FY <strong>2013</strong> <strong>Approved</strong> <strong>Budget</strong> without Double Appropriation Without Double Double FUNDS Appropriation Appropriation Appropriation PROPERTY TAX OPERATING Corporate 163,297,971 162,632,170 665,801 F.I.C.A. 12,087,929 0 12,087,929 I.M.R.F. 19,937,151 0 19,937,151 Liability Insurance 7,140,432 7,083,418 57,014 Veteran's Assistance Commission 412,805 368,730 44,075 Health Department 71,787,469 71,604,169 183,300 Stormwater Management 2,746,082 2,531,227 214,855 Division of Transportation 19,522,949 18,631,136 891,813 Hulse Detention Center 6,101,131 5,897,479 203,652 Winchester House 17,189,775 16,079,931 1,109,844 Tuberculosis Clinic 697,577 657,988 39,589 SUB TOTAL OPERATING 320,921,271 285,486,248 35,435,023 CAPITAL Bridge Tax 3,773,212 3,773,212 0 Matching Tax 8,608,625 8,608,625 0 SUB TOTAL CAPITAL 12,381,837 12,381,837 0 TOTAL PROPERTY TAX 333,303,108 297,868,085 35,435,023 Governmental Funds SPECIAL REVENUE Probation Services Fee 1,774,851 1,742,211 32,640 Law Library 501,933 426,332 75,601 Children's Waiting Room 204,228 189,174 15,054 Neutral Site Custody Exchange Fee 183,000 183,000 0 Court Automation 1,225,731 1,208,918 16,813 Circuit Clerk Electronic Citation 0 0 0 Court Document Storage 2,511,060 2,491,627 19,433 Recorder Automation 1,374,821 1,338,484 36,337 Vital Records Automation 150,316 143,805 6,511 GIS Automation Fund 730,000 730,000 0 Tax Sale Automation 129,315 129,315 0 Coroner Fees 134,556 119,932 14,624 Motor Fuel Tax 10,851,476 10,851,476 0 1/4% Sales Tax 32,044,953 32,044,953 0 Solid Waste Management Tax 201,657 201,657 0 HUD 4,323,613 4,283,559 40,054 Workforce Development 4,927,276 4,751,978 175,298 TOTAL SPECIAL REVENUE 61,268,786 60,836,421 432,365 CAPITAL PROJECT 2008 Bond Construction Projects 0 0 0 2010A Bond Road Construction Projects 0 0 0 2011A Bond Road Construction Projects 0 0 0 TOTAL CAPITAL PROJECT 0 0 0 DEBT SERVICE FUNDS 2008 GO Bonds 2,784,494 0 2,784,494 2010A Taxable GO Bonds 1,596,700 0 1,596,700 2011A GO Bonds 965,200 0 965,200 2005 GO Refunding Bonds 487,830 0 487,830 TOTAL DEBT SERVICE 5,834,224 0 5,834,224 Properietary Funds Special Service Areas INTERNAL SERVICE H-L-D Insurance 45,194,706 11,896,908 33,297,798 ENTERPRISE Public Works 39,161,885 37,571,031 1,590,854 SPECIAL SERVICE AREAS SSA #8 Loon <strong>Lake</strong> 50,000 48,500 1,500 SSA #12 Woods of Ivanhoe 21,546 21,546 0 SSA #10 North Hills 78,583 78,583 0 SSA #13 Tax Exempt A 126,318 126,318 0 SSA #13 Taxable B 130,480 130,480 0 TOTAL SPECIAL SERVICE AREAS 406,927 405,427 1,500 GRAND TOTAL 485,169,636 408,577,872 76,591,764 Note: double appropriation is defined as a transfer between funds or departments 15

