- Page 1 and 2:

2006 NATIONAL SURVEY ON DRUG USE AN

- Page 3 and 4:

General/Misc. 2006 NATIONAL SURVEY

- Page 5 and 6:

ages include the number of drinks c

- Page 7 and 8:

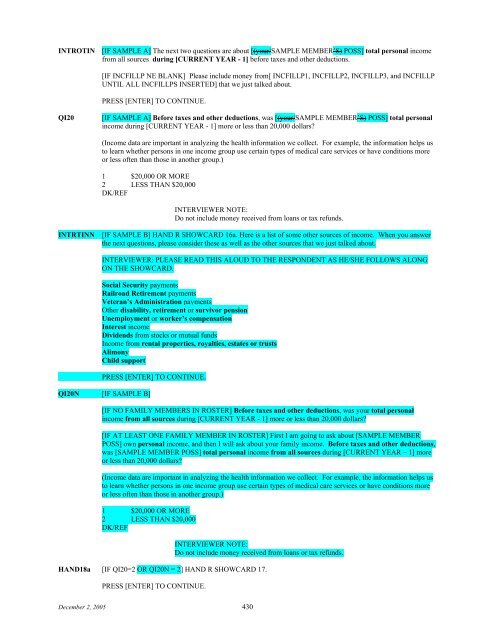

sources of income and asked to incl

- Page 9 and 10:

December 2, 2005 2

- Page 11 and 12:

1 YES 2 NO FIPE2 [IF FIPE1 = 1 AND

- Page 13 and 14:

1 ASIAN INDIAN 2 CHINESE 3 FILIPINO

- Page 15 and 16:

December 2, 2005 8

- Page 17 and 18:

December 2, 2005 10

- Page 19 and 20:

December 2, 2005 12

- Page 21 and 22:

DK/REF STOPLIST If you hear your an

- Page 23 and 24:

CGCC03 [IF CGCC02 = 2 OR CGCC02 = 3

- Page 25 and 26:

1 January 2 February 3 March 4 Apri

- Page 27 and 28:

12 Marlboro 25 Winston 13 Merit 26

- Page 29 and 30:

past 30 days, the cigarette brand y

- Page 31 and 32:

Thank you for your cooperation. PRO

- Page 33 and 34:

CG16m2)] The computer recorded that

- Page 35 and 36:

HARD ERROR: [IF CG26c > CURRENT MON

- Page 37 and 38:

days? 1 1 or 2 days 2 3 to 5 days 3

- Page 39 and 40:

ELSE CHEWAGE = BLANK IF CURNTAGE <

- Page 41 and 42:

DK/REF UPDATE: IF CGCH08 = 1, THEN

- Page 43 and 44:

5 H.B. Scott 6 Levi Garrett 7 Red F

- Page 45 and 46:

AGE: [RANGE: 1 - 110] DK/REF CGCR03

- Page 47 and 48:

4 April 5 May 6 June 7 July 8 Augus

- Page 49 and 50:

BRAND SMOKED: __________________ DK

- Page 51 and 52:

AL02 [IF AL01 = 1 OR ALREF = 1] Thi

- Page 53 and 54:

That would make you [MYR1STAL] year

- Page 55 and 56:

ELSE IF ALMONAVE > 1, THEN FILL1 =

- Page 57 and 58:

DK/REF UPDATE: IF ALCC23a NOT (BLAN

- Page 59 and 60:

# OF DAYS: [RANGE: 0 - 30] DK/REF U

- Page 61 and 62:

UPDATE: IF MJCC04 NOT(BLANK OR DK/R

- Page 63 and 64:

NOT BEGUN YET. TO MAKE THIS BOX DIS

- Page 65 and 66:

MJCC07b [IF ESTIMJ > TOTMJ] For the

- Page 67 and 68:

December 2, 2005 60

- Page 69 and 70:

UPDATE: IF CCCC03 NOT(BLANK OR DK/R

- Page 71 and 72:

