MOU 2012-13 - CCL

MOU 2012-13 - CCL

MOU 2012-13 - CCL

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

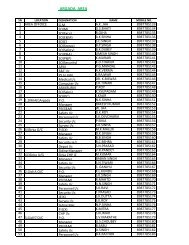

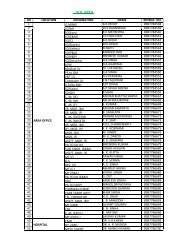

MINISTRY : COAL<br />

COMPANY: CENTRAL COALFIELDS<br />

LIMITED<br />

INCOME-EXPENDITURE STATEMENT<br />

(as on 31st March)<br />

ANNEX VII<br />

4 Annex VII & IX 55.55 MT.xls<br />

2010-11 RE(8.12.11) 2011-12 BE BE<br />

S. No. Particulars Audited 2011-12 Audited <strong>2012</strong>-<strong>13</strong> <strong>2012</strong>-<strong>13</strong><br />

Unit (49.0 Mt) (Upto Dec'11) (55.5Mt) (55.0Mt)<br />

Excellent V.Good<br />

(1) (2) (3)<br />

1 Total Income Rs. Cr 6714.61 7403.37 5023.01 8166.56 8120.46<br />

1.1 Gross Sales '' 7083.<strong>13</strong> 8066.88 6224.94 9144.36 9102.55<br />

1.2 Less: Excise duties & Others '' 1041.43 1116.19 1153.94 1280.44 1274.11 16.28252 16.27543<br />

1.3 Net sales/Operating Income '' 6041.70 6950.69 5071.00 7863.92 7828.44<br />

1.4<br />

Accretion/Depletion to<br />

finished stocks to works-inprogress<br />

'' 281.33 0.00 -401.03 -107.24 -105.92<br />

1.5 Other Income '' 391.59 452.68 353.04 409.89 397.94<br />

2 Total Expenditure '' 4592.82 5646.42 3517.89 5871.18 5847.34<br />

2.1 Raw Materials/Purchase of pr '' 533.22 562.97 387.59 565.07 561.20<br />

2.2<br />

Manufacturing<br />

expenses/Direct<br />

Expenses/Operational<br />

Expenses<br />

''<br />

2.3 Power,Fuel, Water etc '' 234.40 295.<strong>13</strong> 204.23 307.08 300.38<br />

2.4 Salaries & Wages '' 2587.16 3163.32 2149.09 3333.12 3333.12<br />

2.5 Other Expenses '' 1238.03 1625.00 776.98 1665.91 1652.64<br />

3 Gross Margin (PBDIT) '' 2121.79 1756.95 1505.12 2295.38 2273.12<br />

3.1 Depreciation/DRE '' 242.54 242.94 160.70 246.48 246.48<br />

3.2 Gross Profit (Operating Incom '' 1879.25 1514.01 <strong>13</strong>44.42 2048.90 2026.64<br />

4 Profit/Loss on Sale of Assets ''<br />

5 Prior Period Adjustments '' -10.08<br />

6 Extra-ordinary Items (Net) ''<br />

7 Interest '' 8.96 1.60 1.29 1.75 1.75<br />

8 Provision for tax (including def '' 6<strong>13</strong>.39 460.88 434.64 634.70 627.47<br />

9 Net Profit '' 1246.83 1051.53 908.49 1412.45 <strong>13</strong>97.42<br />

10 Dividend Paid '' 748.10 630.91 847.47 838.44<br />

11 Tax on Dividend '' 121.36 104.79 140.76 <strong>13</strong>9.26<br />

12 Retained Profit '' 377.37 315.82 908.49 424.22 419.72<br />

<strong>13</strong> Return to Capital Employed @ '' 427.92 456.22 490.39 511.34 511.83<br />

14 Added Value (3-<strong>13</strong>) '' 1693.88 <strong>13</strong>00.73 1014.73 1784.04 1761.29<br />

15 No. of Employees 52285 48475 50496 46071 46071<br />

377.37 315.81 908.49 424.24 419.72<br />

0.00 0.00 0.00 -0.02 0.00<br />

4 Annex VII & IX 55.55 MT.xls