MARUI CO., LTD.

MARUI CO., LTD.

MARUI CO., LTD.

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

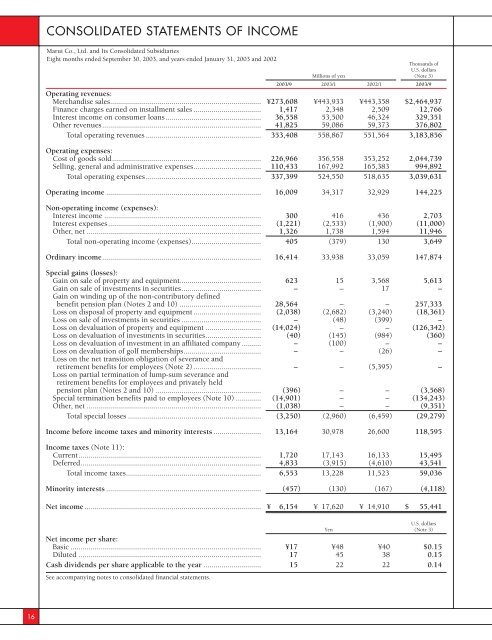

<strong>CO</strong>NSOLIDATED STATEMENTS OF IN<strong>CO</strong>ME<br />

Marui Co., Ltd. and Its Consolidated Subsidiaries<br />

Eight months ended September 30, 2003, and years ended January 31, 2003 and 2002<br />

Thousands of<br />

U.S. dollars<br />

Millions of yen (Note 3)<br />

2003/9 2003/1 2002/1 2003/9<br />

Operating revenues:<br />

Merchandise sales............................................................................ ¥273,608 ¥443,933 ¥443,358 $2,464,937<br />

Finance charges earned on installment sales .................................. 1,417 2,348 2,509 12,766<br />

Interest income on consumer loans ................................................ 36,558 53,500 46,324 329,351<br />

Other revenues................................................................................ 41,825 59,086 59,373 376,802<br />

Total operating revenues .......................................................... 353,408 558,867 551,564 3,183,856<br />

Operating expenses:<br />

Cost of goods sold........................................................................... 226,966 356,558 353,252 2,044,739<br />

Selling, general and administrative expenses.................................. 110,433 167,992 165,383 994,892<br />

Total operating expenses .......................................................... 337,399 524,550 518,635 3,039,631<br />

Operating income .............................................................................. 16,009 34,317 32,929 144,225<br />

Non-operating income (expenses):<br />

Interest income ............................................................................... 300 416 436 2,703<br />

Interest expenses............................................................................. (1,221) (2,533) (1,900) (11,000)<br />

Other, net ........................................................................................ 1,326 1,738 1,594 11,946<br />

Total non-operating income (expenses)................................... 405 (379) 130 3,649<br />

Ordinary income................................................................................ 16,414 33,938 33,059 147,874<br />

Special gains (losses):<br />

Gain on sale of property and equipment......................................... 623 15 3,568 5,613<br />

Gain on sale of investments in securities........................................ – – 17 –<br />

Gain on winding up of the non-contributory defined<br />

benefit pension plan (Notes 2 and 10) ......................................... 28,564 – – 257,333<br />

Loss on disposal of property and equipment .................................. (2,038) (2,682) (3,240) (18,361)<br />

Loss on sale of investments in securities ........................................ – (48) (399) –<br />

Loss on devaluation of property and equipment ............................ (14,024) – – (126,342)<br />

Loss on devaluation of investments in securities............................ (40) (145) (984) (360)<br />

Loss on devaluation of investment in an affiliated company.......... – (100) – –<br />

Loss on devaluation of golf memberships....................................... – – (26) –<br />

Loss on the net transition obligation of severance and<br />

retirement benefits for employees (Note 2) .................................. – – (5,395) –<br />

Loss on partial termination of lump-sum severance and<br />

retirement benefits for employees and privately held<br />

pension plan (Notes 2 and 10) ..................................................... (396) – – (3,568)<br />

Special termination benefits paid to employees (Note 10) ............. (14,901) – – (134,243)<br />

Other, net ........................................................................................ (1,038) – – (9,351)<br />

Total special losses ................................................................... (3,250) (2,960) (6,459) (29,279)<br />

Income before income taxes and minority interests ........................ 13,164 30,978 26,600 118,595<br />

Income taxes (Note 11):<br />

Current............................................................................................ 1,720 17,143 16,133 15,495<br />

Deferred........................................................................................... 4,833 (3,915) (4,610) 43,541<br />

Total income taxes.................................................................... 6,553 13,228 11,523 59,036<br />

Minority interests .............................................................................. (457) (130) (167) (4,118)<br />

Net income......................................................................................... ¥ 6,154 ¥ 17,620 ¥ 14,910 $ 55,441<br />

U.S. dollars<br />

Yen (Note 3)<br />

Net income per share:<br />

Basic ................................................................................................ ¥17 ¥48 ¥40 $0.15<br />

Diluted ............................................................................................ 17 45 38 0.15<br />

Cash dividends per share applicable to the year ............................. 15 22 22 0.14<br />

See accompanying notes to consolidated financial statements.<br />

16