe excl.<br />

Germany<br />

19.3%<br />

Americas<br />

15.5%<br />

Europe excl.<br />

Germany<br />

23.6%<br />

Source: <strong>ISRA</strong> <strong>VISION</strong>, Warburg Research<br />

The company is represented in 25 locations in 15 countries worldwide. Recently a<br />

site in Moscow, Russia was added while a site in Indonesia is being planned. About 75%<br />

of the workforce is located in Europe, about 15% in Asia and 10% in America.<br />

Competitive Landscape<br />

The highly fragmented machine vision market is characterised by a large number of<br />

smaller players. The average size of a European machine vision company is 29<br />

employees (<strong>ISRA</strong> <strong>VISION</strong> had 454 employees on average in 9M 2011/12). <strong>ISRA</strong><br />

<strong>VISION</strong>’s competitors vary depending on market segment, application niche and<br />

geographic market.<br />

Compared to smaller competitors, differentiation is based on size which enables<br />

<strong>ISRA</strong> <strong>VISION</strong> to offer important services, a complete range of solutions e.g. inspection<br />

systems at several relevant stages of a production process, and the respective industryrelated<br />

know-how. Larger, listed competitors include Cognex (US, 2x larger based on<br />

total revenues, however, in surface inspection which is <strong>ISRA</strong> <strong>VISION</strong>’s largest division,<br />

F U L L N O T E Published 25.10.2012 8