FS 63-100 General Provisions - Department of Public Social Services

FS 63-100 General Provisions - Department of Public Social Services

FS 63-100 General Provisions - Department of Public Social Services

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

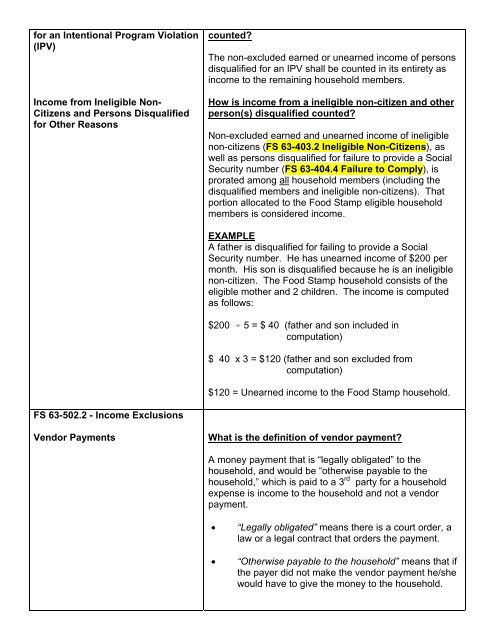

for an Intentional Program Violation<br />

(IPV)<br />

Income from Ineligible Non-<br />

Citizens and Persons Disqualified<br />

for Other Reasons<br />

counted?<br />

The non-excluded earned or unearned income <strong>of</strong> persons<br />

disqualified for an IPV shall be counted in its entirety as<br />

income to the remaining household members.<br />

How is income from a ineligible non-citizen and other<br />

person(s) disqualified counted?<br />

Non-excluded earned and unearned income <strong>of</strong> ineligible<br />

non-citizens (<strong>FS</strong> <strong>63</strong>-403.2 Ineligible Non-Citizens), as<br />

well as persons disqualified for failure to provide a <strong>Social</strong><br />

Security number (<strong>FS</strong> <strong>63</strong>-404.4 Failure to Comply), is<br />

prorated among all household members (including the<br />

disqualified members and ineligible non-citizens). That<br />

portion allocated to the Food Stamp eligible household<br />

members is considered income.<br />

EXAMPLE<br />

A father is disqualified for failing to provide a <strong>Social</strong><br />

Security number. He has unearned income <strong>of</strong> $200 per<br />

month. His son is disqualified because he is an ineligible<br />

non-citizen. The Food Stamp household consists <strong>of</strong> the<br />

eligible mother and 2 children. The income is computed<br />

as follows:<br />

$200 ) 5 = $ 40 (father and son included in<br />

computation)<br />

$ 40 x 3 = $120 (father and son excluded from<br />

computation)<br />

$120 = Unearned income to the Food Stamp household.<br />

<strong>FS</strong> <strong>63</strong>-502.2 - Income Exclusions<br />

Vendor Payments<br />

What is the definition <strong>of</strong> vendor payment?<br />

A money payment that is “legally obligated” to the<br />

household, and would be “otherwise payable to the<br />

household,” which is paid to a 3 rd party for a household<br />

expense is income to the household and not a vendor<br />

payment.<br />

• “Legally obligated” means there is a court order, a<br />

law or a legal contract that orders the payment.<br />

• “Otherwise payable to the household” means that if<br />

the payer did not make the vendor payment he/she<br />

would have to give the money to the household.