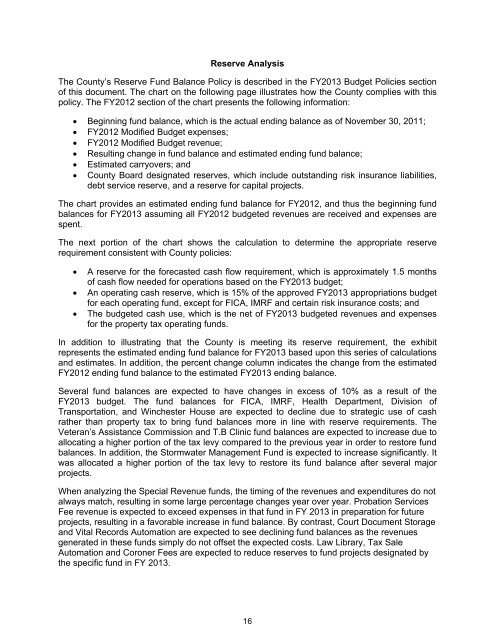

Reserve Analysis The <strong>County</strong>’s Reserve Fund Balance Policy is described in the FY<strong>2013</strong> <strong>Budget</strong> Policies section of this document. The chart on the following page illustrates how the <strong>County</strong> complies with this policy. The FY2012 section of the chart presents the following information: Beginning fund balance, which is the actual ending balance as of November 30, 2011; FY2012 Modified <strong>Budget</strong> expenses; FY2012 Modified <strong>Budget</strong> revenue; Resulting change in fund balance and estimated ending fund balance; Estimated carryovers; and <strong>County</strong> Board designated reserves, which include outstanding risk insurance liabilities, debt service reserve, and a reserve for capital projects. The chart provides an estimated ending fund balance for FY2012, and thus the beginning fund balances for FY<strong>2013</strong> assuming all FY2012 budgeted revenues are received and expenses are spent. The next portion of the chart shows the calculation to determine the appropriate reserve requirement consistent with <strong>County</strong> policies: A reserve for the forecasted cash flow requirement, which is approximately 1.5 months of cash flow needed for operations based on the FY<strong>2013</strong> budget; An operating cash reserve, which is 15% of the approved FY<strong>2013</strong> appropriations budget for each operating fund, except for FICA, IMRF and certain risk insurance costs; and The budgeted cash use, which is the net of FY<strong>2013</strong> budgeted revenues and expenses for the property tax operating funds. In addition to illustrating that the <strong>County</strong> is meeting its reserve requirement, the exhibit represents the estimated ending fund balance for FY<strong>2013</strong> based upon this series of calculations and estimates. In addition, the percent change column indicates the change from the estimated FY2012 ending fund balance to the estimated FY<strong>2013</strong> ending balance. Several fund balances are expected to have changes in excess of 10% as a result of the FY<strong>2013</strong> budget. The fund balances for FICA, IMRF, Health Department, Division of Transportation, and Winchester House are expected to decline due to strategic use of cash rather than property tax to bring fund balances more in line with reserve requirements. The Veteran’s Assistance Commission and T.B Clinic fund balances are expected to increase due to allocating a higher portion of the tax levy compared to the previous year in order to restore fund balances. In addition, the Stormwater Management Fund is expected to increase significantly. It was allocated a higher portion of the tax levy to restore its fund balance after several major projects. When analyzing the Special Revenue funds, the timing of the revenues and expenditures do not always match, resulting in some large percentage changes year over year. Probation Services Fee revenue is expected to exceed expenses in that fund in FY <strong>2013</strong> in preparation for future projects, resulting in a favorable increase in fund balance. By contrast, Court Document Storage and Vital Records Automation are expected to see declining fund balances as the revenues generated in these funds simply do not offset the expected costs. Law Library, Tax Sale Automation and Coroner Fees are expected to reduce reserves to fund projects designated by the specific fund in FY <strong>2013</strong>. 16

- Page 1: APPROVED 2013 ANNUAL BUDGET LAKE CO

- Page 4 and 5: Transmittal Letter 2013 Approved Bu

- Page 6 and 7: The County continues to be challeng

- Page 8 and 9: Debt Service There was no new debt

- Page 10 and 11: Budget Process Lake County operates

- Page 12 and 13: Budget Document This budget documen

- Page 14 and 15: Property Values The County’s equa

- Page 16 and 17: Budgeting Practices The County’s

- Page 18 and 19: Staffing changes - Personnel costs

- Page 22 and 23: LAKE COUNTY FISCAL YEAR 2013 BUDGET

- Page 24 and 25: Lake County Revenues by Fund and Ca

- Page 26 and 27: Lake County Revenues by Fund and Ca

- Page 28 and 29: Property Taxes Property taxes suppo

- Page 30 and 31: 2009 LAKE COUNTY Property Tax 5 Yea

- Page 32 and 33: Income Tax The County’s share of

- Page 34 and 35: Intergovernmental Revenue The Count

- Page 36 and 37: Lake County Expenses by Fund and Ca

- Page 38: Lake County Expenses by Fund and Ca

- Page 41 and 42: Full Time Part Time DEPARTMENT 2013

- Page 43 and 44: New Program/Personnel/Refunding Req

- Page 45 and 46: Fiscal Year 2013 Requests Requestin

- Page 47 and 48: Capital Improvement Program Program

- Page 49 and 50: CCIP Definition The Corporate Capit

- Page 51 and 52: 3. Cost analysis of project based u

- Page 53 and 54: Corporate Capital Improvement Progr

- Page 55 and 56: Capital Improvement Program Rehabil

- Page 57 and 58: Capital Improvement Program Rehab/A

- Page 59 and 60: Capital Improvement Program Departm

- Page 61 and 62: Capital Improvement Program Operati

- Page 63 and 64: Capital Improvement Program Operati

- Page 65 and 66: Capital Improvement Program Initiat

- Page 67 and 68: Capital Improvement Program Initiat

- Page 69 and 70: Capital Improvement Program Major C

- Page 71 and 72:

