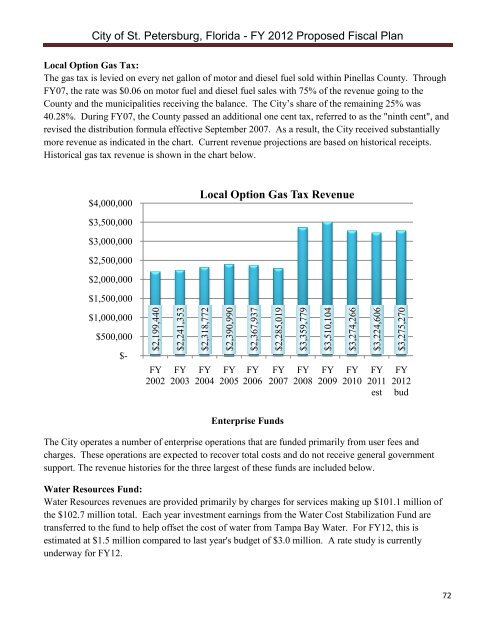

City <<strong>st</strong>rong>of</<strong>st</strong>rong> St. Petersburg, Florida - FY 2012 Proposed Fiscal Plan Local Option Gas Tax: The gas tax is levied on every net gallon <<strong>st</strong>rong>of</<strong>st</strong>rong> motor and diesel fuel sold within Pinellas County. Through FY07, the rate was $0.06 on motor fuel and diesel fuel sales with 75% <<strong>st</strong>rong>of</<strong>st</strong>rong> the revenue going to the County and the municipalities receiving the balance. The City’s share <<strong>st</strong>rong>of</<strong>st</strong>rong> the remaining 25% was 40.28%. During FY07, the County passed an additional one cent tax, referred to as the "ninth cent", and revised the di<strong>st</strong>ribution formula effective September 2007. As a result, the City received sub<strong>st</strong>antially more revenue as indicated in the chart. Current revenue projections are based on hi<strong>st</strong>orical receipts. Hi<strong>st</strong>orical gas tax revenue is shown in the chart below. $4,000,000 Local Option Gas Tax Revenue $3,500,000 $3,000,000 $2,500,000 $2,000,000 $1,500,000 $1,000,000 $500,000 $- $2,199,440 FY 2002 $2,241,353 FY 2003 $2,318,772 FY 2004 $2,390,990 FY 2005 $2,367,937 FY 2006 $2,285,019 FY 2007 $3,359,779 FY 2008 $3,510,104 FY 2009 $3,274,266 FY 2010 $3,224,606 FY 2011 e<strong>st</strong> $3,275,270 FY 2012 bud Enterprise Funds The City operates a number <<strong>st</strong>rong>of</<strong>st</strong>rong> enterprise operations that are funded primarily from user fees and charges. These operations are expected to recover total co<strong>st</strong>s and do not receive general government support. The revenue hi<strong>st</strong>ories for the three large<strong>st</strong> <<strong>st</strong>rong>of</<strong>st</strong>rong> these funds are included below. Water Resources Fund: Water Resources revenues are provided primarily by charges for services making up $101.1 million <<strong>st</strong>rong>of</<strong>st</strong>rong> the $102.7 million total. Each year inve<strong>st</strong>ment earnings from the Water Co<strong>st</strong> Stabilization Fund are transferred to the fund to help <<strong>st</strong>rong>of</<strong>st</strong>rong>fset the co<strong>st</strong> <<strong>st</strong>rong>of</<strong>st</strong>rong> water from Tampa Bay Water. For FY12, this is e<strong>st</strong>imated at $1.5 million compared to la<strong>st</strong> year's <strong>budget</strong> <<strong>st</strong>rong>of</<strong>st</strong>rong> $3.0 million. A rate <strong>st</strong>udy is currently underway for FY12. 72

