Economics Markets Strategy - the DBS Vickers Securities Equities ...

Economics Markets Strategy - the DBS Vickers Securities Equities ...

Economics Markets Strategy - the DBS Vickers Securities Equities ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Economics</strong> – <strong>Markets</strong> – <strong>Strategy</strong><br />

<strong>Economics</strong>: Japan<br />

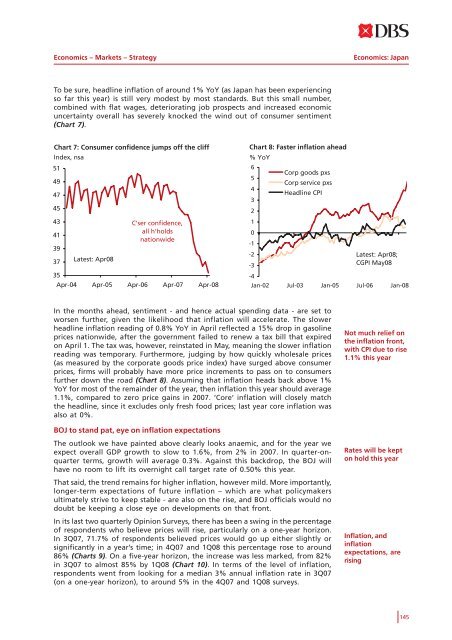

To be sure, headline inflation of around 1% YoY (as Japan has been experiencing<br />

so far this year) is still very modest by most standards. But this small number,<br />

combined with flat wages, deteriorating job prospects and increased economic<br />

uncertainty overall has severely knocked <strong>the</strong> wind out of consumer sentiment<br />

(Chart 7).<br />

Chart 7: Consumer confidence jumps off <strong>the</strong> cliff<br />

Index, nsa<br />

51<br />

49<br />

47<br />

45<br />

43<br />

41<br />

39<br />

37<br />

35<br />

Latest: Apr08<br />

C'ser confidence,<br />

all h'holds<br />

nationwide<br />

Apr-04 Apr-05 Apr-06 Apr-07 Apr-08<br />

Chart 8: Faster inflation ahead<br />

% YoY<br />

6<br />

5<br />

4<br />

3<br />

2<br />

1<br />

0<br />

-1<br />

-2<br />

-3<br />

-4<br />

Corp goods pxs<br />

Corp service pxs<br />

Headline CPI<br />

Latest: Apr08;<br />

CGPI May08<br />

Jan-02 Jul-03 Jan-05 Jul-06 Jan-08<br />

In <strong>the</strong> months ahead, sentiment - and hence actual spending data - are set to<br />

worsen fur<strong>the</strong>r, given <strong>the</strong> likelihood that inflation will accelerate. The slower<br />

headline inflation reading of 0.8% YoY in April reflected a 15% drop in gasoline<br />

prices nationwide, after <strong>the</strong> government failed to renew a tax bill that expired<br />

on April 1. The tax was, however, reinstated in May, meaning <strong>the</strong> slower inflation<br />

reading was temporary. Fur<strong>the</strong>rmore, judging by how quickly wholesale prices<br />

(as measured by <strong>the</strong> corporate goods price index) have surged above consumer<br />

prices, firms will probably have more price increments to pass on to consumers<br />

fur<strong>the</strong>r down <strong>the</strong> road (Chart 8). Assuming that inflation heads back above 1%<br />

YoY for most of <strong>the</strong> remainder of <strong>the</strong> year, <strong>the</strong>n inflation this year should average<br />

1.1%, compared to zero price gains in 2007. ‘Core’ inflation will closely match<br />

<strong>the</strong> headline, since it excludes only fresh food prices; last year core inflation was<br />

also at 0%.<br />

Not much relief on<br />

<strong>the</strong> inflation front,<br />

with CPI due to rise<br />

1.1% this year<br />

BOJ to stand pat, eye on inflation expectations<br />

The outlook we have painted above clearly looks anaemic, and for <strong>the</strong> year we<br />

expect overall GDP growth to slow to 1.6%, from 2% in 2007. In quarter-onquarter<br />

terms, growth will average 0.3%. Against this backdrop, <strong>the</strong> BOJ will<br />

have no room to lift its overnight call target rate of 0.50% this year.<br />

Rates will be kept<br />

on hold this year<br />

That said, <strong>the</strong> trend remains for higher inflation, however mild. More importantly,<br />

longer-term expectations of future inflation – which are what policymakers<br />

ultimately strive to keep stable - are also on <strong>the</strong> rise, and BOJ officials would no<br />

doubt be keeping a close eye on developments on that front.<br />

In its last two quarterly Opinion Surveys, <strong>the</strong>re has been a swing in <strong>the</strong> percentage<br />

of respondents who believe prices will rise, particularly on a one-year horizon.<br />

In 3Q07, 71.7% of respondents believed prices would go up ei<strong>the</strong>r slightly or<br />

significantly in a year’s time; in 4Q07 and 1Q08 this percentage rose to around<br />

86% (Charts 9). On a five-year horizon, <strong>the</strong> increase was less marked, from 82%<br />

in 3Q07 to almost 85% by 1Q08 (Chart 10). In terms of <strong>the</strong> level of inflation,<br />

respondents went from looking for a median 3% annual inflation rate in 3Q07<br />

(on a one-year horizon), to around 5% in <strong>the</strong> 4Q07 and 1Q08 surveys.<br />

Inflation, and<br />

inflation<br />

expectations, are<br />

rising<br />

145