Capital Improvement Program Major C

- Page 73 and 74:

Capital Improvement Program Strateg

- Page 75 and 76:

Budget Process and Policies 2013 Ap

- Page 77 and 78:

LAKE COUNTY BUDGET CALENDAR - FISCA

- Page 79 and 80:

Fund and Department Structure The C

- Page 81 and 82:

The Motor Fuel Tax Fund, which is n

- Page 83 and 84:

FY2013 BUDGET POLICIES FY2013 BUDGE

- Page 85 and 86:

concurrent with the annual budget d

- Page 87 and 88:

eductions or new revenue increases

- Page 89 and 90:

5. Indirect Costs When a fund or de

- Page 91 and 92:

Corporate Fund 2013 Approved Budget

- Page 93 and 94:

FY 2013 Budget Overview Department

- Page 95 and 96:

Lake County Revenue Budget Comparis

- Page 97 and 98:

FY 2013 Budget Overview Circuit Cou

- Page 99 and 100:

Lake County Expense Budget Comparis

- Page 101 and 102:

110% 100% 90% 80% 70% 60% 50% 40% 3

- Page 103 and 104:

Lake County Expense Budget Comparis

- Page 105 and 106:

FY 2013 Budget Overview Department

- Page 107 and 108:

Lake County Revenue Budget Comparis

- Page 109 and 110:

FY 2013 Budget Overview Corporate C

- Page 111 and 112:

Lake County Expense Budget Comparis

- Page 113 and 114:

200 County Administrator's Office C

- Page 115 and 116:

Lake County Revenue Budget Comparis

- Page 117 and 118:

Lake County Expense Budget Comparis

- Page 119 and 120:

Lake County Revenue Budget Comparis

- Page 121 and 122:

FY 2013 Budget Overview Department

- Page 123 and 124:

Lake County Expense Budget Comparis

- Page 125 and 126:

1.00 0.90 0.80 0.70 0.60 0.50 0.40

- Page 127 and 128:

Lake County Expense Budget Comparis

- Page 129 and 130:

FY 2013 Budget Overview General Ope

- Page 131 and 132:

Lake County Expense Budget Comparis

- Page 133 and 134:

FY 2013 Budget Overview Department

- Page 135 and 136:

Lake County Revenue Budget Comparis

- Page 137 and 138:

FY 2013 Budget Overview Information

- Page 139 and 140:

Lake County Revenue Budget Comparis

- Page 141 and 142:

FY 2013 Budget Overview Department

- Page 143 and 144:

Lake County Revenue Budget Comparis

- Page 145 and 146:

Lake County Expense Budget Comparis

- Page 147 and 148:

70 60 50 40 30 20 10 0 Public Defen

- Page 149 and 150:

Lake County Expense Budget Comparis

- Page 151 and 152:

Recorder of Deeds Documents Recorde

- Page 153 and 154:

Lake County Expense Budget Comparis

- Page 155 and 156:

Regional Office of Education Certif

- Page 157 and 158:

Lake County Expense Budget Comparis

- Page 159 and 160:

Lake County Revenue Budget Comparis

- Page 161 and 162:

Lake County Expense Budget Comparis

- Page 163 and 164:

Lake County Revenue Budget Comparis

- Page 165 and 166:

FY 2013 Budget Overview Department

- Page 167 and 168:

Lake County Revenue Budget Comparis

- Page 169 and 170:

Lake County Expense Budget Comparis

- Page 171 and 172:

Lake County Treasurer $1,600,000.00

- Page 173 and 174:

Lake County Expense Budget Comparis

- Page 175 and 176:

FY 2013 Budget Overview Department

- Page 177 and 178:

Lake County Expense Budget Comparis

- Page 179 and 180:

Division of Transportation Annual C

- Page 181 and 182:

Lake County Expense Budget Comparis

- Page 183 and 184:

FY 2013 Budget Overview Department

- Page 185 and 186:

Lake County Expense Budget Comparis

- Page 187 and 188:

Lake County Revenue Budget Comparis

- Page 189 and 190:

Lake County Expense Budget Comparis

- Page 191 and 192:

Lake County Expense Budget Comparis

- Page 193 and 194:

Lake County Revenue Budget Comparis

- Page 195 and 196:

