Download - polytec

Download - polytec

Download - polytec

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

POLYTEC 2012 Notes<br />

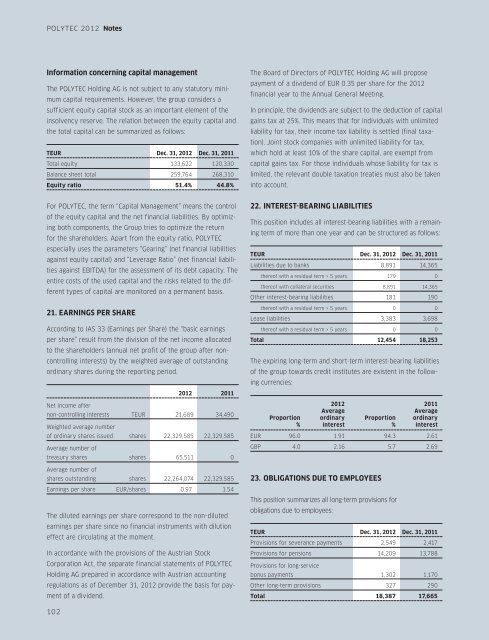

Information concerning capital management<br />

The POLYTEC Holding AG is not subject to any statutory minimum<br />

capital requirements. However, the group considers a<br />

sufficient equity capital stock as an important element of the<br />

insolvency reserve. The relation between the equity capital and<br />

the total capital can be summarized as follows:<br />

TEUr Dec. 31, 2012 Dec. 31, 2011<br />

Total equity 133,622 120,330<br />

Balance sheet total 259,764 268,310<br />

Equity ratio 51.4% 44.8%<br />

The Board of Directors of POLYTEC Holding AG will propose<br />

payment of a dividend of EUR 0.35 per share for the 2012<br />

financial year to the Annual General Meeting.<br />

In principle, the dividends are subject to the deduction of capital<br />

gains tax at 25%. This means that for individuals with unlimited<br />

liability for tax, their income tax liability is settled (final taxation).<br />

Joint stock companies with unlimited liability for tax,<br />

which hold at least 10% of the share capital, are exempt from<br />

capital gains tax. For those individuals whose liability for tax is<br />

limited, the relevant double taxation treaties must also be taken<br />

into account.<br />

For POLYTEC, the term “Capital Management” means the control<br />

of the equity capital and the net financial liabilities. By optimizing<br />

both components, the Group tries to optimize the return<br />

for the shareholders. Apart from the equity ratio, POLYTEC<br />

especially uses the parameters “Gearing” (net financial liabilities<br />

against equity capital) and “Leverage Ratio” (net financial liabilities<br />

against EBITDA) for the assessment of its debt capacity. The<br />

entire costs of the used capital and the risks related to the different<br />

types of capital are monitored on a permanent basis.<br />

21. EarninGS per share<br />

According to IAS 33 (Earnings per Share) the “basic earnings<br />

per share” result from the division of the net income allocated<br />

to the shareholders (annual net profit of the group after noncontrolling<br />

interests) by the weighted average of outstanding<br />

ordinary shares during the reporting period.<br />

2012 2011<br />

Net income after<br />

non-controlling interests TEUR 21,689 34,490<br />

Weighted average number<br />

of ordinary shares issued shares 22,329,585 22,329,585<br />

Average number of<br />

treasury shares shares 65,511 0<br />

Average number of<br />

shares outstanding shares 22,264,074 22,329,585<br />

Earnings per share EUR/shares 0.97 1.54<br />

The diluted earnings per share correspond to the non-diluted<br />

earnings per share since no financial instruments with dilution<br />

effect are circulating at the moment.<br />

In accordance with the provisions of the Austrian Stock<br />

Corporation Act, the separate financial statements of POLYTEC<br />

Holding AG prepared in accordance with Austrian accounting<br />

regulations as of December 31, 2012 provide the basis for payment<br />

of a dividend.<br />

22. Interest-bearing lIABIlities<br />

This position includes all interest-bearing liabilities with a remaining<br />

term of more than one year and can be structured as follows:<br />

TEUr Dec. 31, 2012 Dec. 31, 2011<br />

Liabilities due to banks 8,891 14,365<br />

thereof with a residual term > 5 years 179 0<br />

thereof with collateral securities 8,891 14,365<br />

Other interest-bearing liabilities 181 190<br />

thereof with a residual term > 5 years 0 0<br />

Lease liabilities 3,383 3,698<br />

thereof with a residual term > 5 years 0 0<br />

Total 12,454 18,253<br />

The expiring long-term and short-term interest-bearing liabilities<br />

of the group towards credit institutes are existent in the following<br />

currencies:<br />

2012 2011<br />

Average<br />

Average<br />

proportion ordinary proportion ordinary<br />

% interest % interest<br />

EUR 96.0 1.91 94.3 2.61<br />

GBP 4.0 2.16 5.7 2.69<br />

23. oBlIGAtions due to employees<br />

This position summarizes all long-term provisions for<br />

obligations due to employees:<br />

TEUr Dec. 31, 2012 Dec. 31, 2011<br />

Provisions for severance payments 2,549 2,417<br />

Provisions for pensions 14,209 13,788<br />

Provisions for long-service<br />

bonus payments 1,302 1,170<br />

Other long-term provisions 327 290<br />

Total 18,387 17,665<br />

102