MYR1STCC = AGE AT FIRST USE CALCULA

- Page 73 and 74:

ELSE IF CCMONAVE = 1, THEN FILLCN =

- Page 75 and 76:

December 2, 2005 68

- Page 77 and 78:

IF AGE1STCK=CURNTAGE OR AGE1STCK <

- Page 79 and 80:

BLANK. IF MYR1STCK = AGE1STCK THEN

- Page 81 and 82:

ELSE IF CKWKAVE = 1, THEN FILLCK =

- Page 83 and 84:

December 2, 2005 76

- Page 85 and 86:

IF AGE1STHR = CURNTAGE OR AGE1STHR

- Page 87 and 88:

BLANK. IF MYR1STHE = AGE1STHR THEN

- Page 89 and 90:

DEFINE FILLHERA: IF FILLHER = “[H

- Page 91 and 92:

December 2, 2005 84

- Page 93 and 94:

DK/REF LS01f Have you ever, even on

- Page 95 and 96:

AGE: [RANGE: 1 - 110] DK/REF UPDATE

- Page 97 and 98:

THE QUESTION AGAIN. PRESS [ENTER] T

- Page 99 and 100:

6 No DK/REF DEFINE FILLHAL: IF LSYR

- Page 101 and 102:

about the first time you used LSD.

- Page 103 and 104:

1 CURRENT YEAR -2 2 CURRENT YEAR -1

- Page 105 and 106:

1 1 or 2 days 2 3 to 5 days 3 6 to

- Page 107 and 108:

DK/REF LSCC80 [IF LSCC79 = 6] Pleas

- Page 109 and 110:

QUESTION AGAIN. PRESS [ENTER] TO CO

- Page 111 and 112:

3 More than 12 months ago DK/REF UP

- Page 113 and 114:

LSCC84 [IF LSC83 = 3] On how many d

- Page 115 and 116:

time you used [LSFILL]. How old wer

- Page 117 and 118:

The computer recorded that you firs

- Page 119 and 120:

ELSE IF LSWKAV4 NOT(BLANK OR DK/REF

- Page 121 and 122:

December 2, 2005 114

- Page 123 and 124:

IN01h Have you ever, even once, inh

- Page 125 and 126:

INCC06 [IF INCC05=6] Please answer

- Page 127 and 128:

[INCC19-INCC19a fill]. That would m

- Page 129 and 130:

ELSE IF INMONAVE = 1, THEN FILLINH

- Page 131 and 132:

INTRPILL Now we have some questions

- Page 133 and 134:

9 Hydrocodone 10 Methadone 11 Morph

- Page 135 and 136:

DK/REF PRCC06 [IF PRCC05=6] Please

- Page 137 and 138:

HARD ERROR: [IF PRCC09a > CURRENT M

- Page 139 and 140:

Thank you for your cooperation. PRO

- Page 141 and 142:

PRCC20 The computer recorded that y

- Page 143 and 144:

not prescribed for you or that you

- Page 145 and 146:

9 Limbitrol 10 Meprobamate 11 Milto

- Page 147 and 148:

AGE: [RANGE: 1 - 110] DK/REF UPDATE

- Page 149 and 150:

TRCC10 [IF TRCC08 NE 1 AND MYR1STTR

- Page 151 and 152:

December 2, 2005 144

- Page 153 and 154:

DK/REF ST04a [IF ST04 = 1] Which of

- Page 155 and 156:

STCC05 The computer recorded that y

- Page 157 and 158:

10 October 11 November 12 December

- Page 159 and 160:

AGE: [RANGE: 1-110] DK/REF STCC09a

- Page 161 and 162:

DEFINE MYR1STME: MYR1STME = AGE AT

- Page 163 and 164:

ST10a [IF STIMREC NE BLANK AND METH

- Page 165 and 166:

8 Halcion 9 Phenobarbital 10 Placid

- Page 167 and 168:

