2013 Apr 15 Annual Report 2012 - Phosphagenics

2013 Apr 15 Annual Report 2012 - Phosphagenics

2013 Apr 15 Annual Report 2012 - Phosphagenics

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Notes to the consolidated fi nancial statements<br />

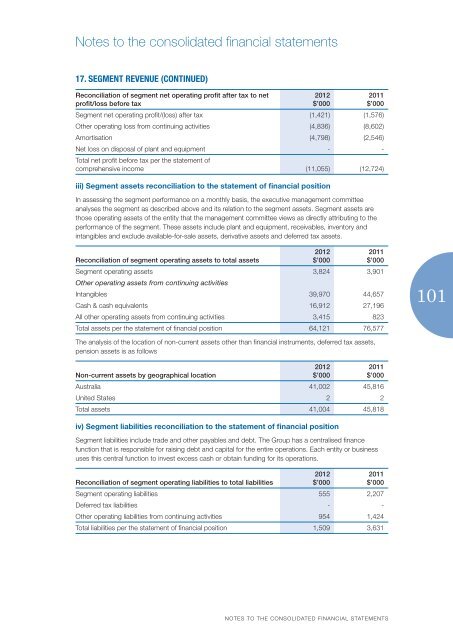

17. SEGMENT REVENUE (CONTINUED)<br />

Reconciliation of segment net operating profit after tax to net<br />

profit/loss before tax<br />

<strong>2012</strong><br />

$’000<br />

2011<br />

$’000<br />

Segment net operating profi t/(loss) after tax (1,421) (1,576)<br />

Other operating loss from continuing activities (4,836) (8,602)<br />

Amortisation (4,798) (2,546)<br />

Net loss on disposal of plant and equipment - -<br />

Total net profi t before tax per the statement of<br />

comprehensive income (11,055) (12,724)<br />

iii) Segment assets reconciliation to the statement of financial position<br />

In assessing the segment performance on a monthly basis, the executive management committee<br />

analyses the segment as described above and its relation to the segment assets. Segment assets are<br />

those operating assets of the entity that the management committee views as directly attributing to the<br />

performance of the segment. These assets include plant and equipment, receivables, inventory and<br />

intangibles and exclude available-for-sale assets, derivative assets and deferred tax assets.<br />

Reconciliation of segment operating assets to total assets<br />

<strong>2012</strong><br />

$’000<br />

2011<br />

$’000<br />

Segment operating assets 3,824 3,901<br />

Other operating assets from continuing activities<br />

Intangibles 39,970 44,657<br />

Cash & cash equivalents 16,912 27,196<br />

All other operating assets from continuing activities 3,4<strong>15</strong> 823<br />

Total assets per the statement of fi nancial position 64,121 76,577<br />

101<br />

The analysis of the location of non-current assets other than fi nancial instruments, deferred tax assets,<br />

pension assets is as follows<br />

Non-current assets by geographical location<br />

<strong>2012</strong><br />

$’000<br />

2011<br />

$’000<br />

Australia 41,002 45,816<br />

United States 2 2<br />

Total assets 41,004 45,818<br />

iv) Segment liabilities reconciliation to the statement of financial position<br />

Segment liabilities include trade and other payables and debt. The Group has a centralised fi nance<br />

function that is responsible for raising debt and capital for the entire operations. Each entity or business<br />

uses this central function to invest excess cash or obtain funding for its operations.<br />

Reconciliation of segment operating liabilities to total liabilities<br />

<strong>2012</strong><br />

$’000<br />

2011<br />

$’000<br />

Segment operating liabilities 555 2,207<br />

Deferred tax liabilities - -<br />

Other operating liabilities from continuing activities 954 1,424<br />

Total liabilities per the statement of fi nancial position 1,509 3,631<br />

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS