Analyst Report Bank Degroof - Quest for Growth

Analyst Report Bank Degroof - Quest for Growth

Analyst Report Bank Degroof - Quest for Growth

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Bank</strong> <strong>Degroof</strong> Belgian Analyser<br />

31 December 2009<br />

“The Holding Company”<br />

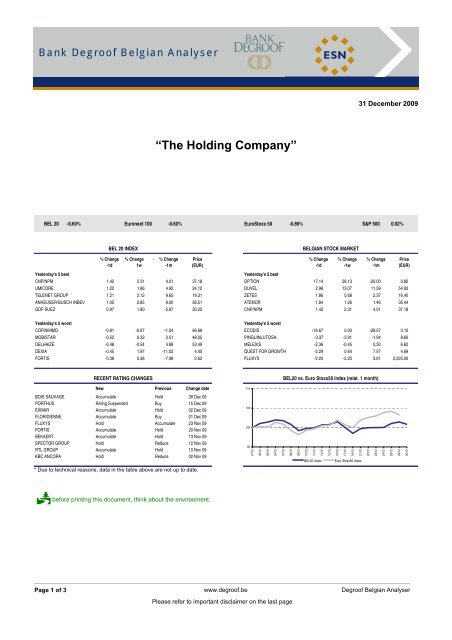

BEL 20 -0.60% Euronext 100 -0.60% EuroStoxx 50 -0.86% S&P 500 0.02%<br />

BEL 20 INDEX<br />

BELGIAN STOCK MARKET<br />

% Change<br />

-1d<br />

% Change -<br />

1w<br />

% Change<br />

-1m<br />

Price<br />

(EUR)<br />

% Change<br />

-1d<br />

% Change<br />

-1w<br />

% Change<br />

-1m<br />

Price<br />

(EUR)<br />

Yesterday's 5 best<br />

Yesterday's 5 best<br />

CNP/NPM 1.42 2.31 4.01 37.18 OPTION 17.14 28.13 -20.00 0.82<br />

UMICORE 1.22 1.86 4.92 24.12 DUVEL 2.96 13.07 11.59 54.00<br />

TELENET GROUP 1.21 2.12 9.65 19.31 ZETES 1.86 0.68 2.37 16.40<br />

ANHEUSER-BUSCH INBEV 1.05 2.85 8.00 36.51 ATENOR 1.84 1.26 1.46 35.44<br />

GDF-SUEZ 0.97 1.80 5.87 30.22 CNP/NPM 1.42 2.31 4.01 37.18<br />

Yesterday's 5 worst<br />

Yesterday's 5 worst<br />

COFINIMMO -0.81 -0.87 -1.04 96.66 ECODIS -16.67 0.00 -28.57 0.10<br />

MOBISTAR -0.52 0.32 2.51 48.05 PINGUINLUTOSA -3.37 -3.91 -1.94 8.60<br />

DELHAIZE -0.48 -0.54 4.88 53.49 MELEXIS -2.36 -0.45 0.30 6.62<br />

DEXIA -0.45 1.97 -11.02 4.45 QUEST FOR GROWTH -2.29 0.64 7.57 4.69<br />

FORTIS -0.38 0.38 -7.98 2.63 FLUXYS -2.20 -2.20 3.01 2,225.00<br />

RECENT RATING CHANGES<br />

BEL20 vs. Euro Stoxx50 Index (relat. 1 month)<br />

New Previous Change date<br />

110<br />

BOIS SAUVAGE Accumulate Hold 30 Dec 09<br />

PORTHUS Rating Suspended Buy 15 Dec 09<br />

EXMAR Accumulate Hold 02 Dec 09<br />

FLORIDIENNE Accumulate Buy 01 Dec 09<br />

FLUXYS Hold Accumulate 23 Nov 09<br />

FORTIS Accumulate Hold 20 Nov 09<br />

BEKAERT Accumulate Hold 13 Nov 09<br />

SPECTOR GROUP Hold Reduce 12 Nov 09<br />

RTL GROUP Accumulate Hold 10 Nov 09<br />

KBC ANCORA Hold Reduce 02 Nov 09<br />

105<br />

100<br />

95<br />

01/12<br />

02/12<br />

03/12<br />

04/12<br />

07/12<br />

08/12<br />

09/12<br />

10/12<br />

11/12<br />

14/12<br />

BEL20 Index<br />

15/12<br />

16/12<br />

17/12<br />

18/12<br />

21/12<br />

Euro Stoxx50 Index<br />

22/12<br />

23/12<br />

24/12<br />

28/12<br />

29/12<br />

30/12<br />

* Due to technical reasons, data in the table above are not up to date.<br />

be<strong>for</strong>e printing this document, think about the environment.<br />

Page 1 of 3 www.degroof.be <strong>Degroof</strong> Belgian Analyser<br />

Please refer to important disclaimer on the last page

31 December 2009<br />

Financial Services<br />

Belgian Holding Companies<br />

Financial Services Holding & portfolio<br />

i f i<br />

Analyser<br />

Holding & portfolio companies per<strong>for</strong>mance overview<br />

260 vvdsvdvsdy<br />

240<br />

220<br />

200<br />

180<br />

160<br />

140<br />

120<br />

Dec 08 Jan 09 Feb 09 Mar 09 Apr 09 May 09 Jun 09 Jul 09 Aug 09 Sep 09 Oct 09 Nov 09 Dec 09<br />

