2011 Annual Report - Khaleeji Commercial Bank BSC

2011 Annual Report - Khaleeji Commercial Bank BSC

2011 Annual Report - Khaleeji Commercial Bank BSC

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

KHALEEJI COMMERCIAL BANK <strong>BSC</strong><br />

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS<br />

for the year ended 31 December <strong>2011</strong><br />

2. SIGNIFICANT ACCOUNTING POLICIES (continued)<br />

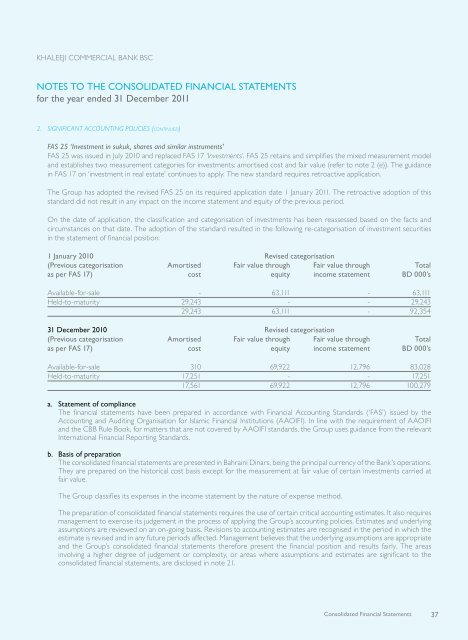

FAS 25 ‘Investment in sukuk, shares and similar instruments’<br />

FAS 25 was issued in July 2010 and replaced FAS 17 ‘Investments’. FAS 25 retains and simplifies the mixed measurement model<br />

and establishes two measurement categories for investments: amortised cost and fair value (refer to note 2 (e)). The guidance<br />

in FAS 17 on ‘investment in real estate’ continues to apply. The new standard requires retroactive application.<br />

The Group has adopted the revised FAS 25 on its required application date 1 January <strong>2011</strong>. The retroactive adoption of this<br />

standard did not result in any impact on the income statement and equity of the previous period.<br />

On the date of application, the classification and categorisation of investments has been reassessed based on the facts and<br />

circumstances on that date. The adoption of the standard resulted in the following re-categorisation of investment securities<br />

in the statement of financial position:<br />

1 January 2010 Revised categorisation<br />

(Previous categorisation amortised Fair value through Fair value through total<br />

as per FAS 17) cost equity income statement BD 000’s<br />

Available-for-sale - 63,111 - 63,111<br />

Held-to-maturity 29,243 - - 29,243<br />

29,243 63,111 - 92,354<br />

31 December 2010 Revised categorisation<br />

(Previous categorisation amortised Fair value through Fair value through total<br />

as per FAS 17) cost equity income statement BD 000’s<br />

Available-for-sale 310 69,922 12,796 83,028<br />

Held-to-maturity 17,251 - - 17,251<br />

17,561 69,922 12,796 100,279<br />

a. Statement of compliance<br />

The financial statements have been prepared in accordance with Financial Accounting Standards (‘FAS’) issued by the<br />

Accounting and Auditing Organisation for Islamic Financial Institutions (AAOIFI). In line with the requirement of AAOIFI<br />

and the CBB Rule Book, for matters that are not covered by AAOIFI standards, the Group uses guidance from the relevant<br />

International Financial <strong>Report</strong>ing Standards.<br />

b. Basis of preparation<br />

The consolidated financial statements are presented in Bahraini Dinars, being the principal currency of the <strong>Bank</strong>’s operations.<br />

They are prepared on the historical cost basis except for the measurement at fair value of certain investments carried at<br />

fair value.<br />

The Group classifies its expenses in the income statement by the nature of expense method.<br />

The preparation of consolidated financial statements requires the use of certain critical accounting estimates. It also requires<br />

management to exercise its judgement in the process of applying the Group’s accounting policies. Estimates and underlying<br />

assumptions are reviewed on an on-going basis. Revisions to accounting estimates are recognised in the period in which the<br />

estimate is revised and in any future periods affected. Management believes that the underlying assumptions are appropriate<br />

and the Group’s consolidated financial statements therefore present the financial position and results fairly. The areas<br />

involving a higher degree of judgement or complexity, or areas where assumptions and estimates are significant to the<br />

consolidated financial statements, are disclosed in note 21.<br />

Consolidated Financial Statements<br />

37