Passive Activity Losses - Uncle Fed's Tax*Board

Passive Activity Losses - Uncle Fed's Tax*Board

Passive Activity Losses - Uncle Fed's Tax*Board

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

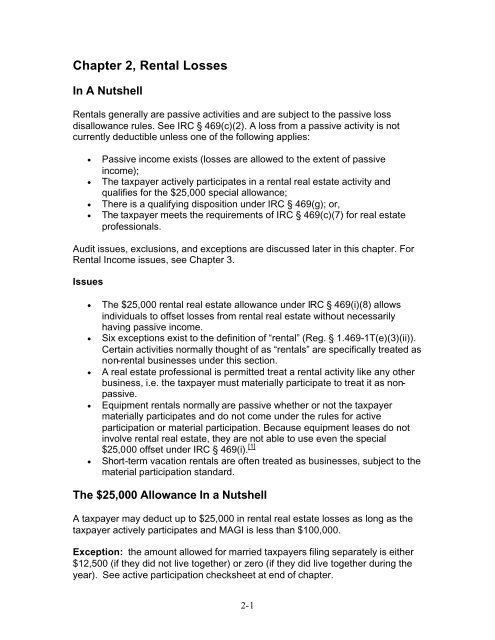

Chapter 2, Rental <strong>Losses</strong><br />

In A Nutshell<br />

Rentals generally are passive activities and are subject to the passive loss<br />

disallowance rules. See IRC § 469(c)(2). A loss from a passive activity is not<br />

currently deductible unless one of the following applies:<br />

• <strong>Passive</strong> income exists (losses are allowed to the extent of passive <br />

income); <br />

• The taxpayer actively participates in a rental real estate activity and <br />

qualifies for the $25,000 special allowance; <br />

• There is a qualifying disposition under IRC § 469(g); or,<br />

• The taxpayer meets the requirements of IRC § 469(c)(7) for real estate<br />

professionals.<br />

Audit issues, exclusions, and exceptions are discussed later in this chapter. For<br />

Rental Income issues, see Chapter 3.<br />

Issues<br />

• The $25,000 rental real estate allowance under IRC § 469(i)(8) allows<br />

individuals to offset losses from rental real estate without necessarily<br />

having passive income.<br />

• Six exceptions exist to the definition of “rental” (Reg. § 1.469-1T(e)(3)(ii)).<br />

Certain activities normally thought of as “rentals” are specifically treated as<br />

non-rental businesses under this section.<br />

• A real estate professional is permitted treat a rental activity like any other<br />

business, i.e. the taxpayer must materially participate to treat it as nonpassive.<br />

• Equipment rentals normally are passive whether or not the taxpayer<br />

materially participates and do not come under the rules for active<br />

participation or material participation. Because equipment leases do not<br />

involve rental real estate, they are not able to use even the special<br />

$25,000 offset under IRC § 469(i). [1]<br />

• Short-term vacation rentals are often treated as businesses, subject to the<br />

material participation standard.<br />

The $25,000 Allowance In a Nutshell<br />

A taxpayer may deduct up to $25,000 in rental real estate losses as long as the<br />

taxpayer actively participates and MAGI is less than $100,000.<br />

Exception: the amount allowed for married taxpayers filing separately is either<br />

$12,500 (if they did not live together) or zero (if they did live together during the<br />

year). See active participation checksheet at end of chapter.<br />

2-1