PDF (1265kB) - Philip Morris

PDF (1265kB) - Philip Morris

PDF (1265kB) - Philip Morris

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

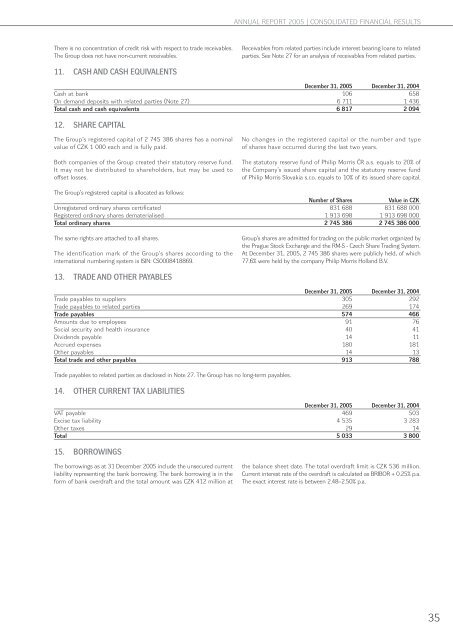

ANNUAL REPORT 2005 | CONSOLIDATED FINANCIAL RESULTS<br />

There is no concentration of credit risk with respect to trade receivables.<br />

The Group does not have non-current receivables.<br />

Receivables from related parties include interest bearing loans to related<br />

parties. See Note 27 for an analysis of receivables from related parties.<br />

11. CASH AND CASH EQUIVALENTS<br />

December 31, 2005 December 31, 2004<br />

Cash at bank 106 658<br />

On demand deposits with related parties (Note 27) 6 711 1 436<br />

Total cash and cash equivalents 6 817 2 094<br />

12. SHARE CAPITAL<br />

The Group’s registered capital of 2 745 386 shares has a nominal<br />

value of CZK 1 000 each and is fully paid.<br />

Both companies of the Group created their statutory reserve fund.<br />

It may not be distributed to shareholders, but may be used to<br />

offset losses.<br />

No changes in the registered capital or the number and type<br />

of shares have occurred during the last two years.<br />

The statutory reserve fund of <strong>Philip</strong> <strong>Morris</strong> ČR a.s. equals to 20% of<br />

the Company’s issued share capital and the statutory reserve fund<br />

of <strong>Philip</strong> <strong>Morris</strong> Slovakia s.r.o. equals to 10% of its issued share capital.<br />

The Group’s registered capital is allocated as follows:<br />

Number of Shares<br />

Value in CZK<br />

Unregistered ordinary shares certificated 831 688 831 688 000<br />

Registered ordinary shares dematerialised 1 913 698 1 913 698 000<br />

Total ordinary shares 2 745 386 2 745 386 000<br />

The same rights are attached to all shares.<br />

The identification mark of the Group’s shares according to the<br />

international numbering system is ISIN: CS0008418869.<br />

Group’s shares are admitted for trading on the public market organized by<br />

the Prague Stock Exchange and the RM-S - Czech Share Trading System.<br />

At December 31, 2005, 2 745 386 shares were publicly held, of which<br />

77.6% were held by the company <strong>Philip</strong> <strong>Morris</strong> Holland B.V.<br />

13. TRADE AND OTHER PAYABLES<br />

December 31, 2005 December 31, 2004<br />

Trade payables to suppliers 305 292<br />

Trade payables to related parties 269 174<br />

Trade payables 574 466<br />

Amounts due to employees 91 76<br />

Social security and health insurance 40 41<br />

Dividends payable 14 11<br />

Accrued expenses 180 181<br />

Other payables 14 13<br />

Total trade and other payables 913 788<br />

Trade payables to related parties as disclosed in Note 27. The Group has no long-term payables.<br />

14. OTHER CURRENT TAX LIABILITIES<br />

December 31, 2005 December 31, 2004<br />

VAT payable 469 503<br />

Excise tax liability 4 535 3 283<br />

Other taxes 29 14<br />

Total 5 033 3 800<br />

15. BORROWINGS<br />

The borrowings as at 31 December 2005 include the unsecured current<br />

liability representing the bank borrowing. The bank borrowing is in the<br />

form of bank overdraft and the total amount was CZK 412 million at<br />

the balance sheet date. The total overdraft limit is CZK 536 million.<br />

Current interest rate of the overdraft is calculated as BRIBOR + 0.25% p.a.<br />

The exact interest rate is between 2.48–2.50% p.a.<br />

35