You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

T{OTES TO THE COI{SOLIDATED STATEMENTS OF IT{COME<br />

2. COSIS OF SALES (conrinued)<br />

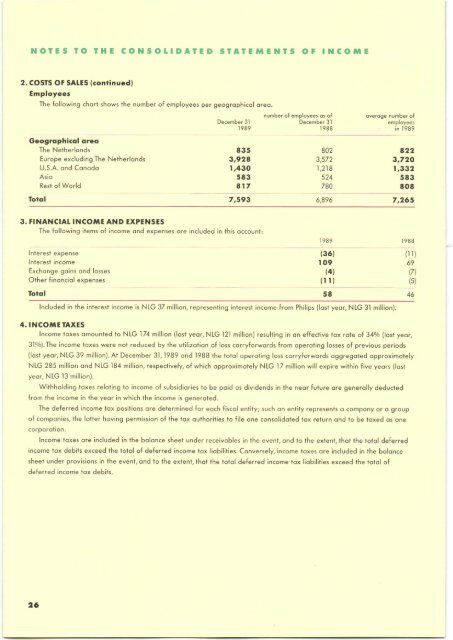

Employees<br />

The following chort shows the number of employees per geogrophicol oreo.<br />

Geogrophicol oreo<br />

The Nelherlonds<br />

Europe excluding The Netherlonds<br />

U.5.A. ond Conodo<br />

Asio<br />

Rest of World<br />

December 3l<br />

1989<br />

835<br />

3,92A<br />

r,43O<br />

s83<br />

al7<br />

number of employees os of<br />

December 3l<br />

198 8<br />

802<br />

3,572<br />

1,218<br />

524<br />

780<br />

overoge number of<br />

employees<br />

in 1989<br />

422<br />

3,720<br />

|,332<br />

583<br />

808<br />

7,593 6,896 7,265<br />

3. FINANCIAT INCO}IE AND EXPENSES<br />

The following items of income ond expenses ore included in lhis occount:<br />

lnierest expense<br />

lnteresi income<br />

Exchonge goins ond losses<br />

Oiher finonciol expenses<br />

Totol<br />

<br />

(36)<br />

r09<br />

(4)<br />

(t t)<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

lncluded in ihe inlerest income is NLG 37 million, representing interest income from Philips (lost yeor, NLG 31 million).<br />

4. INCOME TAXES<br />

lncome toxes omounted to NLG 174 million (losl yeoq NLG 121 million) resuhing in on effective tox rote of 340/o (lost yeor,<br />

310/o). The income toxes were not reduced by the utilizotion of loss corryforwords from operoting losses of previous periods<br />

(losl yeor, NLG 39 million). At December 31, 1989 ond 1988 the iotol operoting loss corryforwords oggregoted opproximolely<br />

NIG 285 million ond NLG 184 million, respectively, of which opproximotely NLG l7 million will expire within five yeors (lost<br />

yeor, NLG l3 million).<br />

Wiihholding toxes reloting to income of subsidiories to be poid os dividends in the neor future ore generolly deducted<br />

from lhe income in the yeor in which ihe income is generoled.<br />

The deferred income lox positions ore determined for eoch fiscol entity; such on entity represenls o compony or o group<br />

of componies, the lotler hoving permission of the tox outhorilies to file one consolidoled tox return ond to be toxed os one<br />

corporotion.<br />

lncome toxes ore included in the bolonce sheel under receivobles in the evenl, ond to the extent, ihot ihe toiol deferred<br />

income lox debits exceed lhe loiol of deferred income tox liobililies. Conversely, income toxes ore included in the bolonce<br />

sheel under provisions in lhe event, ond to the extenl, thot the iotol de{erred income tox liobilities exceed the totol of<br />

deferred income tox debiis.