Passive Activity Losses - Uncle Fed's Tax*Board

Passive Activity Losses - Uncle Fed's Tax*Board

Passive Activity Losses - Uncle Fed's Tax*Board

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

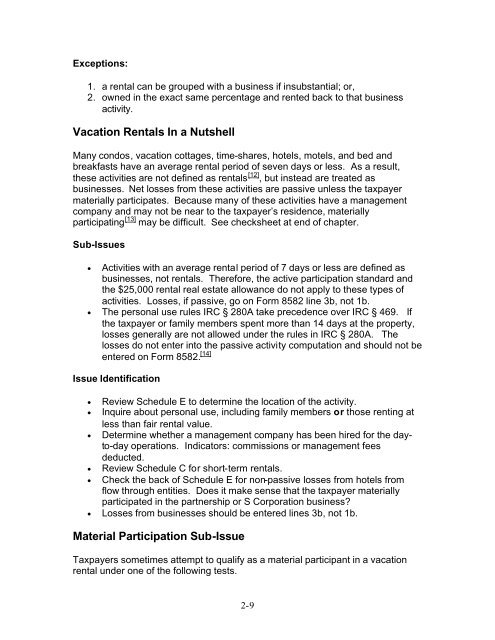

Exceptions:<br />

1. a rental can be grouped with a business if insubstantial; or,<br />

2. owned in the exact same percentage and rented back to that business<br />

activity.<br />

Vacation Rentals In a Nutshell<br />

Many condos, vacation cottages, time-shares, hotels, motels, and bed and<br />

breakfasts have an average rental period of seven days or less. As a result,<br />

these activities are not defined as rentals [12] , but instead are treated as<br />

businesses. Net losses from these activities are passive unless the taxpayer<br />

materially participates. Because many of these activities have a management<br />

company and may not be near to the taxpayer’s residence, materially<br />

participating [13] may be difficult. See checksheet at end of chapter.<br />

Sub-Issues<br />

• Activities with an average rental period of 7 days or less are defined as<br />

businesses, not rentals. Therefore, the active participation standard and<br />

the $25,000 rental real estate allowance do not apply to these types of<br />

activities. <strong>Losses</strong>, if passive, go on Form 8582 line 3b, not 1b.<br />

• The personal use rules IRC § 280A take precedence over IRC § 469. If<br />

the taxpayer or family members spent more than 14 days at the property,<br />

losses generally are not allowed under the rules in IRC § 280A. The<br />

losses do not enter into the passive activity computation and should not be<br />

entered on Form 8582. [14]<br />

Issue Identification<br />

• Review Schedule E to determine the location of the activity.<br />

• Inquire about personal use, including family members or those renting at<br />

less than fair rental value.<br />

• Determine whether a management company has been hired for the dayto-day<br />

operations. Indicators: commissions or management fees<br />

deducted.<br />

• Review Schedule C for short-term rentals.<br />

• Check the back of Schedule E for non-passive losses from hotels from<br />

flow through entities. Does it make sense that the taxpayer materially<br />

participated in the partnership or S Corporation business?<br />

• <strong>Losses</strong> from businesses should be entered lines 3b, not 1b.<br />

Material Participation Sub-Issue<br />

Taxpayers sometimes attempt to qualify as a material participant in a vacation<br />

rental under one of the following tests.<br />

2-9