Energy Subsidies: Lessons Learned in Assessing their Impact - UNEP

Energy Subsidies: Lessons Learned in Assessing their Impact - UNEP

Energy Subsidies: Lessons Learned in Assessing their Impact - UNEP

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Energy</strong> <strong>Subsidies</strong>: <strong>Lessons</strong> <strong>Learned</strong> <strong>in</strong> Assess<strong>in</strong>g <strong>their</strong> <strong>Impact</strong> and Design<strong>in</strong>g Policy Reforms<br />

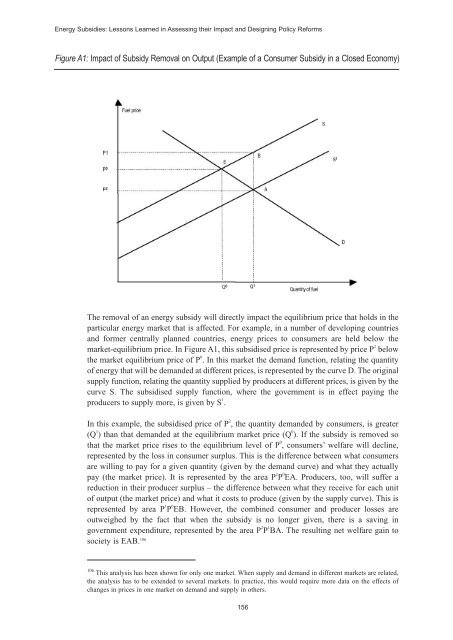

Figure A1: <strong>Impact</strong> of Subsidy Removal on Output (Example of a Consumer Subsidy <strong>in</strong> a Closed Economy)<br />

The removal of an energy subsidy will directly impact the equilibrium price that holds <strong>in</strong> the<br />

particular energy market that is affected. For example, <strong>in</strong> a number of develop<strong>in</strong>g countries<br />

and former centrally planned countries, energy prices to consumers are held below the<br />

market-equilibrium price. In Figure A1, this subsidised price is represented by price P 2 below<br />

the market equilibrium price of P 0 . In this market the demand function, relat<strong>in</strong>g the quantity<br />

of energy that will be demanded at different prices, is represented by the curve D. The orig<strong>in</strong>al<br />

supply function, relat<strong>in</strong>g the quantity supplied by producers at different prices, is given by the<br />

curve S. The subsidised supply function, where the government is <strong>in</strong> effect pay<strong>in</strong>g the<br />

producers to supply more, is given by S 1 .<br />

In this example, the subsidised price of P 2 , the quantity demanded by consumers, is greater<br />

(Q 1 ) than that demanded at the equilibrium market price (Q 0 ). If the subsidy is removed so<br />

that the market price rises to the equilibrium level of P 0 , consumers’ welfare will decl<strong>in</strong>e,<br />

represented by the loss <strong>in</strong> consumer surplus. This is the difference between what consumers<br />

are will<strong>in</strong>g to pay for a given quantity (given by the demand curve) and what they actually<br />

pay (the market price). It is represented by the area P 2 P 0 EA. Producers, too, will suffer a<br />

reduction <strong>in</strong> <strong>their</strong> producer surplus – the difference between what they receive for each unit<br />

of output (the market price) and what it costs to produce (given by the supply curve). This is<br />

represented by area P 1 P 0 EB. However, the comb<strong>in</strong>ed consumer and producer losses are<br />

outweighed by the fact that when the subsidy is no longer given, there is a sav<strong>in</strong>g <strong>in</strong><br />

government expenditure, represented by the area P 2 P 1 BA. The result<strong>in</strong>g net welfare ga<strong>in</strong> to<br />

society is EAB. 106 156<br />

106 This analysis has been shown for only one market. When supply and demand <strong>in</strong> different markets are related,<br />

the analysis has to be extended to several markets. In practice, this would require more data on the effects of<br />

changes <strong>in</strong> prices <strong>in</strong> one market on demand and supply <strong>in</strong> others.