Most Frequent RTP Reason Codes - Palmetto GBA

Most Frequent RTP Reason Codes - Palmetto GBA

Most Frequent RTP Reason Codes - Palmetto GBA

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

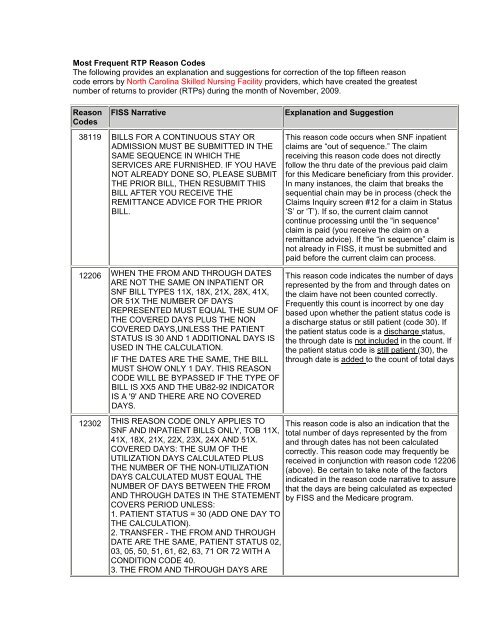

<strong>Most</strong> <strong>Frequent</strong> <strong>RTP</strong> <strong>Reason</strong> <strong>Codes</strong><br />

The following provides an explanation and suggestions for correction of the top fifteen reason<br />

code errors by North Carolina Skilled Nursing Facility providers, which have created the greatest<br />

number of returns to provider (<strong>RTP</strong>s) during the month of November, 2009.<br />

