Passive Activity Losses - Uncle Fed's Tax*Board

Passive Activity Losses - Uncle Fed's Tax*Board

Passive Activity Losses - Uncle Fed's Tax*Board

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

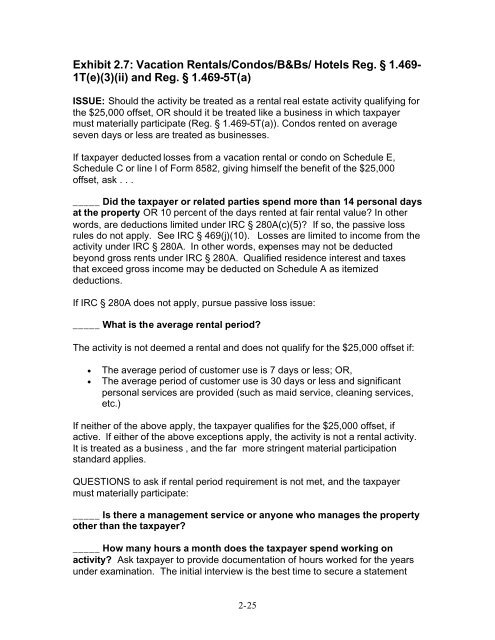

Exhibit 2.7: Vacation Rentals/Condos/B&Bs/ Hotels Reg. § 1.469-<br />

1T(e)(3)(ii) and Reg. § 1.469-5T(a)<br />

ISSUE: Should the activity be treated as a rental real estate activity qualifying for<br />

the $25,000 offset, OR should it be treated like a business in which taxpayer<br />

must materially participate (Reg. § 1.469-5T(a)). Condos rented on average<br />

seven days or less are treated as businesses.<br />

If taxpayer deducted losses from a vacation rental or condo on Schedule E,<br />

Schedule C or line l of Form 8582, giving himself the benefit of the $25,000<br />

offset, ask . . .<br />

_____ Did the taxpayer or related parties spend more than 14 personal days<br />

at the property OR 10 percent of the days rented at fair rental value? In other<br />

words, are deductions limited under IRC § 280A(c)(5)? If so, the passive loss<br />

rules do not apply. See IRC § 469(j)(10). <strong>Losses</strong> are limited to income from the<br />

activity under IRC § 280A. In other words, expenses may not be deducted<br />

beyond gross rents under IRC § 280A. Qualified residence interest and taxes<br />

that exceed gross income may be deducted on Schedule A as itemized<br />

deductions.<br />

If IRC § 280A does not apply, pursue passive loss issue:<br />

_____ What is the average rental period?<br />

The activity is not deemed a rental and does not qualify for the $25,000 offset if:<br />

• The average period of customer use is 7 days or less; OR,<br />

• The average period of customer use is 30 days or less and significant<br />

personal services are provided (such as maid service, cleaning services,<br />

etc.)<br />

If neither of the above apply, the taxpayer qualifies for the $25,000 offset, if<br />

active. If either of the above exceptions apply, the activity is not a rental activity.<br />

It is treated as a business , and the far more stringent material participation<br />

standard applies.<br />

QUESTIONS to ask if rental period requirement is not met, and the taxpayer<br />

must materially participate:<br />

_____ Is there a management service or anyone who manages the property<br />

other than the taxpayer?<br />

_____ How many hours a month does the taxpayer spend working on<br />

activity? Ask taxpayer to provide documentation of hours worked for the years<br />

under examination. The initial interview is the best time to secure a statement<br />

2-25