Passive Activity Losses - Uncle Fed's Tax*Board

Passive Activity Losses - Uncle Fed's Tax*Board

Passive Activity Losses - Uncle Fed's Tax*Board

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

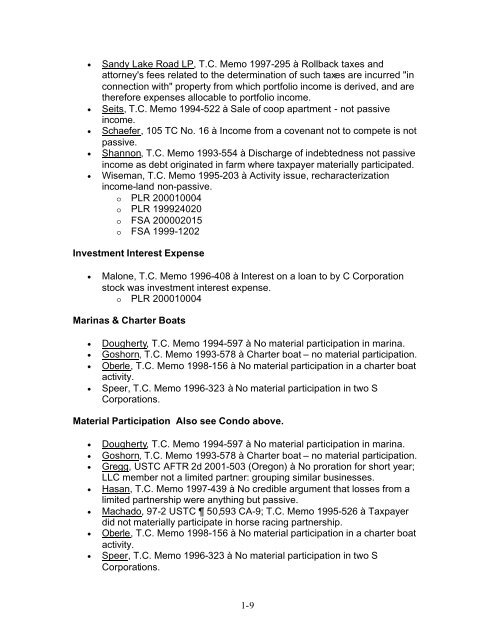

• Sandy Lake Road LP, T.C. Memo 1997-295 à Rollback taxes and<br />

attorney's fees related to the determination of such taxes are incurred "in<br />

connection with" property from which portfolio income is derived, and are<br />

therefore expenses allocable to portfolio income.<br />

• Seits, T.C. Memo 1994-522 à Sale of coop apartment - not passive<br />

income.<br />

• Schaefer, 105 TC No. 16 à Income from a covenant not to compete is not<br />

passive.<br />

• Shannon, T.C. Memo 1993-554 à Discharge of indebtedness not passive<br />

income as debt originated in farm where taxpayer materially participated.<br />

• Wiseman, T.C. Memo 1995-203 à <strong>Activity</strong> issue, recharacterization<br />

income-land non-passive.<br />

o PLR 200010004<br />

o PLR 199924020<br />

o FSA 200002015<br />

o FSA 1999-1202<br />

Investment Interest Expense<br />

• Malone, T.C. Memo 1996-408 à Interest on a loan to by C Corporation<br />

stock was investment interest expense.<br />

o PLR 200010004<br />

Marinas & Charter Boats<br />

• Dougherty, T.C. Memo 1994-597 à No material participation in marina.<br />

• Goshorn, T.C. Memo 1993-578 à Charter boat – no material participation.<br />

• Oberle, T.C. Memo 1998-156 à No material participation in a charter boat<br />

activity.<br />

• Speer, T.C. Memo 1996-323 à No material participation in two S <br />

Corporations. <br />

Material Participation Also see Condo above.<br />

• Dougherty, T.C. Memo 1994-597 à No material participation in marina.<br />

• Goshorn, T.C. Memo 1993-578 à Charter boat – no material participation.<br />

• Gregg, USTC AFTR 2d 2001-503 (Oregon) à No proration for short year;<br />

LLC member not a limited partner: grouping similar businesses.<br />

• Hasan, T.C. Memo 1997-439 à No credible argument that losses from a<br />

limited partnership were anything but passive.<br />

• Machado, 97-2 USTC 50,593 CA-9; T.C. Memo 1995-526 à Taxpayer<br />

did not materially participate in horse racing partnership.<br />

• Oberle, T.C. Memo 1998-156 à No material participation in a charter boat<br />

activity.<br />

• Speer, T.C. Memo 1996-323 à No material participation in two S <br />

Corporations. <br />

1-9