<strong>Reason</strong><br />

<strong>Codes</strong><br />

FISS Narrative<br />

Explanation and Suggestion<br />

38119 BILLS FOR A CONTINUOUS STAY OR<br />

ADMISSION MUST BE SUBMITTED IN THE<br />

SAME SEQUENCE IN WHICH THE<br />

SERVICES ARE FURNISHED. IF YOU HAVE<br />

NOT ALREADY DONE SO, PLEASE SUBMIT<br />

THE PRIOR BILL, THEN RESUBMIT THIS<br />

BILL AFTER YOU RECEIVE THE<br />

REMITTANCE ADVICE FOR THE PRIOR<br />

BILL.<br />

12206 WHEN THE FROM AND THROUGH DATES<br />

ARE NOT THE SAME ON INPATIENT OR<br />

SNF BILL TYPES 11X, 18X, 21X, 28X, 41X,<br />

OR 51X THE NUMBER OF DAYS<br />

REPRESENTED MUST EQUAL THE SUM OF<br />

THE COVERED DAYS PLUS THE NON<br />

COVERED DAYS,UNLESS THE PATIENT<br />

STATUS IS 30 AND 1 ADDITIONAL DAYS IS<br />

USED IN THE CALCULATION.<br />

IF THE DATES ARE THE SAME, THE BILL<br />

MUST SHOW ONLY 1 DAY. THIS REASON<br />

CODE WILL BE BYPASSED IF THE TYPE OF<br />

BILL IS XX5 AND THE UB82-92 INDICATOR<br />

IS A '9' AND THERE ARE NO COVERED<br />

DAYS.<br />

12302 THIS REASON CODE ONLY APPLIES TO<br />

SNF AND INPATIENT BILLS ONLY, TOB 11X,<br />

41X, 18X, 21X, 22X, 23X, 24X AND 51X.<br />

COVERED DAYS: THE SUM OF THE<br />

UTILIZATION DAYS CALCULATED PLUS<br />

THE NUMBER OF THE NON-UTILIZATION<br />

DAYS CALCULATED MUST EQUAL THE<br />

NUMBER OF DAYS BETWEEN THE FROM<br />

AND THROUGH DATES IN THE STATEMENT<br />

COVERS PERIOD UNLESS:<br />

1. PATIENT STATUS = 30 (ADD ONE DAY TO<br />

THE CALCULATION).<br />

2. TRANSFER - THE FROM AND THROUGH<br />

DATE ARE THE SAME, PATIENT STATUS 02,<br />

03, 05, 50, 51, 61, 62, 63, 71 OR 72 WITH A<br />

CONDITION CODE 40.<br />

3. THE FROM AND THROUGH DAYS ARE<br />

This reason code occurs when SNF inpatient<br />

claims are “out of sequence.” The claim<br />

receiving this reason code does not directly<br />

follow the thru date of the previous paid claim<br />

for this Medicare beneficiary from this provider.<br />

In many instances, the claim that breaks the<br />

sequential chain may be in process (check the<br />

Claims Inquiry screen #12 for a claim in Status<br />

‘S’ or ‘T’). If so, the current claim cannot<br />

continue processing until the “in sequence”<br />

claim is paid (you receive the claim on a<br />

remittance advice). If the “in sequence” claim is<br />

not already in FISS, it must be submitted and<br />

paid before the current claim can process.<br />

This reason code indicates the number of days<br />

represented by the from and through dates on<br />

the claim have not been counted correctly.<br />

<strong>Frequent</strong>ly this count is incorrect by one day<br />

based upon whether the patient status code is<br />

a discharge status or still patient (code 30). If<br />

the patient status code is a discharge status,<br />

the through date is not included in the count. If<br />

the patient status code is still patient (30), the<br />

through date is added to the count of total days<br />

This reason code is also an indication that the<br />

total number of days represented by the from<br />

and through dates has not been calculated<br />

correctly. This reason code may frequently be<br />

received in conjunction with reason code 12206<br />

(above). Be certain to take note of the factors<br />

indicated in the reason code narrative to assure<br />

that the days are being calculated as expected<br />

by FISS and the Medicare program.

