FS 63-100 General Provisions - Department of Public Social Services

FS 63-100 General Provisions - Department of Public Social Services

FS 63-100 General Provisions - Department of Public Social Services

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

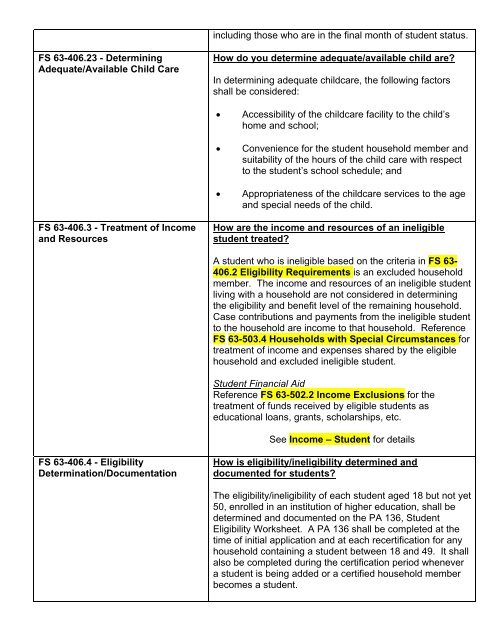

including those who are in the final month <strong>of</strong> student status.<br />

<strong>FS</strong> <strong>63</strong>-406.23 - Determining<br />

Adequate/Available Child Care<br />

How do you determine adequate/available child are?<br />

In determining adequate childcare, the following factors<br />

shall be considered:<br />

• Accessibility <strong>of</strong> the childcare facility to the child’s<br />

home and school;<br />

• Convenience for the student household member and<br />

suitability <strong>of</strong> the hours <strong>of</strong> the child care with respect<br />

to the student’s school schedule; and<br />

• Appropriateness <strong>of</strong> the childcare services to the age<br />

and special needs <strong>of</strong> the child.<br />

<strong>FS</strong> <strong>63</strong>-406.3 - Treatment <strong>of</strong> Income<br />

and Resources<br />

How are the income and resources <strong>of</strong> an ineligible<br />

student treated?<br />

A student who is ineligible based on the criteria in <strong>FS</strong> <strong>63</strong>-<br />

406.2 Eligibility Requirements is an excluded household<br />

member. The income and resources <strong>of</strong> an ineligible student<br />

living with a household are not considered in determining<br />

the eligibility and benefit level <strong>of</strong> the remaining household.<br />

Case contributions and payments from the ineligible student<br />

to the household are income to that household. Reference<br />

<strong>FS</strong> <strong>63</strong>-503.4 Households with Special Circumstances for<br />

treatment <strong>of</strong> income and expenses shared by the eligible<br />

household and excluded ineligible student.<br />

Student Financial Aid<br />

Reference <strong>FS</strong> <strong>63</strong>-502.2 Income Exclusions for the<br />

treatment <strong>of</strong> funds received by eligible students as<br />

educational loans, grants, scholarships, etc.<br />

See Income – Student for details<br />

<strong>FS</strong> <strong>63</strong>-406.4 - Eligibility<br />

Determination/Documentation<br />

How is eligibility/ineligibility determined and<br />

documented for students?<br />

The eligibility/ineligibility <strong>of</strong> each student aged 18 but not yet<br />

50, enrolled in an institution <strong>of</strong> higher education, shall be<br />

determined and documented on the PA 136, Student<br />

Eligibility Worksheet. A PA 136 shall be completed at the<br />

time <strong>of</strong> initial application and at each recertification for any<br />

household containing a student between 18 and 49. It shall<br />

also be completed during the certification period whenever<br />

a student is being added or a certified household member<br />

becomes a student.