Economics Markets Strategy - the DBS Vickers Securities Equities ...

Economics Markets Strategy - the DBS Vickers Securities Equities ...

Economics Markets Strategy - the DBS Vickers Securities Equities ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Currencies<br />

<strong>Economics</strong> – <strong>Markets</strong> – <strong>Strategy</strong><br />

Indonesian rupiah – moving above 8700-9500 range<br />

USD/IDR<br />

forecast, eop<br />

Latest Prev<br />

Close 9310 9160<br />

2Q08 9300 9300<br />

3Q08 9500 9000<br />

4Q08 9600 8700<br />

1Q09 9700 9000<br />

2Q09 9800 9000<br />

3Q09 9500 8980<br />

4Q09 9300 8980<br />

BI benchmark rate<br />

forecast, eop<br />

Latest Prev<br />

Close 8.50 8.00<br />

2Q08 8.75 8.00<br />

3Q08 9.25 8.00<br />

4Q08 9.25 8.00<br />

1Q09 9.25 8.00<br />

2Q09 9.25 8.00<br />

3Q09 9.25 8.00<br />

4Q09 9.25 8.00<br />

Latest close on Jun 11<br />

Prev close on Mar 12<br />

Since 2006, Bank Indonesia (BI) has successfully kept USD/IDR stable in a broad<br />

range between 8700 and 9500. We think that this is about to change.<br />

Despite oil prices surging to USD98/barrel from USD61 in 2007, depreciation<br />

pressures on <strong>the</strong> rupiah were offset by a number of factors. To a great extent,<br />

<strong>the</strong> central bank’s ability to maintain a stable rupiah could be attributed to <strong>the</strong><br />

reflationary environment that followed <strong>the</strong> aggressive fuel price hikes in Oct<br />

2005. As inflation eased from a high of 18.4% YoY in Nov 2005 to a stable range<br />

between 5.3% and 7.0% from Oct 2006 to Dec 2007, <strong>the</strong> central bank lowered<br />

interest rates from 12.75% to 8.00%.<br />

During <strong>the</strong>se two years, <strong>the</strong> Jakarta stock market delivered annual gains of more<br />

than 50%, correctly betting on economic growth to return to pre-crisis levels<br />

above 6%. Meanwhile, foreign reserves started to accummulate at a faster rate<br />

from 2006, and overtook private sector external debt in 2007. The merchandise<br />

trade surplus was strong at almost USD40bn in 2006 and 2007, well above <strong>the</strong><br />

average USD26bn posted in <strong>the</strong> previous eight years. This helped to assuage<br />

concerns about Indonesia’s net oil importer status. Of course, it did not hurt<br />

that <strong>the</strong> USD was weak internationally from <strong>the</strong> aggressive rate cuts during <strong>the</strong><br />

US mortgage/credit crisis that started in Jul 2007.<br />

Unfortunately, this did not last. The positive factors responsible for rupiah stability<br />

in <strong>the</strong> past couple of years started to deteriorate in 2008. As at Jun 2, <strong>the</strong> stock<br />

market has fallen by 12% since <strong>the</strong> start of <strong>the</strong> year, in line with waning consumer<br />

confidence. Oil prices have become a problem as <strong>the</strong>y extended <strong>the</strong>ir ascent to<br />

as high as USD133/barrel on May 21. Apart from lifting inflation to double-digit<br />

levels by May08, high oil prices started to strain fiscal finances as well as to<br />

narrow <strong>the</strong> trade surplus. BI brought forward its policy meeting by two-days to<br />

May 6 and lifted <strong>the</strong> reference rate by 25bps hike to 8.25%. To alleviate <strong>the</strong><br />

pressures on fiscal finances from record high oil prices, <strong>the</strong> government raised<br />

fuel prices by 28.7% on May 24, leaving <strong>the</strong> door open for more hikes and fuel<br />

subsidy cuts should <strong>the</strong> oil prices continue to climb unabated.<br />

Under <strong>the</strong> circumstances, <strong>the</strong> rupiah will be vulnerable if <strong>the</strong> US embarks on a<br />

rate hike cycle, like in 1999-00 and 2004-06. Starting from 4Q08 into 3Q09, <strong>DBS</strong><br />

expects <strong>the</strong> Fed to raise interest rates from 2.00% to 4.25%. Hence, it will become<br />

more challenging for BI to keep USD/IDR within its 8700-9500 range. Taking into<br />

account that rupiah depreciation has become more muted with each cycle, we<br />

reckon that <strong>the</strong> upside for USD/IDR will be limited to 9800-10000 by mid-2009<br />

before coming down again.<br />

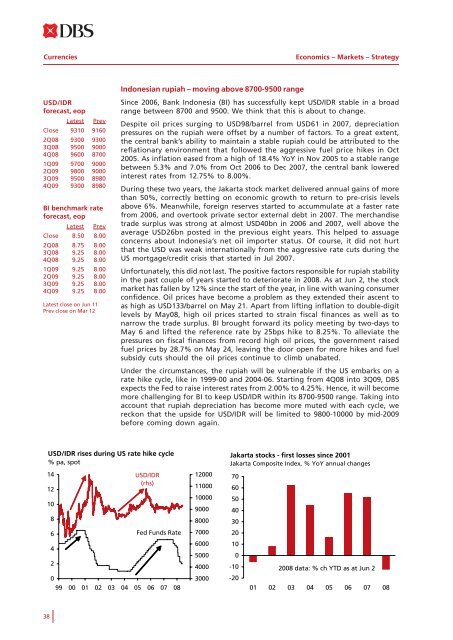

USD/IDR rises during US rate hike cycle<br />

% pa, spot<br />

14<br />

12<br />

10<br />

8<br />

6<br />

4<br />

2<br />

USD/IDR<br />

(rhs)<br />

Fed Funds Rate<br />

0<br />

99 00 01 02 03 04 05 06 07 08<br />

12000<br />

11000<br />

10000<br />

9000<br />

8000<br />

7000<br />

6000<br />

5000<br />

4000<br />

3000<br />

Jakarta stocks - first losses since 2001<br />

Jakarta Composite Index, % YoY annual changes<br />

70<br />

60<br />

50<br />

40<br />

30<br />

20<br />

10<br />

0<br />

-10<br />

-20<br />

2008 data: % ch YTD as at Jun 2<br />

01 02 03 04 05 06 07 08<br />

38