<strong>Reason</strong><br />

<strong>Codes</strong><br />

FISS Narrative<br />

THE SAME BUT NO CONDITION CODE 40<br />

PRESENT.<br />

38117 THE TOB IS EQUAL TO AN SNF, OR THE<br />

CLAIM IS FOR A NON-PPS INPATIENT, OR<br />

AN IPF PPS. THE ADMISSION DATE IS ON<br />

OR AFTER 040195, AND THE STATEMENT<br />

COVERS FROM DATE IS GREATER THAN<br />

THE ADMISSION DATE. THERE IS A PRIOR<br />

CLAIM PENDING, AND THE PRIOR CLAIM'S<br />

THRU DATE IS 1 DAY LESS THAN THIS<br />

CLAIM'S FROM DATE, AND THE REASON<br />

CODE AUTHORIZATION FIELD (CLAIM<br />

PAGE 9) DOES NOT CONTAIN THIS<br />

REASON CODE.<br />

Explanation and Suggestion<br />

The admission date in FL 17 is prior to the<br />

statement from date of this claim. **OR** The<br />

prior claim in the series shows a thru date that<br />

is one day less than<br />

31486 THE CLAIM IS AN SNF CLAIM WITH A<br />

STATEMENT COVERS FROM DATE OF<br />

7/1/98 OR GREATER AND THE SUM OF ALL<br />

REVENUE CODES 0022 DOES NOT EQUAL<br />

THE CLAIM COVERED DAYS COUNT.<br />

15202 FOR 11X, 18X, OR 21X BILLS, THE<br />

COVERED DAYS (FLD 7) MUST<br />

EQUAL THE ACCOMMODATION UNITS (FLD<br />

46) FOR REVENUE CODES<br />

10X - 21X. PLEASE MAKE CORRECTIONS<br />

AND RESUBMIT/REKEY.<br />

HARDCOPY SUBMITTORS RESUBMIT <strong>RTP</strong><br />

REPORT WITH CORRECTIONS.<br />

W7K01 STANDARD NARRATIVE: THE OPPS<br />

VERSION OF OCE HAS DETECTED<br />

AN ERROR IN THE ADMITTING DIAGNOSIS.<br />

This reason code can indicate that the units<br />

field billed on the revenue line for the HIPPS<br />

code (revenue code 0022) does not match the<br />

number of covered days shown on page 1 of<br />

the claim in FISS. However, for most of the<br />

claims receiving this reason code the problem<br />

is that a non-covered claim is being billed, but<br />

the provider is showing covered units (field<br />

name = COV UNIT) for revenue code 0022. If<br />

the claim is a totally non-covered claim, please<br />

remove all covered units.<br />

Provider should be certain that the units<br />

(including covered units on page 2 of claim in<br />

FISS) billed with accommodation revenue<br />

codes (10X-21X) equal the number of covered<br />

days (page 1) billed on the claim. If all of the<br />

days and the units appear to be correct but this<br />

reason code is still returned, contact the<br />

Provider Contact Center (PCC) for assistance.<br />

This reason code indicates that the admitting<br />

diagnosis code (the code in the ADMITTING<br />

DIAGNOSIS field on claim page 03) for the<br />

date of service billed does not match a valid<br />

code in the OPPS version of the Outpatient<br />

Code Editor (OCE). Check this code against<br />

the FISS ICD-9-CM code file (Menu Option<br />

#15) and correct it accordingly<br />

11801 IF THE TYPE OF BILL IS EQUAL TO 11X, OR<br />

41X IF THE ADMISSION TYPE IS EQUAL TO<br />

1, 2, 3, OR 9, THEN THE ADMISSION<br />

SOURCE MUST BE EQUAL TO 1 THRU 9;<br />

OR<br />

IF THE ADMISSION TYPE IS EQUAL TO 4,<br />

Generally the receipt of this reason code<br />

means that the admission source code was not<br />

included on this claim. Please add the<br />

appropriate admission source code to allow the<br />

claim to continue processing. If the admission<br />

source code is present on the claim, please

<strong>Reason</strong><br />

<strong>Codes</strong><br />

FISS Narrative<br />

THEN THE ADMISSION SOURCE MUST BE<br />

EQUAL TO 1, 2, 3, OR 4;<br />

OR<br />

IF THE TYPE OF BILL IS EQUAL TO 13X,<br />

14X, 83X, OR 85X, AND THE DATE OF<br />

SERVICE IS GREATER THAN 02/28/91,<br />

THEN THE ADMISSION SOURCE MUST BE<br />

EQUAL TO 1 THRU 8;<br />

OR<br />

IF THE TYPE OF BILL IS EQUAL TO 18X,<br />

21X, 28X, OR 51X, THEN THE ADMISSION<br />

SOURCE MUST BE A SPACE OR EQUAL TO<br />

AN 'A' OR 1 THRU 9.<br />

OR<br />

IF THE TYPE OF BILL IS EQUAL TO 3X2 OR<br />

3X9, AND THE DATE OF SERVICE IS<br />

10/01/00 OR GREATER THEN THE<br />

ADMISSION SOURCE MUST BE 1 THRU 9,<br />

A, B, OR C.<br />

OR<br />

IF THE DATE OF SERVICE IS EQUAL TO OR<br />

GREATER THAN 1/1/08 THE ADMISSION<br />

SOURCE CODE OF 'A' OR '3' IS NO LONGER<br />

VALID.<br />

32404 ACCORDING TO THE REVENUE CODE FILE<br />

A HCPC IS REQUIRED. HOWEVER, THE<br />

HCPC THAT WAS ENTERED ON THE CLAIM<br />

WAS NOT FOUND ON THE HCPC FILE<br />

CORRECTIONS WITH REPORT.<br />

32200 WHEN DIAGNOSIS CODE 'V048' OR 'V0382'<br />

IS PRESENT ON A CLAIM, A CONDITION<br />

CODE 'A6' IS REQUIRED FOR THE<br />

FOLLOWING BILL TYPES:<br />

12X, 13X, 14X, 22X, 23X, 24X, 34X, 72X, 74X,<br />

75X, 85X.<br />

Explanation and Suggestion<br />

review the conditions listed in the reason code<br />

narrative to determine if the code is correct<br />

according to the other factors/data elements<br />

included on the claim, and change the code<br />

accordingly.<br />

Please refer to the most current CPT-4 HCPCS<br />

coding book to verify that the HCPCS being<br />

billed is valid for the dates of service on the<br />

claim. Make any necessary corrections and<br />

resubmit. Hardcopy submittors resubmit.<br />

Diagnosis codes ‘V048’ and ‘V0382’ are used<br />

to indicate that the patient involved is in need of<br />

a vaccination (influenza and pneumonia,<br />

respectively). Medicare billing guidelines<br />

require that the special program indicator,<br />

condition code ‘A6’, be included on all claims<br />

billing for these services. Therefore, this reason<br />

code is generated whenever these diagnosis<br />

codes are present and condition code ‘A6’ is<br />

not. Add condition code ‘A6’ and the claim<br />

should proceed to payment, or the diagnosis<br />

codes should be removed if the vaccinations<br />

were not provided.<br />

32415 CONDITION CODE A6 IS REQUIRED WHEN<br />

ONE OR MORE OF THE FOLLOWING<br />

HCPCS ARE PRESENT ON THE CLAIM:<br />

HCPC Q0124 WITH FROM DATE LESS THAN<br />

010195 OR 90657, 90658, 90659, 90669,<br />

90724, 90732, G0008 OR G0009.<br />

This reason code occurs because the provider<br />

has not included condition code ‘A6’ (special<br />

program indicator for vaccine billing –<br />

deductible and coinsurance do not apply) on<br />

the claim but there is a pneumonia vaccine or<br />

influenza vaccine being billed. Either the<br />

‘A6’should be added, or the listed HCPCS/CPT<br />

codes should be removed from the claim.

