Energy Subsidies: Lessons Learned in Assessing their Impact - UNEP

Energy Subsidies: Lessons Learned in Assessing their Impact - UNEP

Energy Subsidies: Lessons Learned in Assessing their Impact - UNEP

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Energy</strong> <strong>Subsidies</strong>: <strong>Lessons</strong> <strong>Learned</strong> <strong>in</strong> Assess<strong>in</strong>g <strong>their</strong> <strong>Impact</strong> and Design<strong>in</strong>g Policy Reforms<br />

In general, the magnitude of the change <strong>in</strong> production levels <strong>in</strong>duced by subsidy reform and<br />

the subsequent change <strong>in</strong> environmental effects depend on:<br />

• The characteristics of the support measure be<strong>in</strong>g removed. These might <strong>in</strong>clude among<br />

others, how the subsidy:<br />

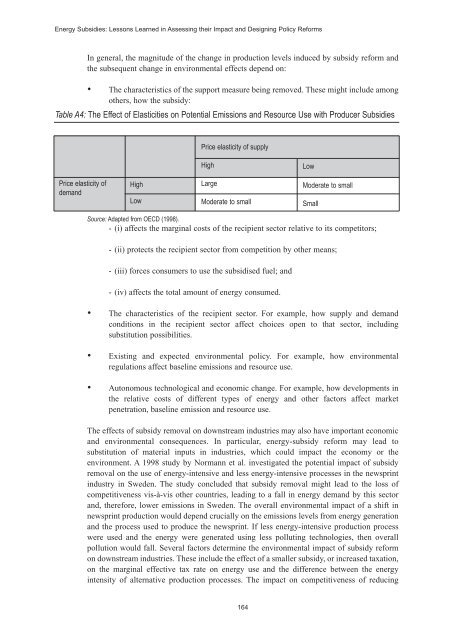

Table A4: The Effect of Elasticities on Potential Emissions and Resource Use with Producer <strong>Subsidies</strong><br />

Price elasticity of supply<br />

High<br />

Low<br />

Price elasticity of<br />

demand<br />

High<br />

Low<br />

Large<br />

Moderate to small<br />

Moderate to small<br />

Small<br />

Source: Adapted from OECD (1998).<br />

- (i) affects the marg<strong>in</strong>al costs of the recipient sector relative to its competitors;<br />

- (ii) protects the recipient sector from competition by other means;<br />

- (iii) forces consumers to use the subsidised fuel; and<br />

- (iv) affects the total amount of energy consumed.<br />

• The characteristics of the recipient sector. For example, how supply and demand<br />

conditions <strong>in</strong> the recipient sector affect choices open to that sector, <strong>in</strong>clud<strong>in</strong>g<br />

substitution possibilities.<br />

• Exist<strong>in</strong>g and expected environmental policy. For example, how environmental<br />

regulations affect basel<strong>in</strong>e emissions and resource use.<br />

• Autonomous technological and economic change. For example, how developments <strong>in</strong><br />

the relative costs of different types of energy and other factors affect market<br />

penetration, basel<strong>in</strong>e emission and resource use.<br />

The effects of subsidy removal on downstream <strong>in</strong>dustries may also have important economic<br />

and environmental consequences. In particular, energy-subsidy reform may lead to<br />

substitution of material <strong>in</strong>puts <strong>in</strong> <strong>in</strong>dustries, which could impact the economy or the<br />

environment. A 1998 study by Normann et al. <strong>in</strong>vestigated the potential impact of subsidy<br />

removal on the use of energy-<strong>in</strong>tensive and less energy-<strong>in</strong>tensive processes <strong>in</strong> the newspr<strong>in</strong>t<br />

<strong>in</strong>dustry <strong>in</strong> Sweden. The study concluded that subsidy removal might lead to the loss of<br />

competitiveness vis-à-vis other countries, lead<strong>in</strong>g to a fall <strong>in</strong> energy demand by this sector<br />

and, therefore, lower emissions <strong>in</strong> Sweden. The overall environmental impact of a shift <strong>in</strong><br />

newspr<strong>in</strong>t production would depend crucially on the emissions levels from energy generation<br />

and the process used to produce the newspr<strong>in</strong>t. If less energy-<strong>in</strong>tensive production process<br />

were used and the energy were generated us<strong>in</strong>g less pollut<strong>in</strong>g technologies, then overall<br />

pollution would fall. Several factors determ<strong>in</strong>e the environmental impact of subsidy reform<br />

on downstream <strong>in</strong>dustries. These <strong>in</strong>clude the effect of a smaller subsidy, or <strong>in</strong>creased taxation,<br />

on the marg<strong>in</strong>al effective tax rate on energy use and the difference between the energy<br />

<strong>in</strong>tensity of alternative production processes. The impact on competitiveness of reduc<strong>in</strong>g<br />

164