---------- DJ Stoxx Financial Services,<br />

DJ Stoxx TMI rebased on sector<br />

<strong>Analyst</strong>(s):<br />

Hans D'Haese <strong>Bank</strong> <strong>Degroof</strong><br />

hans.dhaese@degroof.be<br />

+32 (0) 2 287 9223<br />

mont h e<br />

The facts: Over 2009, holding companies’ share prices overall outper<strong>for</strong>med<br />

the Belgian stock market, with an average per<strong>for</strong>mance of 33.4% (unweighted)<br />

compared to +31.5% <strong>for</strong> the BEL20 index and +27.6% YTD <strong>for</strong> the Belgian All<br />

shares return index.<br />

Our analysis: Share price evolution as such can not be compared between the<br />

holding companies, as some did not pay any dividends at all (eg.<br />

RHJ International, <strong>Quest</strong> <strong>for</strong> <strong>Growth</strong>…), while others traditionally pay rather high<br />

dividends (eg. Gimv, Solvac…). We notice that the average discount has increased<br />

from 28% some 12 months ago to 29% at present. However, when excluding<br />

KBC Ancora, the single-asset company which traded at a small premium<br />

in the midst of the financial crisis one year ago (it is only invested in the at the<br />

time troublesome KBC Group), the overall discount actually has slightly decreased<br />

(from slightly above 30% to below 29%).<br />

Share NAV / Disc. Avg Disc.<br />

Company<br />

Evol. Evol. Evol.<br />

price share end disc. end<br />

name<br />

1 m 3 m 1 Yr<br />

(EUR) (EUR) 2009 2009 2008<br />

Ackerm. & van H. 52.4 63.8 17.9% 22.0% 41.8% 3.0% 5.3% 44.0%<br />

KBC Ancora 16.2 24.3 33.2% -4.7% 18.7% -2.7% -16.9% 32.8%<br />

Auximines 500.0 545.0 8.2% 11.3% 11.8% -2.9% 0.0% 38.9%<br />

Bois Sauvage 168.0 258.1 35.6% 35.4% 44.5% 1.8% 3.1% 10.7%<br />

Brederode 17.0 26.1 34.8% 32.7% 37.1% 1.5% 2.7% 33.3%<br />

CNP/NPM 37.4 49.8 25.0% 21.2% 26.5% 6.6% 0.6% 7.4%<br />

GBL 66.2 92.8 28.8% 27.8% 27.2% 9.0% 4.8% 16.3%<br />

Gimv 36.5 43.3 15.7% 17.8% 34.7% 3.5% -0.5% 17.7%<br />

Luxempart 221.4 332.4 33.4% 34.6% 34.5% -0.3% 4.4% 10.7%<br />

<strong>Quest</strong> <strong>for</strong> <strong>Growth</strong> 4.8 7.2 33.3% 39.0% 44.1% 12.7% 14.9% 52.1%<br />

RHJ International 5.3 9.4 43.2% 58.0% 60.5% 7.9% 6.4% 52.6%<br />

Sofina 68.0 95.8 29.0% 33.6% 38.0% 9.6% 4.5% 41.8%<br />

Solvac 81.6 120.4 32.3% 22.5% 20.2% -0.5% 0.7% 23.6%<br />

Fin. de Tubize 24.3 37.1 34.4% 36.1% 49.4% -0.9% 9.3% 85.7%<br />

Henex 38.9 56.4 31.1% 30.6% 37.2% 1.7% 7.4% 23.5%<br />

Average 29.1% 27.9% 24.8% 3.3% 3.1% 33.4%<br />

BEL20 3.7% 1.0% 31.5%<br />

Source: Company data, ESN – <strong>Bank</strong> <strong>Degroof</strong> Research<br />

Conclusion & Action: Our favourite Belgian holding companies (read: at present<br />

most attractively valued and with the potential <strong>for</strong> discount contraction or<br />

unlocking hidden value in the near future) remain:<br />

• RHJ International: BUY – in trans<strong>for</strong>mation phase from a diversified<br />

holding company, mainly exposed to automotive, to a merchant bank,<br />

• Financière de Tubize: BUY – see <strong>Bank</strong> <strong>Degroof</strong> Research’s investment<br />

case <strong>for</strong> UCB, and<br />

• Gimv: ACCUMULATE – at present taking advantage of more attractive<br />

prices and a better market environment <strong>for</strong> cash-rich private equity investors.<br />

