Economics Markets Strategy - the DBS Vickers Securities Equities ...

Economics Markets Strategy - the DBS Vickers Securities Equities ...

Economics Markets Strategy - the DBS Vickers Securities Equities ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Currencies<br />

<strong>Economics</strong> – <strong>Markets</strong> – <strong>Strategy</strong><br />

USD/KRW<br />

forecast, eop<br />

Latest Prev<br />

Close 1030 971<br />

2Q08 1035 1000<br />

3Q08 1075 980<br />

4Q08 1100 940<br />

1Q09 1075 980<br />

2Q09 1075 980<br />

3Q09 1050 982<br />

4Q09 1050 982<br />

BOK o/n call rate<br />

forecast, eop<br />

Latest Prev<br />

Close 5.00 5.00<br />

2Q08 5.00 5.00<br />

3Q08 5.00 5.00<br />

4Q08 4.75 5.00<br />

1Q09 4.50 5.00<br />

2Q09 4.50 5.00<br />

3Q09 4.50 5.00<br />

4Q09 4.50 5.00<br />

Latest close on Jun 11<br />

Prev close on Mar 12<br />

Korean won – weakened international liquidity position<br />

We downgraded our forecast for KRW on Apr 24. Instead of expecting <strong>the</strong> KRW<br />

to appreciate against USD to 940 by end-2008, we see <strong>the</strong> risk for <strong>the</strong> KRW to<br />

depreciate to 1050-1100 in <strong>the</strong> second half of <strong>the</strong> year instead.<br />

Interestingly, <strong>the</strong> last time <strong>the</strong> KRW depreciated as dramatically as today was<br />

back in 2001-02. Like <strong>the</strong> Y2K crisis back <strong>the</strong>n, it was <strong>the</strong> subprime/credit crisis<br />

that threatened to push <strong>the</strong> US economy into recession. Both periods witnessed<br />

<strong>the</strong> Fed delivering inter-meeting rate cuts. But <strong>the</strong>re is one difference. Foreign<br />

reserves were rising to overtake foreign debt back <strong>the</strong>n. Today, external debt<br />

has already overtaken foreign reserves.<br />

The first hint of <strong>the</strong> KRW’s weakness surfaced during <strong>the</strong> US mortgage/credit<br />

crisis that broke out in Jul 2007. Despite aggressive cuts in US interest rates, <strong>the</strong><br />

KRW depreciated instead of appreciating. Ano<strong>the</strong>r disturbing development was<br />

<strong>the</strong> vulnerability of <strong>the</strong> KRW to unwinding of JPY carry trades or shortages of<br />

USD liquidity. Instinctively, we reckoned that <strong>the</strong>re was a weakening in Korea’s<br />

international liquidity position. Our investigations did not let us down.<br />

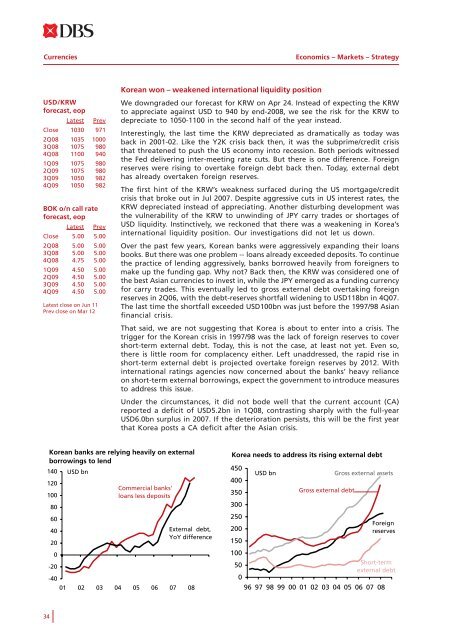

Over <strong>the</strong> past few years, Korean banks were aggressively expanding <strong>the</strong>ir loans<br />

books. But <strong>the</strong>re was one problem -- loans already exceeded deposits. To continue<br />

<strong>the</strong> practice of lending aggressively, banks borrowed heavily from foreigners to<br />

make up <strong>the</strong> funding gap. Why not? Back <strong>the</strong>n, <strong>the</strong> KRW was considered one of<br />

<strong>the</strong> best Asian currencies to invest in, while <strong>the</strong> JPY emerged as a funding currency<br />

for carry trades. This eventually led to gross external debt overtaking foreign<br />

reserves in 2Q06, with <strong>the</strong> debt-reserves shortfall widening to USD118bn in 4Q07.<br />

The last time <strong>the</strong> shortfall exceeded USD100bn was just before <strong>the</strong> 1997/98 Asian<br />

financial crisis.<br />

That said, we are not suggesting that Korea is about to enter into a crisis. The<br />

trigger for <strong>the</strong> Korean crisis in 1997/98 was <strong>the</strong> lack of foreign reserves to cover<br />

short-term external debt. Today, this is not <strong>the</strong> case, at least not yet. Even so,<br />

<strong>the</strong>re is little room for complacency ei<strong>the</strong>r. Left unaddressed, <strong>the</strong> rapid rise in<br />

short-term external debt is projected overtake foreign reserves by 2012. With<br />

international ratings agencies now concerned about <strong>the</strong> banks’ heavy reliance<br />

on short-term external borrowings, expect <strong>the</strong> government to introduce measures<br />

to address this issue.<br />

Under <strong>the</strong> circumstances, it did not bode well that <strong>the</strong> current account (CA)<br />

reported a deficit of USD5.2bn in 1Q08, contrasting sharply with <strong>the</strong> full-year<br />

USD6.0bn surplus in 2007. If <strong>the</strong> deterioration persists, this will be <strong>the</strong> first year<br />

that Korea posts a CA deficit after <strong>the</strong> Asian crisis.<br />

Korean banks are relying heavily on external<br />

borrowings to lend<br />

140 USD bn<br />

120<br />

100<br />

80<br />

60<br />

40<br />

20<br />

0<br />

-20<br />

-40<br />

Commercial banks'<br />

loans less deposits<br />

External debt,<br />

YoY difference<br />

01 02 03 04 05 06 07 08<br />

Korea needs to address its rising external debt<br />

450<br />

400<br />

350<br />

300<br />

250<br />

200<br />

150<br />

100<br />

50<br />

0<br />

USD bn<br />

Gross external debt<br />

Gross external assets<br />

Foreign<br />

reserves<br />

Short-term<br />

external debt<br />

96 97 98 99 00 01 02 03 04 05 06 07 08<br />

34