City <<strong>st</strong>rong>of</<strong>st</strong>rong> St. Petersburg, Florida - FY 2012 Proposed Fiscal Plan $120,000,000 Water Resources Operating Fund Revenues $100,000,000 $80,000,000 $60,000,000 $40,000,000 $20,000,000 $0 $67,005,000 $81,811,699 $88,031,964 $91,480,871 $97,154,395 $97,445,600 $94,984,361 $97,121,870 $93,028,035 $96,457,279 $102,709,669 FY 2002 FY 2003 FY 2004 FY 2005 FY 2006 FY 2007 FY 2008 FY 2009 FY 2010 FY 2011 e<strong>st</strong> FY 2012 bud Sanitation Fund: Until FY04, the Sanitation Rate Stabilization Fund was used to <<strong>st</strong>rong>of</<strong>st</strong>rong>fset <strong>operating</strong> co<strong>st</strong>s for this service. Once the reserve was depleted, rate increases were required. A rate <strong>st</strong>udy is currently under way for FY12. $45,000,000 $40,000,000 $35,000,000 $30,000,000 $25,000,000 $20,000,000 Sanitation Operating Fund Revenues $15,000,000 $10,000,000 $5,000,000 $0 $30,542,000 $30,470,690 $34,407,000 $34,061,112 $37,593,017 $40,122,265 $40,601,003 $41,175,623 $40,459,253 $40,557,179 $40,113,876 FY 2002 FY 2003 FY 2004 FY 2005 FY 2006 FY 2007 FY 2008 FY 2009 FY 2010 FY 2011 e<strong>st</strong> FY 2012 bud 73

- Page 1:

CITY OF ST. PETERSBURG PROPOSED OPE

- Page 6 and 7:

City of St. Peters

- Page 8 and 9:

City of St. Peters

- Page 10 and 11:

City of St. Peters

- Page 12 and 13:

City of St. Peters

- Page 14 and 15:

City of St. Peters

- Page 16 and 17:

Long Term Budget Goals City <strong

- Page 18 and 19:

City of St. Peters

- Page 20 and 21:

City of St. Peters

- Page 22 and 23:

City of St. Peters

- Page 24 and 25:

City of St. Peters

- Page 26 and 27:

City of St. Peters

- Page 28 and 29:

City of St. Peters

- Page 30 and 31:

City of St. Peters

- Page 32 and 33:

City of St. Peters

- Page 34 and 35:

City of St. Peters

- Page 36 and 37:

City of St. Peters

- Page 38 and 39:

City of St. Peters

- Page 40 and 41:

City of St. Peters

- Page 42 and 43: City of St. Peters

- Page 44 and 45: City of St. Peters

- Page 46 and 47: City of St. Peters

- Page 48 and 49: City of St. Peters

- Page 50 and 51: City of St. Peters

- Page 52 and 53: City of St. Peters

- Page 54 and 55: City of St. Peters

- Page 56 and 57: City of St. Peters

- Page 58 and 59: City of St. Peters

- Page 60 and 61: City of St. Peters

- Page 62 and 63: City of St. Peters

- Page 64 and 65: City of St. Peters

- Page 66 and 67: City of St. Peters

- Page 68 and 69: City of St. Peters

- Page 70 and 71: City of St. Peters

- Page 72 and 73: City of St. Peters

- Page 74 and 75: City of St. Peters

- Page 76 and 77: City of St. Peters

- Page 78 and 79: City of St. Peters

- Page 80 and 81: City of St. Peters

- Page 82 and 83: City of St. Peters

- Page 84 and 85: City of St. Peters

- Page 86 and 87: City of St. Peters

- Page 88 and 89: City of St. Peters

- Page 90 and 91: Utility Taxes: City of</str

- Page 94 and 95: City of St. Peters

- Page 96 and 97: City of St. Peters

- Page 98 and 99: City of St. Peters

- Page 100 and 101: City of St. Peters

- Page 102 and 103: City of St. Peters

- Page 104 and 105: City of St. Peters

- Page 106 and 107: City of St. Peters

- Page 108 and 109: City of St. Peters

- Page 110 and 111: City of St. Peters

- Page 112 and 113: City of St. Peters

- Page 114 and 115: City of St. Peters

- Page 116 and 117: City of St. Peters

- Page 118 and 119: City of St. Peters

- Page 120 and 121: City of St. Peters

- Page 122 and 123: City of St. Peters

- Page 124 and 125: City of St. Peters

- Page 126 and 127: City of St. Peters

- Page 128 and 129: City of St. Peters

- Page 130 and 131: City of St. Peters

- Page 132 and 133: City of St. Peters

- Page 134 and 135: City of St. Peters

- Page 136 and 137: City of St. Peters

- Page 138 and 139: City of St. Peters

- Page 140 and 141: City of St. Peters

- Page 142 and 143:

