1lzXuhv

1lzXuhv

1lzXuhv

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Sustainability Statement (Continued)<br />

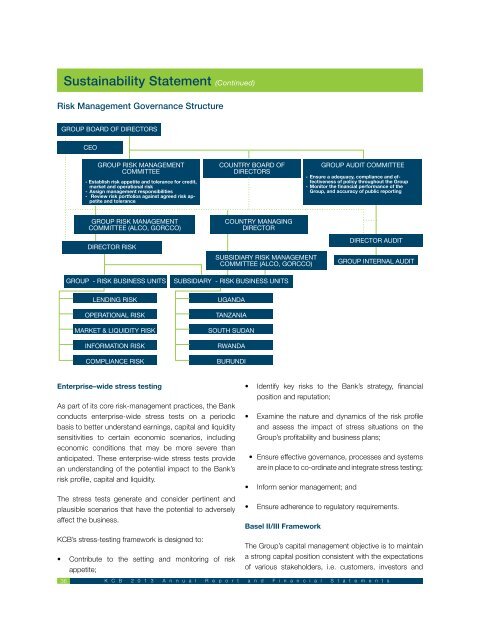

Risk Management Governance Structure<br />

GROUP BOARD OF DIRECTORS<br />

CEO<br />

Group risk management<br />

Committee<br />

- Establish risk appetite and tolerance for credit,<br />

market and operational risk<br />

- Assign management responsibilities<br />

- Review risk portfolios against agreed risk appetite<br />

and tolerance<br />

Country Board of<br />

Directors<br />

GROUP AUDIT COMMITTEE<br />

- Ensure a adequacy, compliance and effectiveness<br />

of policy throughout the Group<br />

- Monitor the financial performance of the<br />

Group, and accuracy of public reporting<br />

Group Risk Management<br />

Committee (ALCO, GORCCO)<br />

Director Risk<br />

Country Managing<br />

Director<br />

Subsidiary Risk Management<br />

Committee (ALCO, GORCCO)<br />

Director Audit<br />

GROUP Internal Audit<br />

Group - Risk Business Units<br />

Lending Risk<br />

Operational Risk<br />

Market & Liquidity Risk<br />

Information Risk<br />

Compliance Risk<br />

Subsidiary - Risk Business Units<br />

Uganda<br />

Tanzania<br />

South Sudan<br />

Rwanda<br />

Burundi<br />

Enterprise–wide stress testing<br />

As part of its core risk-management practices, the Bank<br />

conducts enterprise-wide stress tests on a periodic<br />

basis to better understand earnings, capital and liquidity<br />

sensitivities to certain economic scenarios, including<br />

economic conditions that may be more severe than<br />

anticipated. These enterprise-wide stress tests provide<br />

an understanding of the potential impact to the Bank’s<br />

risk profile, capital and liquidity.<br />

The stress tests generate and consider pertinent and<br />

plausible scenarios that have the potential to adversely<br />

affect the business.<br />

KCB’s stress-testing framework is designed to:<br />

• Contribute to the setting and monitoring of risk<br />

appetite;<br />

• Identify key risks to the Bank’s strategy, financial<br />

position and reputation;<br />

• Examine the nature and dynamics of the risk profile<br />

and assess the impact of stress situations on the<br />

Group’s profitability and business plans;<br />

• Ensure effective governance, processes and systems<br />

are in place to co-ordinate and integrate stress testing;<br />

• Inform senior management; and<br />

• Ensure adherence to regulatory requirements.<br />

Basel II/III Framework<br />

The Group’s capital management objective is to maintain<br />

a strong capital position consistent with the expectations<br />

of various stakeholders, i.e. customers, investors and<br />

27 36<br />

K C B 2 0 1 3 A n n u a l R e p o r t a n d F i n a n c i a l S t a t e m e n t s