MARUI CO., LTD.

MARUI CO., LTD.

MARUI CO., LTD.

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Millions of yen<br />

Thousands of<br />

U.S. dollars<br />

2003/9 2003/1 2003/9<br />

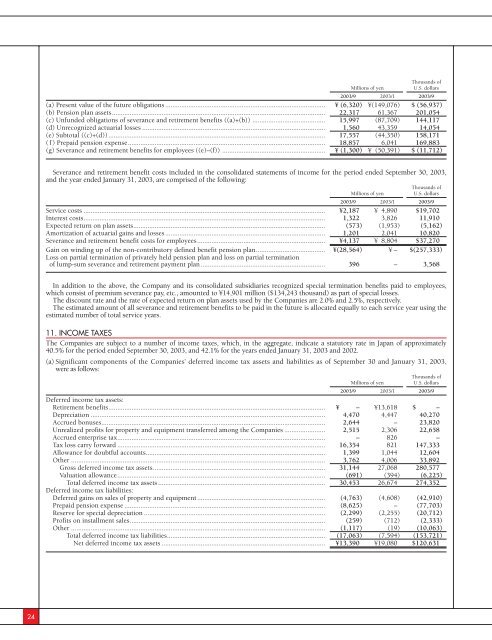

(a) Present value of the future obligations .......................................................................................... ¥ (6,320) ¥(149,076) $ (56,937)<br />

(b) Pension plan assets........................................................................................................................ 22,317 61,367 201,054<br />

(c) Unfunded obligations of severance and retirement benefits ((a)+(b)) ......................................... 15,997 (87,709) 144,117<br />

(d) Unrecognized actuarial losses ....................................................................................................... 1,560 43,359 14,054<br />

(e) Subtotal ((c)+(d)).......................................................................................................................... 17,557 (44,350) 158,171<br />

(f) Prepaid pension expense............................................................................................................... 18,857 6,041 169,883<br />

(g) Severance and retirement benefits for employees ((e)–(f)) .......................................................... ¥ (1,300) ¥ (50,391) $ (11,712)<br />

Severance and retirement benefit costs included in the consolidated statements of income for the period ended September 30, 2003,<br />

and the year ended January 31, 2003, are comprised of the following:<br />

Thousands of<br />

Millions of yen<br />

U.S. dollars<br />

2003/9 2003/1 2003/9<br />

Service costs ........................................................................................................................................ ¥2,187 ¥ 4,890 $19,702<br />

Interest costs........................................................................................................................................ 1,322 3,826 11,910<br />

Expected return on plan assets............................................................................................................ (573) (1,953) (5,162)<br />

Amortization of actuarial gains and losses .......................................................................................... 1,201 2,041 10,820<br />

Severance and retirement benefit costs for employees........................................................................ ¥4,137 ¥ 8,804 $37,270<br />

Gain on winding up of the non-contributory defined benefit pension plan....................................... ¥(28,564) ¥ – $(257,333)<br />

Loss on partial termination of privately held pension plan and loss on partial termination<br />

of lump-sum severance and retirement payment plan ...................................................................... 396 – 3,568<br />

In addition to the above, the Company and its consolidated subsidiaries recognized special termination benefits paid to employees,<br />

which consist of premium severance pay, etc., amounted to ¥14,901 million ($134,243 thousand) as part of special losses.<br />

The discount rate and the rate of expected return on plan assets used by the Companies are 2.0% and 2.5%, respectively.<br />

The estimated amount of all severance and retirement benefits to be paid in the future is allocated equally to each service year using the<br />

estimated number of total service years.<br />

11. IN<strong>CO</strong>ME TAXES<br />

The Companies are subject to a number of income taxes, which, in the aggregate, indicate a statutory rate in Japan of approximately<br />

40.5% for the period ended September 30, 2003, and 42.1% for the years ended January 31, 2003 and 2002.<br />

(a) Significant components of the Companies’ deferred income tax assets and liabilities as of September 30 and January 31, 2003,<br />

were as follows:<br />

Thousands of<br />

Millions of yen<br />

U.S. dollars<br />

2003/9 2003/1 2003/9<br />

Deferred income tax assets:<br />

Retirement benefits.......................................................................................................................... ¥ – ¥13,618 $ –<br />

Depreciation .................................................................................................................................... 4,470 4,447 40,270<br />

Accrued bonuses.............................................................................................................................. 2,644 – 23,820<br />

Unrealized profits for property and equipment transferred among the Companies ....................... 2,515 2,306 22,658<br />

Accrued enterprise tax..................................................................................................................... – 826 –<br />

Tax loss carry forward ..................................................................................................................... 16,354 821 147,333<br />

Allowance for doubtful accounts..................................................................................................... 1,399 1,044 12,604<br />

Other ............................................................................................................................................... 3,762 4,006 33,892<br />

Gross deferred income tax assets................................................................................................. 31,144 27,068 280,577<br />

Valuation allowance..................................................................................................................... (691) (394) (6,225)<br />

Total deferred income tax assets .............................................................................................. 30,453 26,674 274,352<br />

Deferred income tax liabilities:<br />

Deferred gains on sales of property and equipment ........................................................................ (4,763) (4,608) (42,910)<br />

Prepaid pension expense ................................................................................................................. (8,625) – (77,703)<br />

Reserve for special depreciation ...................................................................................................... (2,299) (2,255) (20,712)<br />

Profits on installment sales.............................................................................................................. (259) (712) (2,333)<br />

Other ............................................................................................................................................... (1,117) (19) (10,063)<br />

Total deferred income tax liabilities......................................................................................... (17,063) (7,594) (153,721)<br />

Net deferred income tax assets ............................................................................................ ¥13,390 ¥19,080 $120,631<br />

24