2011 Annual Report - Khaleeji Commercial Bank BSC

2011 Annual Report - Khaleeji Commercial Bank BSC

2011 Annual Report - Khaleeji Commercial Bank BSC

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

KHALEEJI COMMERCIAL BANK <strong>BSC</strong><br />

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS<br />

for the year ended 31 December <strong>2011</strong><br />

BD 000’s<br />

23. RELATED PARTY TRANSACTIONS (continued)<br />

Transactions with restricted investment accounts<br />

Transactions involving transfer/sale of assets to restricted investment accounts are generally executed based on the preagreed<br />

values as per the terms of the contracts for each restricted investment product. During the year, in its normal course<br />

of business, the <strong>Bank</strong> has bought certain investments at agreed contractual values amounting to BD 1,240 thousands. In 2010,<br />

the <strong>Bank</strong> had sold certain investments at agreed contractual values amounting to BD 167 thousand to its restricted investment<br />

accounts at a profit of BD 55 thousand.<br />

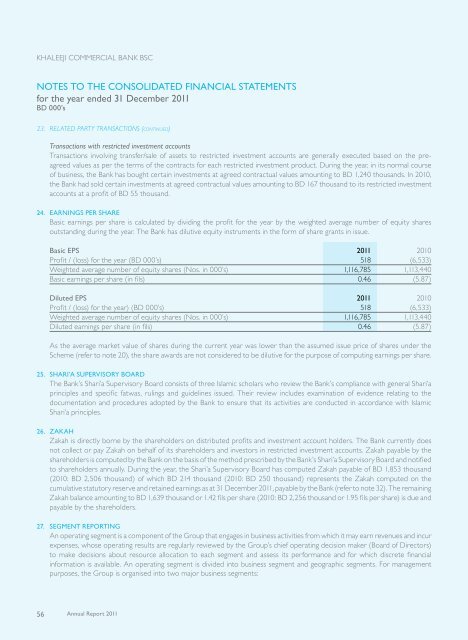

24. EARNINGS PER SHARE<br />

Basic earnings per share is calculated by dividing the profit for the year by the weighted average number of equity shares<br />

outstanding during the year. The <strong>Bank</strong> has dilutive equity instruments in the form of share grants in issue.<br />

Basic EPS <strong>2011</strong> 2010<br />

Profit / (loss) for the year (BD 000’s) 518 (6,533)<br />

Weighted average number of equity shares (Nos. in 000’s) 1,116,785 1,113,440<br />

Basic earnings per share (in fils) 0.46 (5.87)<br />

Diluted EPS <strong>2011</strong> 2010<br />

Profit / (loss) for the year) (BD 000’s) 518 (6,533)<br />

Weighted average number of equity shares (Nos. in 000’s) 1,116,785 1,113,440<br />

Diluted earnings per share (in fils) 0.46 (5.87)<br />

As the average market value of shares during the current year was lower than the assumed issue price of shares under the<br />

Scheme (refer to note 20), the share awards are not considered to be dilutive for the purpose of computing earnings per share.<br />

25. SHARI’A SUPERVISORY BOARD<br />

The <strong>Bank</strong>’s Shari’a Supervisory Board consists of three Islamic scholars who review the <strong>Bank</strong>’s compliance with general Shari’a<br />

principles and specific fatwas, rulings and guidelines issued. Their review includes examination of evidence relating to the<br />

documentation and procedures adopted by the <strong>Bank</strong> to ensure that its activities are conducted in accordance with Islamic<br />

Shari’a principles.<br />

26. ZAKAH<br />

Zakah is directly borne by the shareholders on distributed profits and investment account holders. The <strong>Bank</strong> currently does<br />

not collect or pay Zakah on behalf of its shareholders and investors in restricted investment accounts. Zakah payable by the<br />

shareholders is computed by the <strong>Bank</strong> on the basis of the method prescribed by the <strong>Bank</strong>’s Shari’a Supervisory Board and notified<br />

to shareholders annually. During the year, the Shari’a Supervisory Board has computed Zakah payable of BD 1,853 thousand<br />

(2010: BD 2,506 thousand) of which BD 214 thousand (2010: BD 250 thousand) represents the Zakah computed on the<br />

cumulative statutory reserve and retained earnings as at 31 December <strong>2011</strong>, payable by the <strong>Bank</strong> (refer to note 32). The remaining<br />

Zakah balance amounting to BD 1,639 thousand or 1.42 fils per share (2010: BD 2,256 thousand or 1.95 fils per share) is due and<br />

payable by the shareholders.<br />

27. SEGMENT REPORTING<br />

An operating segment is a component of the Group that engages in business activities from which it may earn revenues and incur<br />

expenses, whose operating results are regularly reviewed by the Group’s chief operating decision maker (Board of Directors)<br />

to make decisions about resource allocation to each segment and assess its performance and for which discrete financial<br />

information is available. An operating segment is divided into business segment and geographic segments. For management<br />

purposes, the Group is organised into two major business segments:<br />

56<br />

<strong>Annual</strong> <strong>Report</strong> <strong>2011</strong>