Energy Subsidies: Lessons Learned in Assessing their Impact - UNEP

Energy Subsidies: Lessons Learned in Assessing their Impact - UNEP

Energy Subsidies: Lessons Learned in Assessing their Impact - UNEP

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Energy</strong> <strong>Subsidies</strong>: <strong>Lessons</strong> <strong>Learned</strong> <strong>in</strong> Assess<strong>in</strong>g <strong>their</strong> <strong>Impact</strong> and Design<strong>in</strong>g Policy Reforms<br />

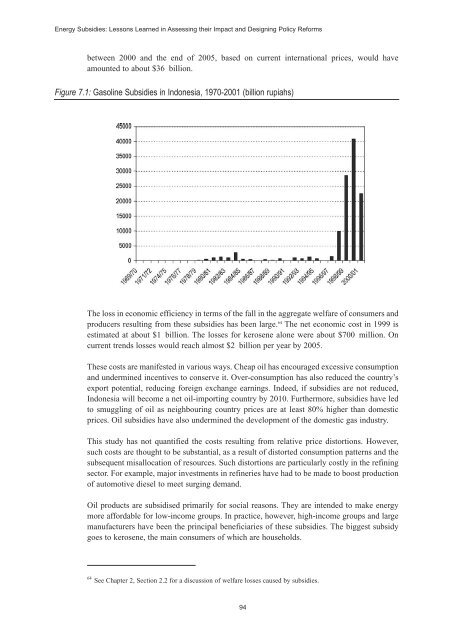

between 2000 and the end of 2005, based on current <strong>in</strong>ternational prices, would have<br />

amounted to about $36 billion.<br />

Figure 7.1: Gasol<strong>in</strong>e <strong>Subsidies</strong> <strong>in</strong> Indonesia, 1970-2001 (billion rupiahs)<br />

The loss <strong>in</strong> economic efficiency <strong>in</strong> terms of the fall <strong>in</strong> the aggregate welfare of consumers and<br />

producers result<strong>in</strong>g from these subsidies has been large. 64 The net economic cost <strong>in</strong> 1999 is<br />

estimated at about $1 billion. The losses for kerosene alone were about $700 million. On<br />

current trends losses would reach almost $2 billion per year by 2005.<br />

These costs are manifested <strong>in</strong> various ways. Cheap oil has encouraged excessive consumption<br />

and underm<strong>in</strong>ed <strong>in</strong>centives to conserve it. Over-consumption has also reduced the country’s<br />

export potential, reduc<strong>in</strong>g foreign exchange earn<strong>in</strong>gs. Indeed, if subsidies are not reduced,<br />

Indonesia will become a net oil-import<strong>in</strong>g country by 2010. Furthermore, subsidies have led<br />

to smuggl<strong>in</strong>g of oil as neighbour<strong>in</strong>g country prices are at least 80% higher than domestic<br />

prices. Oil subsidies have also underm<strong>in</strong>ed the development of the domestic gas <strong>in</strong>dustry.<br />

This study has not quantified the costs result<strong>in</strong>g from relative price distortions. However,<br />

such costs are thought to be substantial, as a result of distorted consumption patterns and the<br />

subsequent misallocation of resources. Such distortions are particularly costly <strong>in</strong> the ref<strong>in</strong><strong>in</strong>g<br />

sector. For example, major <strong>in</strong>vestments <strong>in</strong> ref<strong>in</strong>eries have had to be made to boost production<br />

of automotive diesel to meet surg<strong>in</strong>g demand.<br />

Oil products are subsidised primarily for social reasons. They are <strong>in</strong>tended to make energy<br />

more affordable for low-<strong>in</strong>come groups. In practice, however, high-<strong>in</strong>come groups and large<br />

manufacturers have been the pr<strong>in</strong>cipal beneficiaries of these subsidies. The biggest subsidy<br />

goes to kerosene, the ma<strong>in</strong> consumers of which are households.<br />

64<br />

See Chapter 2, Section 2.2 for a discussion of welfare losses caused by subsidies.<br />

94