PDF (1265kB) - Philip Morris

PDF (1265kB) - Philip Morris

PDF (1265kB) - Philip Morris

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

ANNUAL REPORT 2005 | CONSOLIDATED FINANCIAL RESULTS<br />

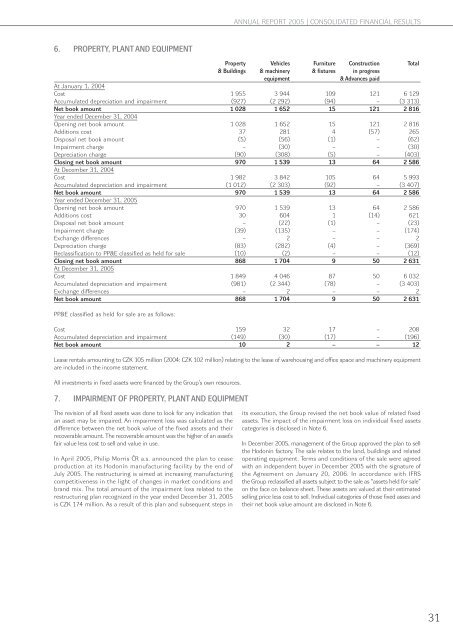

6. PROPERTY, PLANT AND EQUIPMENT<br />

Property Vehicles Furniture Construction Total<br />

& Buildings & machinery & fixtures in progress<br />

equipment<br />

& Advances paid<br />

At January 1, 2004<br />

Cost 1 955 3 944 109 121 6 129<br />

Accumulated depreciation and impairment (927) (2 292) (94) – (3 313)<br />

Net book amount 1 028 1 652 15 121 2 816<br />

Year ended December 31, 2004<br />

Opening net book amount 1 028 1 652 15 121 2 816<br />

Additions cost 37 281 4 (57) 265<br />

Disposal net book amount (5) (56) (1) – (62)<br />

Impairment charge – (30) – – (30)<br />

Depreciation charge (90) (308) (5) – (403)<br />

Closing net book amount 970 1 539 13 64 2 586<br />

At December 31, 2004<br />

Cost 1 982 3 842 105 64 5 993<br />

Accumulated depreciation and impairment (1 012) (2 303) (92) – (3 407)<br />

Net book amount 970 1 539 13 64 2 586<br />

Year ended December 31, 2005<br />

Opening net book amount 970 1 539 13 64 2 586<br />

Additions cost 30 604 1 (14) 621<br />

Disposal net book amount – (22) (1) – (23)<br />

Impairment charge (39) (135) – – (174)<br />

Exchange differences – 2 – – 2<br />

Depreciation charge (83) (282) (4) – (369)<br />

Reclassification to PP&E classified as held for sale (10) (2) – – (12)<br />

Closing net book amount 868 1 704 9 50 2 631<br />

At December 31, 2005<br />

Cost 1 849 4 046 87 50 6 032<br />

Accumulated depreciation and impairment (981) (2 344) (78) – (3 403)<br />

Exchange differences – 2 – – 2<br />

Net book amount 868 1 704 9 50 2 631<br />

PP&E classified as held for sale are as follows:<br />

Cost 159 32 17 – 208<br />

Accumulated depreciation and impairment (149) (30) (17) – (196)<br />

Net book amount 10 2 – – 12<br />

Lease rentals amounting to CZK 105 million (2004: CZK 102 million) relating to the lease of warehousing and office space and machinery equipment<br />

are included in the income statement.<br />

All investments in fixed assets were financed by the Group’s own resources.<br />

7. IMPAIRMENT OF PROPERTY, PLANT AND EQUIPMENT<br />

The revision of all fixed assets was done to look for any indication that<br />

an asset may be impaired. An impairment loss was calculated as the<br />

difference between the net book value of the fixed assets and their<br />

recoverable amount. The recoverable amount was the higher of an asset’s<br />

fair value less cost to sell and value in use.<br />

In April 2005, <strong>Philip</strong> <strong>Morris</strong> ČR a.s. announced the plan to cease<br />

production at its Hodonín manufacturing facility by the end of<br />

July 2005. The restructuring is aimed at increasing manufacturing<br />

competitiveness in the light of changes in market conditions and<br />

brand mix. The total amount of the impairment loss related to the<br />

restructuring plan recognized in the year ended December 31, 2005<br />

is CZK 174 million. As a result of this plan and subsequent steps in<br />

its execution, the Group revised the net book value of related fixed<br />

assets. The impact of the impairment loss on individual fixed assets<br />

categories is disclosed in Note 6.<br />

In December 2005, management of the Group approved the plan to sell<br />

the Hodonín factory. The sale relates to the land, buildings and related<br />

operating equipment. Terms and conditions of the sale were agreed<br />

with an independent buyer in December 2005 with the signature of<br />

the Agreement on January 20, 2006. In accordance with IFRS<br />

the Group reclassified all assets subject to the sale as “assets held for sale”<br />

on the face on balance sheet. These assets are valued at their estimated<br />

selling price less cost to sell. Individual categories of those fixed asses and<br />

their net book value amount are disclosed in Note 6.<br />

31