Page 2 of 3 www.degroof.be <strong>Degroof</strong> Belgian Analyser<br />

Please refer to important disclaimer on the last page

<strong>Bank</strong> <strong>Degroof</strong> Belgian Analyser<br />

31 December 2009<br />

Agenda<br />

06-Jan-09 QUEST FOR GROWTH Detailed NAV update<br />

07-Jan-10 VAN DE VELDE FY results Sales announcement<br />

11-Jan-10 SOLVAY 1H Ex-dividend date<br />

14-Jan-10 DELHAIZE FY results Sales announcement<br />

14-Jan-10 SOLVAY 1H Dividend payment<br />

15-Jan-10 ARSEUS 4Q09 Sales announcement<br />

<strong>Bank</strong> <strong>Degroof</strong> acts as liquidity provider <strong>for</strong>: Aedifica, Atenor, Banimmo, Bois Sauvage, Duvel, Floridienne, GIMV, IBt,<br />

Intervest Retail, IPTE, I.R.I.S., Kinepolis, Leasinvest, Luxempart, Montea, NewTree, PinguinLutosa, RealCo, Resilux, Sapec, Ter Beke and<br />

Van de Velde.<br />

<strong>Bank</strong> <strong>Degroof</strong> holds a significant stake in: Aedifica, Fountain and Proximedia<br />

Bois Sauvage holds a significant stake in <strong>Bank</strong> <strong>Degroof</strong><br />

<strong>Bank</strong> <strong>Degroof</strong> direction and employees hold mandates in the following listed companies: Atenor, CFE, Cofinimmo, Brederode,<br />

Bois Sauvage, Deceuninck, D'Ieteren, Emakina, Floridienne, FuturaGene, Lotus Bakeries, Proximedia, Recticel, Sipef, Ter Beke, Tessenderlo and<br />

UCB.<br />

Institutional equity sales team<br />

Equity brokerage<br />

Damien Crispiels +32 2 287 96 97 John Paladino +32 2 287 96 40<br />

Bart Beullens +32 2 287 91 80 Laurent Delante +32 2 287 91 90<br />

Laurent Goethals +32 2 287 91 85 Tanguy del Marmol +32 2 287 96 13<br />

Pascal Magis +32 2 287 97 81 Frédéric Lebrun +32 2 287 97 62<br />

Peter Rysselaere +32 2 287 97 46 Robin Podevyn +32 2 287 91 82<br />

Stéphane Van Nimmen* +32 2 287 97 72 Christian Saint-Jean +32 2 287 97 80<br />

Institutional bond sales team<br />

Derivatives brokerage<br />

Peter Deknopper +32 2 287 91 22 Mohamed Abalhossain +32 2 287 95 10<br />

Fabrice Faccenda +32 2 287 91 81 Olivier-Pierre Morrot +32 2 287 96 18<br />

Charles Feiner* +32 2 287 91 83<br />

Structured products<br />

Equity research<br />

Jeroen De Keer +32 2 287 93 54 Preben Bruggeman +32 2 287 95 71<br />

Gaëtan De Vliegher +32 2 287 91 88 Jean-Marie Caucheteux +32 2 287 99 20<br />

Sébastien Fraboni +32 2 287 92 56 Hans D’Haese +32 2 287 92 23<br />

Edouard Nouvellon +32 2 287 93 23 Bernard Hanssens +32 2 287 96 89<br />

Siddy Jobe +32 2 287 92 79<br />

Funds services Ivan Lathouders, CFA +32 2 287 91 76<br />

Olivier Gigounon +32 2 287 91 84 Marc Leemans, CFA +32 2 287 93 61<br />

Thomas Palmblad +32 2 287 93 27 Thibaud Rutsaert, CFA +32 2 287 94 28<br />

Fabio Ghezzi Morgalanti +32 2 287 92 72<br />

Sven Van den Bogaert +32 2 287 93 06<br />

* authorised agent Mail: firstname.lastname@degroof.be<br />

All opinions and projections expressed in this document constitute the judgment of <strong>Bank</strong> <strong>Degroof</strong> as of the date of their publication and are subject to change without notice. <strong>Bank</strong> <strong>Degroof</strong> and/or<br />

any of its subsidiaries may hold long/short positions in the securities referred to herein including derivative instruments related to the latter or may have business relations with the companies<br />

discussed herein. This material is intended <strong>for</strong> the in<strong>for</strong>mation of the recipient only and does not constitute an offer to subscribe or purchase any securities. Although they are based on data<br />

which is presumed to be reliable and all while reasonable care has been taken to ensure they are derived from sources which are reliable, <strong>Bank</strong> <strong>Degroof</strong> has not independently verified such data<br />

and takes no responsibility as to their accuracy or completeness and accepts no liability <strong>for</strong> loss arising from the use of the opinions expressed in this document. Local laws and regulations may<br />

restrict the distribution of this document in other jurisdictions. Persons who enter in possession of this document should in<strong>for</strong>m themselves about and observe any such restrictions. All<br />

in<strong>for</strong>mation presented in this document is, unless otherwise specified, under copyright of <strong>Bank</strong> <strong>Degroof</strong>. No part of this publication may be copied or redistributed to other persons or firms without<br />

the written consent of <strong>Bank</strong> <strong>Degroof</strong>.<br />

Page 3 of 3 www.degroof.be <strong>Degroof</strong> Belgian Analyser