QIAGEN N.V. Annual Report 2001

QIAGEN N.V. Annual Report 2001

QIAGEN N.V. Annual Report 2001

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

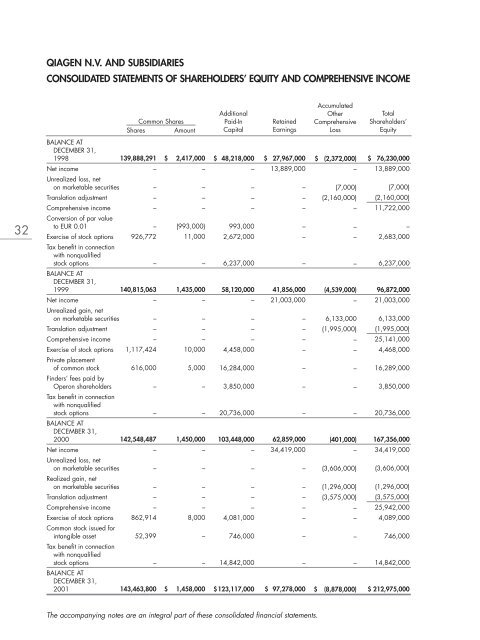

<strong>QIAGEN</strong> N.V. AND SUBSIDIARIES<br />

CONSOLIDATED STATEMENTS OF SHAREHOLDERS’ EQUITY AND COMPREHENSIVE INCOME<br />

Common Shares<br />

Shares Amount<br />

Additional<br />

Paid-In<br />

Capital<br />

Retained<br />

Earnings<br />

Accumulated<br />

Other<br />

Comprehensive<br />

Loss<br />

Total<br />

Shareholders’<br />

Equity<br />

32<br />

BALANCE AT<br />

DECEMBER 31,<br />

1998<br />

139,888,291<br />

Net income<br />

–<br />

Unrealized loss, net<br />

on marketable securities<br />

–<br />

Translation adjustment<br />

–<br />

Comprehensive income<br />

–<br />

Conversion of par value<br />

to EUR 0.01<br />

–<br />

Exercise of stock options 926,772<br />

Tax benefit in connection<br />

with nonqualified<br />

stock options<br />

–<br />

BALANCE AT<br />

DECEMBER 31,<br />

1999<br />

140,815,063<br />

Net income<br />

–<br />

Unrealized gain, net<br />

on marketable securities<br />

–<br />

Translation adjustment<br />

–<br />

Comprehensive income<br />

–<br />

Exercise of stock options 1,117,424<br />

Private placement<br />

of common stock 616,000<br />

Finders’ fees paid by<br />

Operon shareholders<br />

–<br />

Tax benefit in connection<br />

with nonqualified<br />

stock options<br />

–<br />

BALANCE AT<br />

DECEMBER 31,<br />

2000<br />

142,548,487<br />

Net income<br />

–<br />

Unrealized loss, net<br />

on marketable securities<br />

–<br />

Realized gain, net<br />

on marketable securities<br />

–<br />

Translation adjustment<br />

–<br />

Comprehensive income<br />

–<br />

Exercise of stock options 862,914<br />

Common stock issued for<br />

intangible asset<br />

52,399<br />

Tax benefit in connection<br />

with nonqualified<br />

stock options<br />

–<br />

BALANCE AT<br />

DECEMBER 31,<br />

<strong>2001</strong><br />

143,463,800<br />

$ 2,417,000<br />

–<br />

–<br />

–<br />

–<br />

(993,000)<br />

11,000<br />

–<br />

1,435,000<br />

–<br />

–<br />

–<br />

–<br />

10,000<br />

5,000<br />

–<br />

–<br />

1,450,000<br />

–<br />

–<br />

–<br />

–<br />

–<br />

8,000<br />

–<br />

–<br />

$ 1,458,000<br />

$ 48,218,000<br />

–<br />

–<br />

–<br />

–<br />

993,000<br />

2,672,000<br />

6,237,000<br />

58,120,000<br />

–<br />

–<br />

–<br />

–<br />

4,458,000<br />

16,284,000<br />

3,850,000<br />

20,736,000<br />

103,448,000<br />

–<br />

–<br />

–<br />

–<br />

–<br />

4,081,000<br />

746,000<br />

14,842,000<br />

$123,117,000<br />

$ 27,967,000<br />

13,889,000<br />

–<br />

–<br />

–<br />

–<br />

–<br />

–<br />

41,856,000<br />

21,003,000<br />

–<br />

–<br />

–<br />

–<br />

–<br />

–<br />

–<br />

62,859,000<br />

34,419,000<br />

–<br />

–<br />

–<br />

–<br />

–<br />

–<br />

–<br />

$ 97,278,000<br />

$ (2,372,000)<br />

–<br />

(7,000)<br />

(2,160,000)<br />

–<br />

–<br />

–<br />

–<br />

(4,539,000)<br />

–<br />

6,133,000<br />

(1,995,000)<br />

–<br />

–<br />

–<br />

–<br />

–<br />

(401,000)<br />

–<br />

(3,606,000)<br />

(1,296,000)<br />

(3,575,000)<br />

–<br />

–<br />

–<br />

–<br />

$ (8,878,000)<br />

$ 76,230,000<br />

13,889,000<br />

(7,000)<br />

(2,160,000)<br />

11,722,000<br />

–<br />

2,683,000<br />

6,237,000<br />

96,872,000<br />

21,003,000<br />

6,133,000<br />

(1,995,000)<br />

25,141,000<br />

4,468,000<br />

16,289,000<br />

3,850,000<br />

20,736,000<br />

167,356,000<br />

34,419,000<br />

(3,606,000)<br />

(1,296,000)<br />

(3,575,000)<br />

25,942,000<br />

4,089,000<br />

746,000<br />

14,842,000<br />

$ 212,975,000<br />

The accompanying notes are an integral part of these consolidated financial statements.