SV07a [IF SVCC05 NE DK/RE AND SVCC0

- Page 169 and 170:

fill]. That would make you [MYR1STS

- Page 171 and 172:

December 2, 2005 164

- Page 173 and 174:

SDHEUSE4 [IF SDHEUSE = 2] How long

- Page 175 and 176:

DK/REF SD05a [IF SD05 = 1] Please t

- Page 177 and 178:

DMT, also called dimethyltryptamine

- Page 179 and 180:

December 2, 2005 172

- Page 181 and 182:

RK01g How much do people risk harmi

- Page 183 and 184:

5 I don’t drive DK/REF December 2

- Page 185 and 186:

12 December DK/REF HARD ERROR: [IF

- Page 187 and 188:

1 I last used marijuana or hashish

- Page 189 and 190:

December 2, 2005 182

- Page 191 and 192:

DRCGE03 [IF CIG30DAY=1] You sometim

- Page 193 and 194:

DRCGE15 [IF CIG30DAY=1] Your smokin

- Page 195 and 196:

• Sweating or feeling that your h

- Page 197 and 198:

DRMJ04 [IF MAR12MON= 1 - 3] During

- Page 199 and 200:

IF COC12MON = 1 AND CRK12MON = 1 TH

- Page 201 and 202:

school, taking care of children, do

- Page 203 and 204:

• Having a fever • Having troub

- Page 205 and 206:

DRLS05 [IF DRLS04 = 1] Were you abl

- Page 207 and 208:

DRIN02 [IF DRIN01 = 2 OR DK/REF] Du

- Page 209 and 210:

DK/REF DRPR [IF PAI12MON = 1] Think

- Page 211 and 212:

1 Yes 2 No DK/REF DRPR17 [IF PAI12M

- Page 213 and 214:

2 No DK/REF DRTR15 [IF DRTR13 = 2 O

- Page 215 and 216:

DK/REF DRST10 [IF DRST8 = 2 OR DK/R

- Page 217 and 218:

DRSV01 [IF SED12MON = 1] During the

- Page 219 and 220:

2 No DK/REF DRSV18 [IF SED12MON = 1

- Page 221 and 222:

SP03g [IF SP02 = 1 - 99 OR DK/REF]

- Page 223 and 224:

1 Yes 2 No DK/REF SP06b [IF SP06a =

- Page 225 and 226:

MJE09 [IF MJE08 = 4 AND MJE07 > 1 O

- Page 227 and 228:

6 $101.00 to $150.99 7 $151.00 to $

- Page 229 and 230:

2 More than 30 days ago but within

- Page 231 and 232:

# OF GRAMS: __________ [RANGE 10 -

- Page 233 and 234:

all for yourself? 1 Yes 2 No DK/REF

- Page 235 and 236:

December 2, 2005 228

- Page 237 and 238:

12 December DK/REF HARD ERROR: [IF

- Page 239 and 240:

UPDATE: IF LUCC06 NOT (BLANK OR DK/

- Page 241 and 242:

LU04 [IF CG15=1] Earlier the comput

- Page 243 and 244:

12 December DK/REF HARD ERROR: [IF

- Page 245 and 246:

last use snuff in [CURRENT YEAR-2],

- Page 247 and 248:

AND YEAR OF LAST USE (LU06a-d). IF

- Page 249 and 250:

LU07d [IF LU07a = 1 - 2 OR LU07b =

- Page 251 and 252:

1 CURRENT YEAR - 2 2 CURRENT YEAR -

- Page 253 and 254:

this correct? 4 Yes 6 No DK/REF LUC

- Page 255 and 256:

make you [MYRLSTCC] years old when

- Page 257 and 258:

5 May 6 June 7 July 8 August 9 Sept

- Page 259 and 260:

3 Neither answer is correct DK/REF

- Page 261 and 262:

BEGUN YET. TO MAKE THIS BOX DISAPPE

- Page 263 and 264:

