Promoting renewable energies - RETS Project

Promoting renewable energies - RETS Project

Promoting renewable energies - RETS Project

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Toolkit and evaluation procedure for<br />

investment decisions<br />

There are several possibilities in the assessment of an<br />

investment, whereas in practice often only the payback<br />

period is considered as a criterion. The payback period,<br />

however, does not indicate an investment’s profitability,<br />

but rather only the time needed to “recover the money”.<br />

The payback period is therefore also only a measure of<br />

risk and not a measure of profitability.<br />

Since in the usual procedure, one and the same payback<br />

period is applied as a standard for all investments (e.g.,<br />

three years), long-term investments — such as<br />

investments in <strong>renewable</strong> <strong>energies</strong> or energy efficiency<br />

— are subjected implicitly to higher profitability<br />

requirements.<br />

To avoid this problem, one requires a decision<br />

criterion based on a measure of profitability that<br />

considers the entire usage period of the investment.<br />

The internal rate of return and the present value meet<br />

these requirements. The two quantities are closely<br />

related to one another, as the internal rate of return<br />

ultimately only represents a special case of the present<br />

value calculation.<br />

Example:<br />

With a required payback period of three years, a<br />

production system with a useful life of five years still<br />

“earns” money for two years. However, a combined<br />

heat and power plant with a useful life of 12 years<br />

and the same payback period “earns” money for<br />

nine years and is therefore significantly more<br />

profitable than the production system under the<br />

same conditions. Such excessive implicit<br />

profitability requirements, however, prevent many<br />

investments in energy efficiency or <strong>renewable</strong><br />

<strong>energies</strong>.<br />

Few parameters are generally necessary for calculating<br />

the individual quantities:<br />

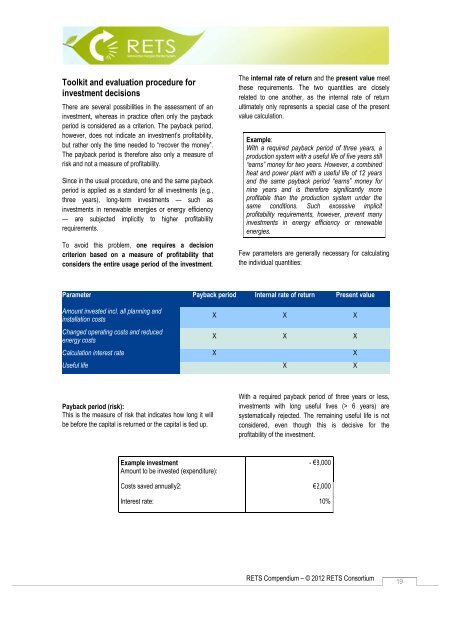

Parameter Payback period Internal rate of return Present value<br />

Amount invested incl. all planning and<br />

installation costs<br />

Changed operating costs and reduced<br />

energy costs<br />

X X X<br />

X X X<br />

Calculation interest rate X X<br />

Useful life X X<br />

Payback period (risk):<br />

This is the measure of risk that indicates how long it will<br />

be before the capital is returned or the capital is tied up.<br />

With a required payback period of three years or less,<br />

investments with long useful lives (> 6 years) are<br />

systematically rejected. The remaining useful life is not<br />

considered, even though this is decisive for the<br />

profitability of the investment.<br />

Example investment<br />

Amount to be invested (expenditure):<br />

- €8,000<br />

Costs saved annually2: €2,000<br />

Interest rate: 10%<br />

<strong>RETS</strong> Compendium – © 2012 <strong>RETS</strong> Consortium<br />

19