MOU 2012-13 - CCL

MOU 2012-13 - CCL

MOU 2012-13 - CCL

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

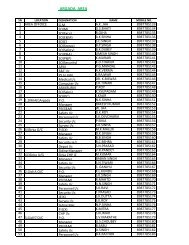

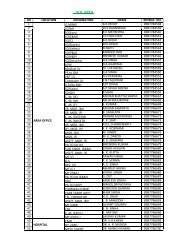

MINISTRY : COAL<br />

Company : CENTRAL COALIELDS LIMITED<br />

MANAGEMENT DATA RATIOS FOR <strong>MOU</strong> ( as on 31st MARCH)<br />

Annex IX<br />

2008-09 2009-10 2010-11 RE BE <strong>2012</strong>-<strong>13</strong><br />

Actual Actual 2011-12 <strong>2012</strong>-<strong>13</strong> BE-New<br />

Sl. No. Particulars Unit as per Excellent V.Good<br />

Accounts 49/49 55/.55/57.17 55/56<br />

(1) (2) (3) (11)<br />

Production- U/Ground Lakh Te 15.579 14.712 12.737 12.950 <strong>13</strong>.500 <strong>13</strong>.50<br />

Opencast Lakh Te 416.777 456.119 462.478 477.050 542.000 536.50<br />

Total Lakh Te 432.356 470.831 475.215 490.000 555.500 550.00<br />

OBR Lakh CuM 556.281 560.479 625.216 630.000 680.000 680.000<br />

1 Gross Sales Rs Crs 5978.37 6291.92 7083.<strong>13</strong> 8066.88 9144.36 9102.55<br />

2 Gross Margin Rs Crs 1048.06 1936.42 2121.80 1756.95 2295.38 2273.12<br />

3 Profit before Tax Rs Crs 763.80 1533.05 1860.22 1512.41 2047.15 2024.89<br />

4 Gross Block Rs Crs 4484.91 4659.00 4590.<strong>13</strong> 4940.<strong>13</strong> 5365.<strong>13</strong> 5365.<strong>13</strong><br />

5 Less Depreciation Rs Crs 3038.01 3142.81 3204.05 3446.99 3693.47 3693.47<br />

6 Net Block Rs Crs 1446.90 1516.19 <strong>13</strong>86.08 1493.14 1671.66 1671.66<br />

7 Share Capital of CPSE Rs Crs 940.00 940.00 940.00 940.00 940.00 940.00<br />

8 Reserves & Surplus of CPSE Rs Crs 1206.83 1720.64 2098.01 24<strong>13</strong>.83 2838.05 2833.54<br />

9 Less Defferred Revenue Exp / Rs Crs<br />

pre acquisition loss<br />

10 Less Profit & Loss a\c Rs Crs<br />

11 Net Worth of CPSE Rs Crs 2146.83 2660.64 3038.01 3353.83 3778.05 3773.54<br />

12 Investment Rs Crs 65.96 56.54 47.12 37.70 28.28 28.28<br />

Sundry Debtors 745.26 512.45 941.64 992.96 1021.29 1016.68<br />

<strong>13</strong> Sundry Debtors / Sales Rs Crs 0.12 0.08 0.<strong>13</strong> 0.12 0.11 0.11<br />

15 Inventory Rs Crs 968.06 1177.18 1446.99 <strong>13</strong>77.52 <strong>13</strong>71.79 <strong>13</strong>66.74<br />

16 Total Current Assets Rs Crs 6270.<strong>13</strong> 5666.44 6643.57 6593.23 6654.62 6630.79<br />

17 Total Current liabilities & provision Rs Crs 6218.54 5316.80 3750.48 3524.19 3212.89 3184.12<br />

18 Net Current assets Rs Crs 51.59 349.64 2893.09 3069.04 3441.73 3446.67<br />

19 Capitl Employed (Net Block + Net Rs Crs 1498.49 1865.83 4279.17 4562.18 51<strong>13</strong>.39 5118.33<br />

current assets)<br />

20 Total debt (loan funds) Rs Crs 293.98 112.05 90.91 83.71 69.77 69.77<br />

21 Total assets Rs Crs 1564.45 1922.37 4326.29 4599.88 5141.67 5146.60<br />

22 No of Employees of CPSE 56553 54057 52285 48475 46071 46071<br />

23 Dividend Paid Rs Crs 195.97 386.32 748.10 630.91 847.47 838.44<br />

24 Added Value ( gross margin less Rs Crs 898.21 1749.84 1693.88 <strong>13</strong>00.73 1784.04 1761.29<br />

capital recovery factor @ 10%)<br />

Ratio<br />

25 Debt/Equity 0.14 0.04 0.03 0.02 0.02 0.02<br />

26 Return on Net Worth (% age) 22.82% 36.30% 41.04% 31.35% 37.39% 37.03%<br />

27 PBDIT/Total employment of CPSE 0.02 0.04 0.04 0.04 0.05 0.05<br />

28 Earning per Share (Rs.10 each) 521.20 1027.43 <strong>13</strong>26.42 1118.65 1502.61 1486.62<br />

29 Dividend pay out (% of Net Profit) 40.00% 40.00% 60.00% 60.00% 60.00% 60.00%<br />

30 Added Value/Gross Sales (% age) 0.15 0.28 0.24 0.16 0.20 0.19<br />

31 Net Profit / Net Worth (% age) 0.23 0.36 0.41 0.31 0.37 0.37<br />

32 Working of gross margin<br />

33 Net Profit Rs Crs 489.93 965.79 1246.83 1051.53 1412.45 <strong>13</strong>97.42<br />

34 Tax Rs Crs 273.87 567.26 6<strong>13</strong>.39 460.88 634.70 627.47<br />

35 Net Profit before tax Rs Crs 763.80 1533.05 1860.22 1512.41 2047.15 2024.89<br />

36 add Prior Period Rs Crs -21.29 -1.06 10.08<br />

37 add Extra ordinary income Rs Crs<br />

38 Profit before prior period Rs Crs 742.51 1531.99 1870.30 1512.41 2047.15 2024.89<br />

39 add Interest Rs Crs 43.51 17.39 8.96 1.60 1.75 1.75<br />

40 Gross Profit Rs Crs 786.02 1549.38 1879.25 1514.01 2048.90 2026.64<br />

41 add Depreciation & DRE (OBR Adj) Rs Crs 262.04 387.05 242.54 242.94 246.48 246.48<br />

42 Misc. Expenditure written off Rs Crs<br />

43 Gross Margin before Interest, Rs Crs 1048.06 1936.42 2121.80 1756.95 2295.38 2273.12