HARD ERROR: [IF LU13c > CURRENT MON

- Page 265 and 266:

2 CURRENT YEAR - 1 DK/REF LU14c [IF

- Page 267 and 268:

LUCC32 [IF LUCC31 = 6] Please answe

- Page 269 and 270:

UPDATE: IF LUEC08 NE (6, BLANK OR D

- Page 271 and 272:

5 May 6 June 7 July 8 August 9 Sept

- Page 273 and 274:

either of these ways. Is this corre

- Page 275 and 276:

10 October 11 November 12 December

- Page 277 and 278:

prescription tranquilizer that was

- Page 279 and 280:

UPDATE: IF LUTR07a NE (0 OR DK/RE)

- Page 281 and 282:

UPDATE: IF LUST06 = 1, THEN AGELSTS

- Page 283 and 284:

8 August 9 September 10 October 11

- Page 285 and 286:

LU21b [IF AGELSTSV = CURNTAGE - 1 A

- Page 287 and 288:

LU22 [IF AGE1STCG = AGE1STAL NE AGE

- Page 289 and 290:

_____________ DK/REF LU28SP [IF ANY

- Page 291 and 292:

10 I got the stimulants in some oth

- Page 293 and 294:

Methamphetamine. [IF (MORE THAN ONE

- Page 295 and 296:

_____________ DK/REF LU36SP [IF ANY

- Page 297 and 298:

TX04b [IF TX03 NE BLANK] During the

- Page 299 and 300:

TX04i1 [IF TX03 = 3 AND TX04i = 1]

- Page 301 and 302:

TX20 [IF (SV01 = 1 OR SV02 = 1 OR S

- Page 303 and 304:

To select more than one reason from

- Page 305 and 306:

1 Yes 2 No DK/REF TX34 [IF ST01 =1

- Page 307 and 308:

5 You left because your family need

- Page 309 and 310:

[IF (TX01 = 1 AND TX07 = 1) OR TX38

- Page 311 and 312:

2 No DK/REF TX47a [IF TX47 = 1] How

- Page 313 and 314:

December 2, 2005 306

- Page 315 and 316:

FROM THE LIST. TO MAKE THIS BOX DIS

- Page 317 and 318:

hospital for mental health care? #

- Page 319 and 320:

DK/REF ADMT15 [IF ADMT14 = 6] Pleas

- Page 321 and 322:

To select more than one reason from

- Page 323 and 324:

December 2, 2005 316

- Page 325 and 326:

Your religious beliefs are a very i

- Page 327 and 328:

2 No DK/REF pe02d [IF PE01a = 1 OR

- Page 329 and 330:

December 2, 2005 322

- Page 331 and 332:

YE14 [IF YE09 = 1 OR YE09a = 1] Dur

- Page 333 and 334:

3 3 to 5 times 4 6 to 9 times 5 10

- Page 335 and 336:

DK/REF YE20b [IF CURNTAGE = 12 - 17

- Page 337 and 338:

1 Yes 2 No DK/REF YE24c [IF YE09 =

- Page 339 and 340:

DSDOWN [IF CURNTAGE = 18 OR OLDER]

- Page 341 and 342:

IF (AD01b = 2 OR DK/REF) THEN FEELF

- Page 343 and 344:

[IF AD22c NE BLANK] In answering th

- Page 345 and 346:

1 Yes 2 No DK/REF AD26m [IF AD26l =

- Page 347 and 348:

ELSE IF AD26G = 2 AND AD26H = 2, TH

- Page 349 and 350:

0 1 2 3 4 5 6 7 8 9 10 DK/REF, 95 A

- Page 351 and 352:

December 2, 2005 344

- Page 353 and 354:

1 Yes 2 No DK/REF YSU05 [IF YSU04=1

- Page 355 and 356:

DK/REF YSU12a [IF ANY ENTRY IN YSU1

- Page 357 and 358:

