Passive Activity Losses - Uncle Fed's Tax*Board

Passive Activity Losses - Uncle Fed's Tax*Board

Passive Activity Losses - Uncle Fed's Tax*Board

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

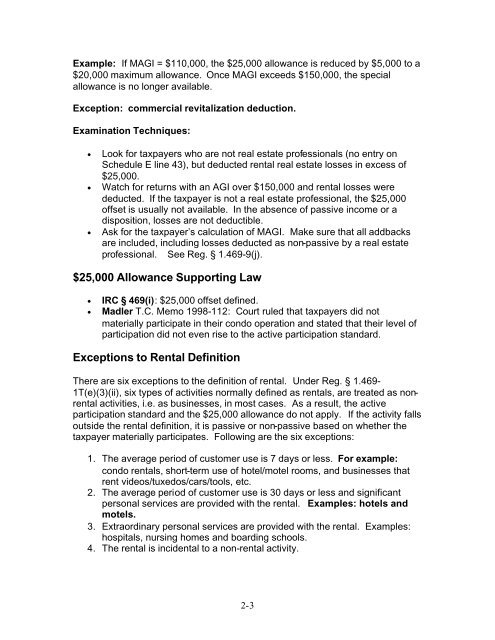

Example: If MAGI = $110,000, the $25,000 allowance is reduced by $5,000 to a<br />

$20,000 maximum allowance. Once MAGI exceeds $150,000, the special<br />

allowance is no longer available.<br />

Exception: commercial revitalization deduction.<br />

Examination Techniques:<br />

• Look for taxpayers who are not real estate professionals (no entry on<br />

Schedule E line 43), but deducted rental real estate losses in excess of<br />

$25,000.<br />

• Watch for returns with an AGI over $150,000 and rental losses were<br />

deducted. If the taxpayer is not a real estate professional, the $25,000<br />

offset is usually not available. In the absence of passive income or a<br />

disposition, losses are not deductible.<br />

• Ask for the taxpayer’s calculation of MAGI. Make sure that all addbacks<br />

are included, including losses deducted as non-passive by a real estate<br />

professional. See Reg. § 1.469-9(j).<br />

$25,000 Allowance Supporting Law<br />

• IRC § 469(i): $25,000 offset defined.<br />

• Madler T.C. Memo 1998-112: Court ruled that taxpayers did not<br />

materially participate in their condo operation and stated that their level of<br />

participation did not even rise to the active participation standard.<br />

Exceptions to Rental Definition<br />

There are six exceptions to the definition of rental. Under Reg. § 1.469-<br />

1T(e)(3)(ii), six types of activities normally defined as rentals, are treated as nonrental<br />

activities, i.e. as businesses, in most cases. As a result, the active<br />

participation standard and the $25,000 allowance do not apply. If the activity falls<br />

outside the rental definition, it is passive or non-passive based on whether the<br />

taxpayer materially participates. Following are the six exceptions:<br />

1. The average period of customer use is 7 days or less. For example:<br />

condo rentals, short-term use of hotel/motel rooms, and businesses that<br />

rent videos/tuxedos/cars/tools, etc.<br />

2. The average period of customer use is 30 days or less and significant<br />

personal services are provided with the rental. Examples: hotels and<br />

motels.<br />

3. Extraordinary personal services are provided with the rental. Examples:<br />

hospitals, nursing homes and boarding schools.<br />

4. The rental is incidental to a non-rental activity.<br />

2-3