Economics Markets Strategy - the DBS Vickers Securities Equities ...

Economics Markets Strategy - the DBS Vickers Securities Equities ...

Economics Markets Strategy - the DBS Vickers Securities Equities ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Economics</strong> – <strong>Markets</strong> – <strong>Strategy</strong><br />

<strong>Economics</strong>: Indonesia<br />

135/bbl for <strong>the</strong> rest of <strong>the</strong> year and a USD/IDR average of 9,550, <strong>the</strong>n doubling<br />

subsidized fuel prices as early as Sept08 would still leave <strong>the</strong> subsidy:GDP ratio<br />

at 3.1%. If we assume prices remain close to current levels, ie. crude at USD 130/<br />

bbl and USD/IDR at 9,350, <strong>the</strong>n doubling prices would bring <strong>the</strong> subsidy:GDP<br />

ratio to 3%.<br />

In <strong>the</strong> mean time, growth will cool<br />

The May fuel price hike will moderate activity, and to that end we have shaded<br />

our growth forecasts lower, to 6.0% this year and 6.3% for 2009. Our previous<br />

projections had been at 6.3% for 2008 (unchanged from 2007) and 6.5% for<br />

2009.<br />

We look for growth<br />

of 6.0% and 6.3%,<br />

in 2008 and 2009<br />

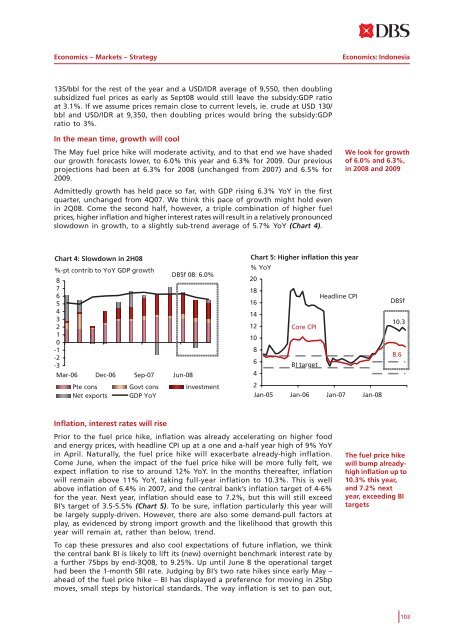

Admittedly growth has held pace so far, with GDP rising 6.3% YoY in <strong>the</strong> first<br />

quarter, unchanged from 4Q07. We think this pace of growth might hold even<br />

in 2Q08. Come <strong>the</strong> second half, however, a triple combination of higher fuel<br />

prices, higher inflation and higher interest rates will result in a relatively pronounced<br />

slowdown in growth, to a slightly sub-trend average of 5.7% YoY (Chart 4).<br />

Chart 4: Slowdown in 2H08<br />

%-pt contrib to YoY GDP growth<br />

8<br />

7<br />

6<br />

5<br />

4<br />

3<br />

2<br />

1<br />

0<br />

-1<br />

-2<br />

-3<br />

Mar-06 Dec-06 Sep-07 Jun-08<br />

<strong>DBS</strong>f 08: 6.0%<br />

Pte cons Govt cons Investment<br />

Net exports GDP YoY<br />

Chart 5: Higher inflation this year<br />

% YoY<br />

20<br />

18<br />

Headline CPI<br />

16<br />

14<br />

12<br />

Core CPI<br />

10<br />

8<br />

6<br />

BI target<br />

4<br />

2<br />

Jan-05 Jan-06 Jan-07 Jan-08<br />

<strong>DBS</strong>f<br />

10.3<br />

8.6<br />

Inflation, interest rates will rise<br />

Prior to <strong>the</strong> fuel price hike, inflation was already accelerating on higher food<br />

and energy prices, with headline CPI up at a one and a-half year high of 9% YoY<br />

in April. Naturally, <strong>the</strong> fuel price hike will exacerbate already-high inflation.<br />

Come June, when <strong>the</strong> impact of <strong>the</strong> fuel price hike will be more fully felt, we<br />

expect inflation to rise to around 12% YoY. In <strong>the</strong> months <strong>the</strong>reafter, inflation<br />

will remain above 11% YoY, taking full-year inflation to 10.3%. This is well<br />

above inflation of 6.4% in 2007, and <strong>the</strong> central bank’s inflation target of 4-6%<br />

for <strong>the</strong> year. Next year, inflation should ease to 7.2%, but this will still exceed<br />

BI’s target of 3.5-5.5% (Chart 5). To be sure, inflation particularly this year will<br />

be largely supply-driven. However, <strong>the</strong>re are also some demand-pull factors at<br />

play, as evidenced by strong import growth and <strong>the</strong> likelihood that growth this<br />

year will remain at, ra<strong>the</strong>r than below, trend.<br />

The fuel price hike<br />

will bump alreadyhigh<br />

inflation up to<br />

10.3% this year,<br />

and 7.2% next<br />

year, exceeding BI<br />

targets<br />

To cap <strong>the</strong>se pressures and also cool expectations of future inflation, we think<br />

<strong>the</strong> central bank BI is likely to lift its (new) overnight benchmark interest rate by<br />

a fur<strong>the</strong>r 75bps by end-3Q08, to 9.25%. Up until June 8 <strong>the</strong> operational target<br />

had been <strong>the</strong> 1-month SBI rate. Judging by BI’s two rate hikes since early May –<br />

ahead of <strong>the</strong> fuel price hike – BI has displayed a preference for moving in 25bp<br />

moves, small steps by historical standards. The way inflation is set to pan out,<br />

103