YSU19 [IF CURNTAGE = 12 -17] During

- Page 359 and 360:

1 You thought about killing yoursel

- Page 361 and 362:

DEFINE FEELFILL: IF (YD01a = 1), TH

- Page 363 and 364:

YD24a [IF YD22a NE BLANK] In answer

- Page 365 and 366:

DK/REF YD26m [IF YD26l = 1] Did any

- Page 367 and 368:

DEFINE D_MDEA5Y: IF YD26M = 1 OR YD

- Page 369 and 370:

YD66c [IF YD38 = 1] How much did yo

- Page 371 and 372:

December 2, 2005 364

- Page 373 and 374:

2 AND PAI30USE = 2 AND TRA30USE = 2

- Page 375 and 376:

1 I bought it at a store, restauran

- Page 377 and 378:

BACC02 [IF BACC01=6] Please answer

- Page 379 and 380:

BACC05a fill]. That would make you

- Page 381 and 382:

DK/REF UPDATE: IF WBACC04 = 1, THEN

- Page 383 and 384:

Back-End Demographics INTRODM2 For

- Page 385 and 386: 9 THE DISTRICT OF COLUMBIA (WASHING

- Page 387 and 388: QD17 The next questions are about s

- Page 389 and 390: 0 KINDERGARTEN OR LOWER 1 1 ST GRAD

- Page 391 and 392: ALLOW 200 CHARACTERS. HARD ERROR IF

- Page 393 and 394: QD26 [IF CURNTAGE = 15 OR OLDER] Th

- Page 395 and 396: INOC06 [IF QD26 =1 OR QD27 = 1 AND

- Page 397 and 398: INOC07 [IF QD33 = 1 AND (QD39b AND

- Page 399 and 400: 1 LESS THAN 10 PEOPLE 2 10-24 PEOPL

- Page 401 and 402: QD54 Altogether, how many people li

- Page 403 and 404: HIGHLIGHT ‘SUPPRESS’ AND PRESS

- Page 405 and 406: [BIOBRO AND R MORE THAN 25 YEARS AP

- Page 407 and 408: [ENTER]. SUPPGIL [IF FI CHOOSES TO

- Page 409 and 410: RESPONDENT. PLEASE VERIFY THE NUMBE

- Page 411 and 412: PROXYINT PROXY INFORMATION The next

- Page 413 and 414: 8 [ROSTER FILL] 9 [ROSTER FILL] 10

- Page 415 and 416: SAMPLE MEMBER POSS = “your mother

- Page 417 and 418: December 2, 2005 410

- Page 419 and 420: IF FIPE4 =30 THEN MEDIFILL = NONE I

- Page 421 and 422: Military health care refers to heal

- Page 423 and 424: December 2, 2005 416

- Page 425 and 426: QI05N [IF SAMPLE B] [IF NO FAMILY M

- Page 427 and 428: 1 YES 2 NO DK/REF QI06B [IF SAMPLE

- Page 429 and 430: IF FIPE4 = 39 THEN TANFFILL = Penns

- Page 431 and 432: getting a job, placement in educati

- Page 433 and 434: Rental Income: Income received from

- Page 435: QI16B [IF SAMPLE A AND AT LEAST 1 O

- Page 439 and 440: IF QI08 = 1 OR QI09A=1 OR QI09B =1,

- Page 441 and 442: 14 $13,000 - $13,999 15 $14,000 - $

- Page 443 and 444: FOLLWINT [IF THIS IS A T2 RELIABILI

- Page 445 and 446: December 2, 2005 438

- Page 447 and 448: show that I did the interview. [SHO

- Page 449 and 450: 1 RESPONDENT AGREES TO RECONTACT 2

- Page 451 and 452: FIDBFINTR DO NOT READ THIS TO R. Th

- Page 453 and 454: INCENT06 Do you think you would hav

- Page 455: in the room. 1 COMPLETELY PRIVATE