Donna Saslove And Simon Lugassy - JO LEE Magazine

Donna Saslove And Simon Lugassy - JO LEE Magazine

Donna Saslove And Simon Lugassy - JO LEE Magazine

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

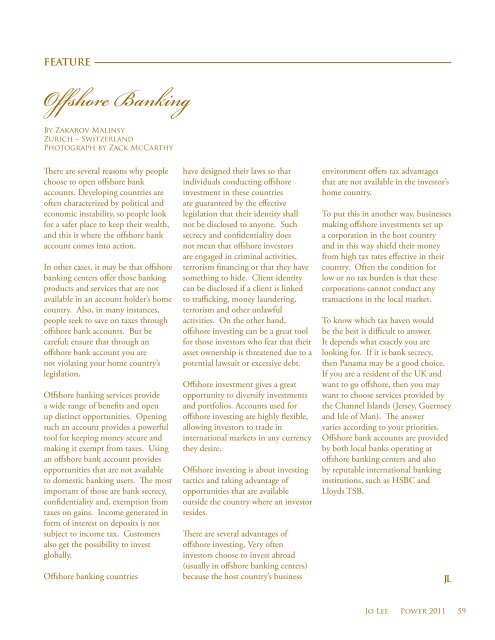

FEATURE<br />

Offshore Banking<br />

By Zakarov Malinsy<br />

Zurich – Switzerland<br />

Photograph by Zack McCarthy<br />

There are several reasons why people<br />

choose to open offshore bank<br />

accounts. Developing countries are<br />

often characterized by political and<br />

economic instability, so people look<br />

for a safer place to keep their wealth,<br />

and this is where the offshore bank<br />

account comes into action.<br />

In other cases, it may be that offshore<br />

banking centers offer those banking<br />

products and services that are not<br />

available in an account holder’s home<br />

country. Also, in many instances,<br />

people seek to save on taxes through<br />

offshore bank accounts. But be<br />

careful; ensure that through an<br />

offshore bank account you are<br />

not violating your home country’s<br />

legislation.<br />

Offshore banking services provide<br />

a wide range of benefits and open<br />

up distinct opportunities. Opening<br />

such an account provides a powerful<br />

tool for keeping money secure and<br />

making it exempt from taxes. Using<br />

an offshore bank account provides<br />

opportunities that are not available<br />

to domestic banking users. The most<br />

important of those are bank secrecy,<br />

confidentiality and, exemption from<br />

taxes on gains. Income generated in<br />

form of interest on deposits is not<br />

subject to income tax. Customers<br />

also get the possibility to invest<br />

globally.<br />

Offshore banking countries<br />

have designed their laws so that<br />

individuals conducting offshore<br />

investment in these countries<br />

are guaranteed by the effective<br />

legislation that their identity shall<br />

not be disclosed to anyone. Such<br />

secrecy and confidentiality does<br />

not mean that offshore investors<br />

are engaged in criminal activities,<br />

terrorism financing or that they have<br />

something to hide. Client identity<br />

can be disclosed if a client is linked<br />

to trafficking, money laundering,<br />

terrorism and other unlawful<br />

activities. On the other hand,<br />

offshore investing can be a great tool<br />

for those investors who fear that their<br />

asset ownership is threatened due to a<br />

potential lawsuit or excessive debt.<br />

Offshore investment gives a great<br />

opportunity to diversify investments<br />

and portfolios. Accounts used for<br />

offshore investing are highly flexible,<br />

allowing investors to trade in<br />

international markets in any currency<br />

they desire.<br />

Offshore investing is about investing<br />

tactics and taking advantage of<br />

opportunities that are available<br />

outside the country where an investor<br />

resides.<br />

There are several advantages of<br />

offshore investing. Very often<br />

investors choose to invest abroad<br />

(usually in offshore banking centers)<br />

because the host country’s business<br />

environment offers tax advantages<br />

that are not available in the investor’s<br />

home country.<br />

To put this in another way, businesses<br />

making offshore investments set up<br />

a corporation in the host country<br />

and in this way shield their money<br />

from high tax rates effective in their<br />

country. Often the condition for<br />

low or no tax burden is that these<br />

corporations cannot conduct any<br />

transactions in the local market.<br />

To know which tax haven would<br />

be the best is difficult to answer.<br />

It depends what exactly you are<br />

looking for. If it is bank secrecy,<br />

then Panama may be a good choice.<br />

If you are a resident of the UK and<br />

want to go offshore, then you may<br />

want to choose services provided by<br />

the Channel Islands (Jersey, Guernsey<br />

and Isle of Man). The answer<br />

varies according to your priorities.<br />

Offshore bank accounts are provided<br />

by both local banks operating at<br />

offshore banking centers and also<br />

by reputable international banking<br />

institutions, such as HSBC and<br />

Lloyds TSB.<br />

JL<br />

Jo Lee Power 2011 59