Download - polytec

Download - polytec

Download - polytec

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

POLYTEC 2012 Notes<br />

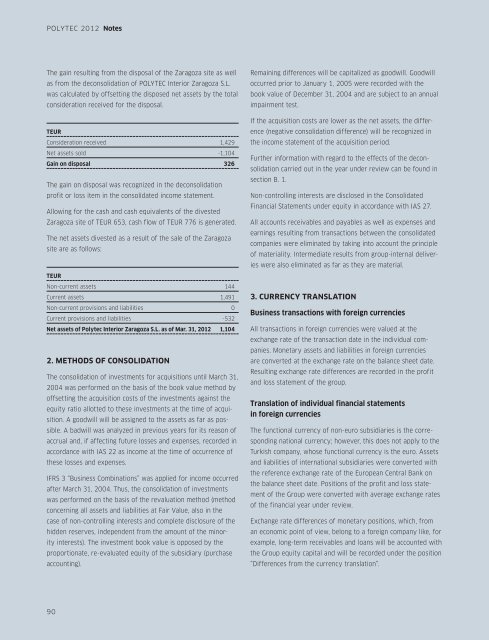

The gain resulting from the disposal of the Zaragoza site as well<br />

as from the deconsolidation of POLYTEC Interior Zaragoza S.L.<br />

was calculated by offsetting the disposed net assets by the total<br />

consideration received for the disposal.<br />

TEUR<br />

Consideration received 1,429<br />

Net assets sold -1,104<br />

Gain on disposal 326<br />

The gain on disposal was recognized in the deconsolidation<br />

profit or loss item in the consolidated income statement.<br />

Allowing for the cash and cash equivalents of the divested<br />

Zaragoza site of TEUR 653, cash flow of TEUR 776 is generated.<br />

The net assets divested as a result of the sale of the Zaragoza<br />

site are as follows:<br />

TEUR<br />

Non-current assets 144<br />

Current assets 1,491<br />

Non-current provisions and liabilities 0<br />

Current provisions and liabilities -532<br />

Net assets of Polytec Interior Zaragoza S.L. as of Mar. 31, 2012 1,104<br />

2. METHods of consolidation<br />

The consolidation of investments for acquisitions until March 31,<br />

2004 was performed on the basis of the book value method by<br />

offsetting the acquisition costs of the investments against the<br />

equity ratio allotted to these investments at the time of acquisition.<br />

A goodwill will be assigned to the assets as far as possible.<br />

A badwill was analyzed in previous years for its reason of<br />

accrual and, if affecting future losses and expenses, recorded in<br />

accordance with IAS 22 as income at the time of occurrence of<br />

these losses and expenses.<br />

IFRS 3 “Business Combinations” was applied for income occurred<br />

after March 31, 2004. Thus, the consolidation of investments<br />

was performed on the basis of the revaluation method (method<br />

concerning all assets and liabilities at Fair Value, also in the<br />

case of non-controlling interests and complete disclosure of the<br />

hidden reserves, independent from the amount of the minority<br />

interests). The investment book value is opposed by the<br />

proportionate, re-evaluated equity of the subsidiary (purchase<br />

accounting).<br />

Remaining differences will be capitalized as goodwill. Goodwill<br />

occurred prior to January 1, 2005 were recorded with the<br />

book value of December 31, 2004 and are subject to an annual<br />

impairment test.<br />

If the acquisition costs are lower as the net assets, the difference<br />

(negative consolidation difference) will be recognized in<br />

the income statement of the acquisition period.<br />

Further information with regard to the effects of the deconsolidation<br />

carried out in the year under review can be found in<br />

section B. 1.<br />

Non-controlling interests are disclosed in the Consolidated<br />

Financial Statements under equity in accordance with IAS 27.<br />

All accounts receivables and payables as well as expenses and<br />

earnings resulting from transactions between the consolidated<br />

companies were eliminated by taking into account the principle<br />

of materiality. Intermediate results from group-internal deliveries<br />

were also eliminated as far as they are material.<br />

3. Currency translation<br />

Business transactions with foreign currencies<br />

All transactions in foreign currencies were valued at the<br />

exchange rate of the transaction date in the individual companies.<br />

Monetary assets and liabilities in foreign currencies<br />

are converted at the exchange rate on the balance sheet date.<br />

Resulting exchange rate differences are recorded in the profit<br />

and loss statement of the group.<br />

Translation of individual financial statements<br />

in foreign currencies<br />

The functional currency of non-euro subsidiaries is the corresponding<br />

national currency; however, this does not apply to the<br />

Turkish company, whose functional currency is the euro. Assets<br />

and liabilities of international subsidiaries were converted with<br />

the reference exchange rate of the European Central Bank on<br />

the balance sheet date. Positions of the profit and loss statement<br />

of the Group were converted with average exchange rates<br />

of the financial year under review.<br />

Exchange rate differences of monetary positions, which, from<br />

an economic point of view, belong to a foreign company like, for<br />

example, long-term receivables and loans will be accounted with<br />

the Group equity capital and will be recorded under the position<br />

“Differences from the currency translation”.<br />

90