City of St. Peters

- Page 144 and 145:

City of St. Peters

- Page 146 and 147:

City of St. Peters

- Page 148 and 149:

City of St. Peters

- Page 150 and 151:

City of St. Peters

- Page 152 and 153:

City of St. Peters

- Page 154 and 155:

City of St. Peters

- Page 156 and 157:

City of St. Peters

- Page 158 and 159:

City of St. Peters

- Page 160 and 161:

City of St. Peters

- Page 162 and 163:

City of St. Peters

- Page 164 and 165:

City of St. Peters

- Page 166 and 167:

City of St. Peters

- Page 168 and 169:

City of St. Peters

- Page 170 and 171:

City of St. Peters

- Page 172 and 173:

City of St. Peters

- Page 174 and 175:

City of St. Peters

- Page 176 and 177:

City of St. Peters

- Page 178 and 179:

City of St. Peters

- Page 180 and 181:

City of St. Peters

- Page 182 and 183:

Revenue Sources City of</st

- Page 184 and 185:

Department Mission Statement City <

- Page 186 and 187:

Revenue Sources City of</st

- Page 188 and 189:

Department Mission Statement City <

- Page 190 and 191:

City of St. Peters

- Page 192 and 193:

Department Mission Statement City <

- Page 194 and 195:

Objective and Performance Measure C

- Page 196 and 197:

Appropriations By Fund/Program City

- Page 198 and 199:

City of St. Peters

- Page 200 and 201:

City of St. Peters

- Page 202 and 203:

City of St. Peters

- Page 204 and 205:

City of St. Peters

- Page 206 and 207:

Revenue Sources City of</st

- Page 208 and 209:

City of St. Peters

- Page 210 and 211:

City of St. Peters

- Page 212 and 213:

Revenue Sources City of</st

- Page 214 and 215:

City of St. Peters

- Page 216 and 217:

Revenue Sources City of</st

- Page 218 and 219:

City of St. Peters

- Page 220 and 221:

City of St. Peters

- Page 222 and 223:

Revenue Sources City of</st

- Page 224 and 225:

City of St. Peters

- Page 226 and 227:

Appropriations By Fund/Program City

- Page 228 and 229:

Objective and Performance Measure e

- Page 230 and 231:

Department Mission Statement City <

- Page 232 and 233:

City of St. Peters

- Page 234 and 235:

City of St. Peters

- Page 236 and 237:

City of St. Peters

- Page 238 and 239:

City of St. Peters

- Page 240 and 241:

City of St. Peters

- Page 242 and 243:

City of St. Peters

- Page 244 and 245:

Objective and Performance Measure C

- Page 246 and 247:

Appropriations By Fund/Program City

- Page 248 and 249:

City of St. Peters

- Page 250 and 251:

Department Mission Statement City <

- Page 252 and 253:

City of St. Peters

- Page 254 and 255:

City of St. Peters

- Page 256 and 257:

Appropriations By Fund/Program City

- Page 258 and 259:

Objective and Performance Measure C

- Page 260 and 261:

Objective and Performance Measure C

- Page 262 and 263:

City of St. Peters

- Page 264 and 265:

Department Mission Statement City <

- Page 266 and 267:

City of St. Peters

- Page 268 and 269:

Department Mission Statement City <

- Page 270 and 271:

City of St. Peters

- Page 272 and 273:

Objective and Performance Measure C

- Page 274 and 275:

City of St. Peters

- Page 276 and 277:

City of St. Peters

- Page 278 and 279:

City of St. Peters

- Page 280 and 281:

City of St. Peters

- Page 282 and 283:

Revenue Sources City of</st

- Page 284 and 285:

City of St. Peters

- Page 286 and 287:

City of St. Peters

- Page 288 and 289:

Appropriations By Fund/Program City

- Page 290 and 291:

Department Mission Statement City <

- Page 292 and 293:

City of St. Peters

- Page 294 and 295:

Department Mission Statement City <

- Page 296 and 297:

City of St. Peters