2011 Hampton Roads Real Estate Market Review - College of ...

2011 Hampton Roads Real Estate Market Review - College of ...

2011 Hampton Roads Real Estate Market Review - College of ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>2011</strong> O F F I C E<br />

New and existing <strong>Hampton</strong> <strong>Roads</strong> tenants are preparing to backfill vacancies created by USJFCOM’s exodus in the<br />

Harbour View area <strong>of</strong> Suffolk. In addition, <strong>Hampton</strong> <strong>Roads</strong> looks forward to the benefits <strong>of</strong> the completion <strong>of</strong> the Norfolk<br />

Southern “Heartland Corridor” which will be a direct rail connection from the Virginia ports to Chicago.<br />

<strong>Market</strong> Conditions<br />

In many ways, 2010 represented a settling period in the market. Other than medical sector growth, some government contractors,<br />

and private colleges and universities entering and expanding in the <strong>Hampton</strong> <strong>Roads</strong> area, there has been little economic<br />

growth by way <strong>of</strong> <strong>of</strong>fice tenants. There were fewer lease transactions completed in the last quarter <strong>of</strong> 2010 than any other since<br />

the beginning <strong>of</strong> 2009, resulting in a fairly stagnant market. The overall vacancy rate remained a steady 14.6 percent, which is<br />

still below the National Office <strong>Market</strong> vacancy <strong>of</strong> 16.2%. Rental rates remained flat throughout the year, and large rent abatements<br />

remain prevalent. Despite the lack <strong>of</strong> leasing<br />

activity, brokers in the market reported a surge<br />

in tour activity. The increase in tour activity due to<br />

new tenants entering the market will hopefully<br />

translate into positive absorption and continued increases<br />

in activity in <strong>2011</strong>.<br />

Outlook<br />

<strong>Market</strong> performance during the first two quarters<br />

<strong>of</strong> <strong>2011</strong> will be especially important in measuring<br />

overall market recovery and potential growth<br />

in <strong>Hampton</strong> <strong>Roads</strong>. Leasing activity is expected to<br />

increase as tenants gain more confidence in the<br />

market. Rent rates will likely remain relatively flat<br />

over the next 12 months, and tenants will continue<br />

to expect highly attractive rent concessions. The<br />

market has become less dependent on “blend and<br />

extend” renewals and it is possible that fundamentals<br />

will begin to shift as early as the fourth quarter<br />

<strong>of</strong> <strong>2011</strong> or the beginning <strong>of</strong> 2012.<br />

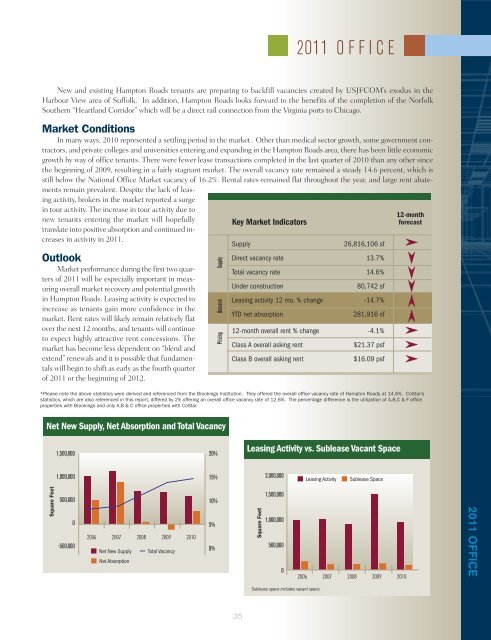

Pricing Demand Supply<br />

Key <strong>Market</strong> Indicators<br />

Supply<br />

26,816,106 sf<br />

Direct vacancy rate 13.7%<br />

Total vacancy rate 14.6%<br />

Under construction<br />

80,742 sf<br />

Leasing activity 12 mo. % change -14.7%<br />

YTD net absorption<br />

281,916 sf<br />

12-month overall rent % change -4.1%<br />

Class A overall asking rent<br />

Class B overall asking rent<br />

$21.37 psf<br />

$16.09 psf<br />

12-month<br />

forecast<br />

*Please note the above statistics were derived and referenced from the Brookings Institution. They <strong>of</strong>fered the overall <strong>of</strong>fice vacancy rate <strong>of</strong> <strong>Hampton</strong> <strong>Roads</strong> at 14.6%. CoStar’s<br />

statistics, which are also referenced in this report, differed by 2% <strong>of</strong>fering an overall <strong>of</strong>fice vacancy rate <strong>of</strong> 12.6%. The percentage difference is the utilization <strong>of</strong> A,B,C & F <strong>of</strong>fice<br />

properties with Brookings and only A,B & C <strong>of</strong>fice properties with CoStar.<br />

Net New Supply, Net Absorption and Total Vacancy<br />

1,500,000<br />

20%<br />

Leasing Activity vs. Sublease Vacant Space<br />

1,000,000<br />

15%<br />

2,000,000<br />

Leasing Activity<br />

Sublease Space<br />

Square Feet<br />

500,000<br />

0<br />

-500,000<br />

2006 2007 2008 2009 2010<br />

Net New Supply Total Vacancy<br />

Net Absorption<br />

10%<br />

5%<br />

0%<br />

Square Feet<br />

1,500,000<br />

1,000,000<br />

500,000<br />

0<br />

2006 2007 2008 2009 2010<br />

<strong>2011</strong> OFFICE<br />

Sublease space includes vacant space.<br />

35