Download - polytec

Download - polytec

Download - polytec

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

POLYTEC 2012 Group Management Report<br />

FinancIAl ReSUlt<br />

The financial result in 2012 amounted to EUR -0.9 million compared<br />

to EUR -3.1 million in the previous year.<br />

In the year under review, the marked decline in financial expenses<br />

by more than 60% or EUR 2.3 million to EUR –1.1 million was mainly<br />

attributable to interest income resulting from the investment of<br />

available liquidity over the course of 2012 in addition to an overall<br />

lower usage of bank loans. Income from other investments includes<br />

dividends from the POLYTEC Immobilien Group of EUR 0.1 million.<br />

Including deferred tax effects, the Group’s effective tax rate<br />

amounted to 16.8% in 2012 and was therefore considerably lower<br />

than the full taxation of income due to the conservative measurement<br />

of tax losses carried forward in previous years.<br />

Net profit amounted to EUR 21.7 million in the year under review.<br />

This corresponds to earnings per share of EUR 0.97.<br />

GroUP Key BALANCE Sheet AND FINANCIAL FIGURES<br />

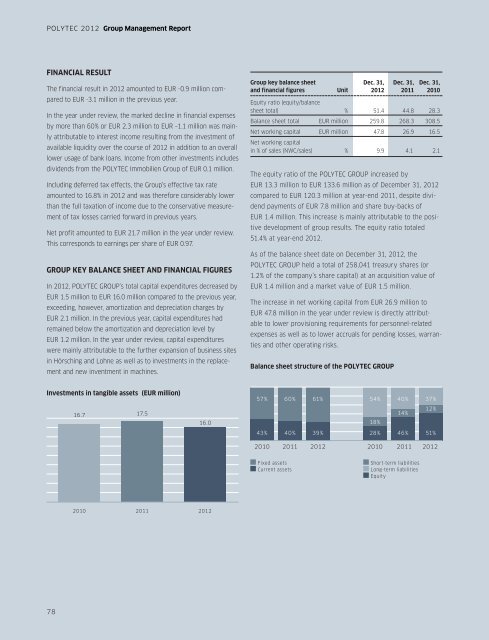

In 2012, POLYTEC GROUP’s total capital expenditures decreased by<br />

EUR 1.5 million to EUR 16.0 million compared to the previous year,<br />

exceeding, however, amortization and depreciation charges by<br />

EUR 2.1 million. In the previous year, capital expenditures had<br />

remained below the amortization and depreciation level by<br />

EUR 1.2 million. In the year under review, capital expenditures<br />

were mainly attributable to the further expansion of business sites<br />

in Hörsching and Lohne as well as to investments in the replacement<br />

and new inventment in machines.<br />

Group key balance sheet Dec. 31, Dec. 31, Dec. 31,<br />

and financial figures Unit 2012 2011 2010<br />

Equity ratio (equity/balance<br />

sheet total) % 51.4 44.8 28.3<br />

Balance sheet total EUR million 259.8 268.3 308.5<br />

Net working capital EUR million 47.8 26.9 16.5<br />

Net working capital<br />

in % of sales (NWC/sales) % 9.9 4.1 2.1<br />

The equity ratio of the POLYTEC GROUP increased by<br />

EUR 13.3 million to EUR 133.6 million as of December 31, 2012<br />

compared to EUR 120.3 million at year-end 2011, despite dividend<br />

payments of EUR 7.8 million and share buy-backs of<br />

EUR 1.4 million. This increase is mainly attributable to the positive<br />

development of group results. The equity ratio totaled<br />

51.4% at year-end 2012.<br />

As of the balance sheet date on December 31, 2012, the<br />

POLYTEC GROUP held a total of 258,041 treasury shares (or<br />

1.2% of the company’s share capital) at an acquisition value of<br />

EUR 1.4 million and a market value of EUR 1.5 million.<br />

The increase in net working capital from EUR 26.9 million to<br />

EUR 47.8 million in the year under review is directly attributable<br />

to lower provisioning requirements for personnel-related<br />

expenses as well as to lower accruals for pending losses, warranties<br />

and other operating risks.<br />

Balance sheet structure of the POLYTEC GroUP<br />

Investments in tangible assets (EUR million)<br />

57% 60%<br />

61%<br />

54%<br />

40%<br />

37%<br />

16.7<br />

17.5<br />

16.0<br />

18%<br />

14%<br />

12%<br />

43% 40% 39%<br />

28%<br />

46%<br />

51%<br />

2010<br />

2011<br />

2012<br />

2010<br />

2011<br />

2012<br />

Fixed assets<br />

Current assets<br />

Short-term liabilities<br />

Long-term liabilities<br />

Equity<br />

2010<br />

2011<br />

2012<br />

78