PDF (1265kB) - Philip Morris

PDF (1265kB) - Philip Morris

PDF (1265kB) - Philip Morris

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

ANNUAL REPORT 2005 | CONSOLIDATED FINANCIAL RESULTS<br />

The wages and salaries expense for 2005 includes the severance<br />

payment paid to the employees in accordance with the Amendment to<br />

the Collective Labor Agreement relating the closure of Hodonín plant in<br />

2005 described in Note 7. The total amount charged to expenses was<br />

CZK 206 million.<br />

The Group is legally required to make contributions to government health,<br />

retirement benefit and unemployment schemes. During 2005 and 2004,<br />

the Group paid contributions at a rate of 35% of gross salaries and is not<br />

required to make any contributions in excess of this statutory rate.<br />

The Group has a voluntary pension plan for employees under which<br />

the Group makes contributions on behalf of the Group’s employees to<br />

approved pension plan providers, under defined contribution schemes.<br />

Certain members of the Group’s management participate in the Altria<br />

Group’s stock compensation plans. As at December 31, 2005, the 2005<br />

Performance Incentive Plan (the “2005 Plan”) was in place and as at<br />

December 31, 2004, 2000 Performance Incentive Plan (the “2000 Plan”)<br />

was in place. Under both 2005 and 2000 Plans, the Parent Company<br />

granted stock options and restricted stock to eligible employees.<br />

Compensation expenses arising in respect of these plans incurred by<br />

Altria Group are recharged to the Group for the applicable employee’s<br />

employment period at the Group, upon the exercise of the award by<br />

the employee. Related expenses for 2005 amounted to CZK 37 million<br />

(2004: CZK 33 million).<br />

Liability in respect of the awards outstanding as at December 31, 2005<br />

was CZK 73 million (2004: CZK 48 million).<br />

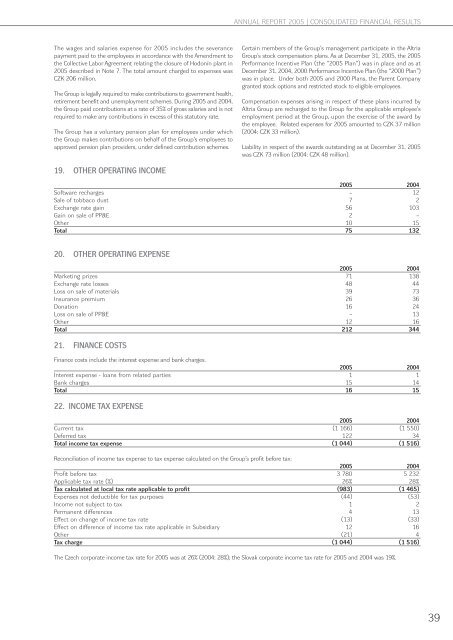

19. OTHER OPERATING INCOME<br />

2005 2004<br />

Software recharges – 12<br />

Sale of tobbaco dust 7 2<br />

Exchange rate gain 56 103<br />

Gain on sale of PP&E 2 –<br />

Other 10 15<br />

Total 75 132<br />

20. OTHER OPERATING EXPENSE<br />

2005 2004<br />

Marketing prizes 71 138<br />

Exchange rate losses 48 44<br />

Loss on sale of materials 39 73<br />

Insurance premium 26 36<br />

Donation 16 24<br />

Loss on sale of PP&E – 13<br />

Other 12 16<br />

Total 212 344<br />

21. FINANCE COSTS<br />

Finance costs include the interest expense and bank charges.<br />

2005 2004<br />

Interest expense - loans from related parties 1 1<br />

Bank charges 15 14<br />

Total 16 15<br />

22. INCOME TAX EXPENSE<br />

2005 2004<br />

Current tax (1 166) (1 550)<br />

Deferred tax 122 34<br />

Total income tax expense (1 044) (1 516)<br />

Reconciliation of income tax expense to tax expense calculated on the Group’s profit before tax:<br />

2005 2004<br />

Profit before tax 3 780 5 232<br />

Applicable tax rate (%) 26% 28%<br />

Tax calculated at local tax rate applicable to profit (983) (1 465)<br />

Expenses not deductible for tax purposes (44) (53)<br />

Income not subject to tax 1 2<br />

Permanent differences 4 13<br />

Effect on change of income tax rate (13) (33)<br />

Effect on difference of income tax rate applicable in Subsidiary 12 16<br />

Other (21) 4<br />

Tax charge (1 044) (1 516)<br />

The Czech corporate income tax rate for 2005 was at 26% (2004: 28%); the Slovak corporate income tax rate for 2005 and 2004 was 19%.<br />

39