<strong>Reason</strong><br />

<strong>Codes</strong><br />

FISS Narrative<br />

Explanation and Suggestion<br />

153#1 TOTAL CHARGES: THE TOTAL CHARGES<br />

ON REVENUE CODE 001 MUST BE EQUAL<br />

TO THE SUM OF ALL THE CHARGES<br />

ABOVE IT.<br />

30949 TYPE OF BILL EQUALS XX7 OR XX8 BUT<br />

NO CONDITION CODE IS PRESENT ON THE<br />

BILL. PLEASE INCLUDE THE APPROPRIATE<br />

CONDITION CODE OF<br />

D0 - CHANGES TO SERVICE DATES<br />

D1 - CHANGES IN CHARGES<br />

D2 - CHANGES IN REVENUE CODE/HCPC<br />

D3 - SECOND OR SUBSEQUENT INTERIM<br />

PPS BILL<br />

D4 - CHANGE IN GROUPER INPUT (DRG)<br />

D5 - CANCEL ONLY TO CORRECT A HIC OR<br />

PROVIDER NUMBER<br />

D6 - CANCEL ONLY - DUPLICATE<br />

PAYMENT, OUTPATIENT TO INPATIENT<br />

OVERLAP, OIG OVERPAYMENT<br />

D7 - CHANGE TO MAKE MEDICARE<br />

SECONDARY PAYER<br />

D8 - CHANGE TO MAKE MEDICARE<br />

PRIMARY PAYER<br />

D9 - ANY OTHER CHANGES.<br />

PLEASE MAKE CORRECTIONS AND<br />

RESUBMIT/REKEY.<br />

13314 FOR OCCURRENCE SPAN CODE<br />

70(QUALIFYING STAY DATE) THE "FROM"<br />

DATE IS GREATER THAN THE "THROUGH"<br />

DATE. *VERIFY THE QUALIFYING STAY<br />

THRU DATE (REPORTED WITH<br />

OCCURRENCE CODE 70) IS GREATER<br />

THAN THE ADMISSION DATE OF THE<br />

CLAIM.<br />

OR<br />

THIS IS A SNF, AND THE OCCURRENCE<br />

SPAN CODE 80 (PRIOR SAME-SNF STAY)<br />

FROM DATE IS GREATER THAN THE CLAIM<br />

ADMISSION FROM DATE.<br />

31094 TOTAL COVERED CHARGES CANNOT BE<br />

GREATER THAN ZERO IF THE THIRD<br />

POSITION OF THE TYPE OF BILL (TOB)<br />

EQUALS ZERO. PLEASE VERIFY THE TYPE<br />

This reason code indicates that the Total<br />

Charges revenue line (0001) contains a charge<br />

that is not the sum total of the line items on this<br />

claim. This may be an indication that some line<br />

item changes were made but the Total Charge<br />

line was not “deleted” and re-entered with the<br />

corrected total charge amount. If the Total<br />

Charge line item is not “corrected” in the same<br />

manner as all other line items, this reason code<br />

is likely to occur.<br />

In this instance, the provider is submitting an<br />

adjustment (type of bill = xx7) or a paid claim<br />

cancellation (xx8), but they have failed to<br />

include the claim change condition code (FL<br />

24-30) that explains the adjustment or<br />

cancellation. Please add one of the condition<br />

codes listed in the reason code narrative to<br />

your claim.<br />

On most of the claims receiving this reason<br />

code the Admission Date billed on the claim is<br />

BEFORE the qualifying stay date (occurrence<br />

code 70) which is incorrect. It appears that an<br />

”old” (prior) admit date is being used rather<br />

than the admit date that relates to the from and<br />

through dates on the current claim. Please<br />

review the admit date, the qualifying stay date<br />

and the from and through date on the claim to<br />

assure that the appropriate, current dates are<br />

being used and that they are in the proper<br />

sequence.<br />

This reason code is received because the claim<br />

is billed with a zero (0) in the third position of<br />

the type of bill (TOB) indicating a no pay and/or<br />

non-covered claim, but the charges on the

<strong>Reason</strong><br />

<strong>Codes</strong><br />

FISS Narrative<br />

OF BILL AND/OR THE TOTAL COVERED<br />

CHARGES REPORTED. PLEASE CORRECT<br />

AND RESUBMIT/REKEY. HARDCOPY<br />

SUBMITTORS RESUBMIT <strong>RTP</strong> REPORT<br />

WITH CORRECTIONS.<br />

Explanation and Suggestion<br />

claim are listed as covered charges. In some<br />

cases the type of bill may be reported<br />

incorrectly. If this is the case please update the<br />

type of bill (TOB). If this is in fact a no pay<br />

and/or non-covered claim, the charges must be<br />

moved to the non-covered column.<br />

If you encounter some other reason code that you are unable to decipher, please submit it to us<br />

using the “I Have a Question” form included in the Medicare Advisory.