Passive Activity Losses - Uncle Fed's Tax*Board

Passive Activity Losses - Uncle Fed's Tax*Board

Passive Activity Losses - Uncle Fed's Tax*Board

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

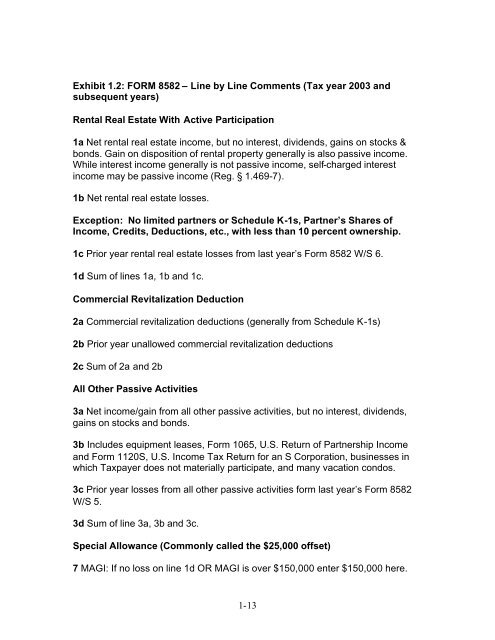

Exhibit 1.2: FORM 8582 – Line by Line Comments (Tax year 2003 and<br />

subsequent years)<br />

Rental Real Estate With Active Participation<br />

1a Net rental real estate income, but no interest, dividends, gains on stocks & <br />

bonds. Gain on disposition of rental property generally is also passive income. <br />

While interest income generally is not passive income, self-charged interest <br />

income may be passive income (Reg. § 1.469-7).<br />

1b Net rental real estate losses. <br />

Exception: No limited partners or Schedule K-1s, Partner’s Shares of <br />

Income, Credits, Deductions, etc., with less than 10 percent ownership.<br />

1c Prior year rental real estate losses from last year’s Form 8582 W/S 6.<br />

1d Sum of lines 1a, 1b and 1c.<br />

Commercial Revitalization Deduction<br />

2a Commercial revitalization deductions (generally from Schedule K-1s)<br />

2b Prior year unallowed commercial revitalization deductions<br />

2c Sum of 2a and 2b<br />

All Other <strong>Passive</strong> Activities<br />

3a Net income/gain from all other passive activities, but no interest, dividends, <br />

gains on stocks and bonds.<br />

3b Includes equipment leases, Form 1065, U.S. Return of Partnership Income <br />

and Form 1120S, U.S. Income Tax Return for an S Corporation, businesses in<br />

which Taxpayer does not materially participate, and many vacation condos.<br />

3c Prior year losses from all other passive activities form last year’s Form 8582<br />

W/S 5.<br />

3d Sum of line 3a, 3b and 3c.<br />

Special Allowance (Commonly called the $25,000 offset)<br />

7 MAGI: If no loss on line 1d OR MAGI is over $150,000 enter $150,000 here.<br />

1-13