Lake County Expense Budget Comparis

- Page 197 and 198:

Lake County Revenue Budget Comparis

- Page 199 and 200:

FY 2013 Budget Overview Department

- Page 201 and 202:

Lake County Expense Budget Comparis

- Page 203 and 204:

Lake County Revenue Budget Comparis

- Page 205 and 206:

FY 2013 Budget Overview Department

- Page 207 and 208:

Lake County Revenue Budget Comparis

- Page 209 and 210:

FY 2013 Budget Overview TB Clinic D

- Page 211 and 212:

Lake County Expense Budget Comparis

- Page 213 and 214:

FY 2013 Budget Overview Department

- Page 215 and 216:

Lake County Revenue Budget Comparis

- Page 217 and 218:

FY 2013 Budget Overview Department

- Page 219 and 220:

Lake County Expense Budget Comparis

- Page 221 and 222:

Special Revenue Funds 2013 Approved

- Page 223 and 224:

Lake County Revenue Budget Comparis

- Page 225 and 226:

FY 2013 Budget Overview Department

- Page 227 and 228:

Lake County Expense Budget Comparis

- Page 229 and 230:

Lake County Revenue Budget Comparis

- Page 231 and 232:

FY 2013 Budget Overview Document St

- Page 233 and 234:

Lake County Expense Budget Comparis

- Page 235 and 236:

Lake County Revenue Budget Comparis

- Page 237 and 238:

Lake County Revenue Budget Comparis

- Page 239 and 240:

FY 2013 Budget Overview Department

- Page 241 and 242:

Lake County Expense Budget Comparis

- Page 243 and 244:

Lake County Revenue Budget Comparis

- Page 245 and 246:

FY 2013 Budget Overview Department

- Page 247 and 248:

Lake County Expense Budget Comparis

- Page 249 and 250:

Lake County Revenue Budget Comparis

- Page 251 and 252:

FY 2013 Budget Overview Probation S

- Page 253 and 254:

Lake County Expense Budget Comparis

- Page 255 and 256:

Lake County Revenue Budget Comparis

- Page 257 and 258:

FY 2013 Budget Overview Department

- Page 259 and 260:

Lake County Expense Budget Comparis

- Page 261 and 262:

Lake County Revenue Budget Comparis

- Page 263 and 264:

FY 2013 Budget Overview Tax Sale Au

- Page 265 and 266:

Lake County Expense Budget Comparis

- Page 267 and 268:

Lake County Revenue Budget Comparis

- Page 269 and 270:

FY 2013 Budget Overview Department

- Page 271 and 272:

Workforce Development 100% WIA Trai

- Page 273 and 274:

Lake County Expense Budget Comparis

- Page 275 and 276:

Capital Projects 2013 Approved Budg

- Page 277 and 278:

Lake County Revenue Budget Comparis

- Page 279 and 280:

FY 2013 Budget Overview 2010A Bond

- Page 281 and 282:

Lake County Expense Budget Comparis

- Page 283 and 284:

Lake County Revenue 2011A Budget Ta

- Page 285 and 286:

Debt Service Funds 2013 Approved Bu

- Page 287 and 288:

Lake County Revenue Budget Comparis

- Page 289 and 290:

FY 2013 Budget Overview Department

- Page 291 and 292:

Lake County Expense Budget Comparis

- Page 293 and 294:

Lake County Revenue Budget Comparis

- Page 295 and 296:

FY 2013 Budget Overview 2011A Tax E

- Page 297 and 298:

Lake County Expense Budget Comparis

- Page 299 and 300:

FY 2013 Budget Overview Department

- Page 301 and 302:

Lake County Expense Budget Comparis

- Page 303 and 304:

FY 2013 Budget Overview Department

- Page 305 and 306:

Lake County Revenue Budget Comparis

- Page 307 and 308:

Lake County Expense Budget Comparis

- Page 309 and 310:

Special Service Areas 2013 Approved

- Page 311 and 312:

Lake County Revenue Budget Comparis

- Page 313 and 314:

FY 2013 Budget Overview Special Ser

- Page 315 and 316:

Lake County Expense Budget Comparis

- Page 317 and 318:

Lake County Revenue Budget Special

- Page 319 and 320:

FY 2013 Budget Overview Special Ser

- Page 321 and 322:

Lake County Expense Budget Comparis

- Page 323 and 324:

Lake County Revenue Budget Comparis

- Page 325 and 326:

Glossary And Acronyms 2013 Approved

- Page 327 and 328:

Charges for Service: Corporate Capi

- Page 329 and 330:

members are responsible for budget

- Page 331 and 332:

Tuberculosis Clinic Fund: Unfunded