AUDITED CONDENSED CONSOLIDATED FINANCIAL ... - AFGRI

AUDITED CONDENSED CONSOLIDATED FINANCIAL ... - AFGRI

AUDITED CONDENSED CONSOLIDATED FINANCIAL ... - AFGRI

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

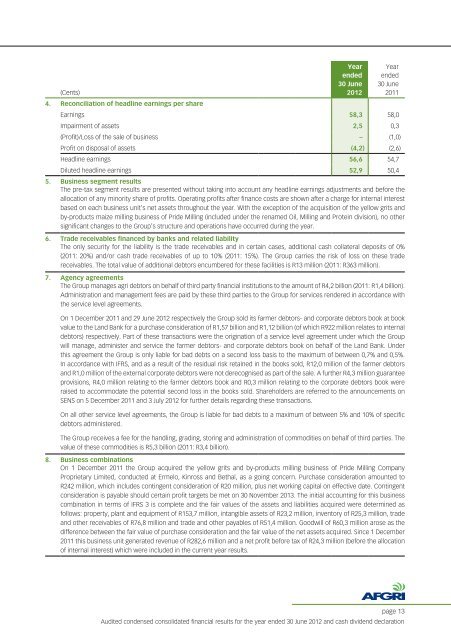

(Cents)<br />

4. Reconciliation of headline earnings per share<br />

Year<br />

ended<br />

30 June<br />

2012<br />

Year<br />

ended<br />

30 June<br />

2011<br />

Earnings 58,3 58,0<br />

Impairment of assets 2,5 0,3<br />

(Profit)/Loss of the sale of business – (1,0)<br />

Profit on disposal of assets (4,2) (2,6)<br />

Headline earnings 56,6 54,7<br />

Diluted headline earnings 52,9 50,4<br />

5. Business segment results<br />

The pre-tax segment results are presented without taking into account any headline earnings adjustments and before the<br />

allocation of any minority share of profits. Operating profits after finance costs are shown after a charge for internal interest<br />

based on each business unit’s net assets throughout the year. With the exception of the acquisition of the yellow grits and<br />

by-products maize milling business of Pride Milling (included under the renamed Oil, Milling and Protein division), no other<br />

significant changes to the Group’s structure and operations have occurred during the year.<br />

6. Trade receivables financed by banks and related liability<br />

The only security for the liability is the trade receivables and in certain cases, additional cash collateral deposits of 0%<br />

(2011: 20%) and/or cash trade receivables of up to 10% (2011: 15%). The Group carries the risk of loss on these trade<br />

receivables. The total value of additional debtors encumbered for these facilities is R13 million (2011: R363 million).<br />

7. Agency agreements<br />

The Group manages agri debtors on behalf of third party financial institutions to the amount of R4,2 billion (2011: R1,4 billion).<br />

Administration and management fees are paid by these third parties to the Group for services rendered in accordance with<br />

the service level agreements.<br />

On 1 December 2011 and 29 June 2012 respectively the Group sold its farmer debtors- and corporate debtors book at book<br />

value to the Land Bank for a purchase consideration of R1,57 billion and R1,12 billion (of which R922 million relates to internal<br />

debtors) respectively. Part of these transactions were the origination of a service level agreement under which the Group<br />

will manage, administer and service the farmer debtors- and corporate debtors book on behalf of the Land Bank. Under<br />

this agreement the Group is only liable for bad debts on a second loss basis to the maximum of between 0,7% and 0,5%.<br />

In accordance with IFRS, and as a result of the residual risk retained in the books sold, R12,0 million of the farmer debtors<br />

and R1,0 million of the external corporate debtors were not derecognised as part of the sale. A further R4,3 million guarantee<br />

provisions, R4,0 million relating to the farmer debtors book and R0,3 million relating to the corporate debtors book were<br />

raised to accommodate the potential second loss in the books sold. Shareholders are referred to the announcements on<br />

SENS on 5 December 2011 and 3 July 2012 for further details regarding these transactions.<br />

On all other service level agreements, the Group is liable for bad debts to a maximum of between 5% and 10% of specific<br />

debtors administered.<br />

The Group receives a fee for the handling, grading, storing and administration of commodities on behalf of third parties. The<br />

value of these commodities is R5,3 billion (2011: R3,4 billion).<br />

8. Business combinations<br />

On 1 December 2011 the Group acquired the yellow grits and by-products milling business of Pride Milling Company<br />

Proprietary Limited, conducted at Ermelo, Kinross and Bethal, as a going concern. Purchase consideration amounted to<br />

R242 million, which includes contingent consideration of R20 million, plus net working capital on effective date. Contingent<br />

consideration is payable should certain profit targets be met on 30 November 2013. The initial accounting for this business<br />

combination in terms of IFRS 3 is complete and the fair values of the assets and liabilities acquired were determined as<br />

follows: property, plant and equipment of R153,7 million, intangible assets of R23,2 million, inventory of R25,3 million, trade<br />

and other receivables of R76,8 million and trade and other payables of R51,4 million. Goodwill of R60,3 million arose as the<br />

difference between the fair value of purchase consideration and the fair value of the net assets acquired. Since 1 December<br />

2011 this business unit generated revenue of R282,6 million and a net profit before tax of R24,3 million (before the allocation<br />

of internal interest) which were included in the current year results.<br />

page 13<br />

Audited condensed consolidated financial results for the year ended 30 June 2012 and cash dividend declaration